Square Unveils 0% Fee Bitcoin Payments, Boosting Block Stock to 8-Month High

Square, a subsidiary of Jack Dorsey’s Block Inc., has announced the launch of Square Bitcoin, a fully integrated payments and wallet solution that enables over four million U.S. merchants to accept and manage Bitcoin directly within the Square ecosystem. This move marks a significant step towards mainstream Bitcoin adoption, allowing businesses to process Bitcoin payments with zero fees for the first year and instant settlement options in either Bitcoin or U.S. dollars.

The new feature, set to go live on November 10, 2025, will also permit merchants to automatically convert up to 50% of their daily card sales into Bitcoin, helping them diversify their savings without leaving the platform. However, it’s worth noting that this service will not be available in New York due to regulatory restrictions. Miles Suter, Head of Bitcoin Product at Block, described the rollout as a key moment in bridging traditional commerce with digital currency, stating that “we’re making Bitcoin payments as seamless as card payments while giving small businesses access to financial management tools that, until now, were exclusive to large corporations.”

Square Bitcoin Debuts, Letting Merchants Accept, Convert, and Hold BTC in One Platform

According to research firm eMarketer, U.S. cryptocurrency payment users are projected to grow by more than 80% between 2024 and 2026. This growth is supported by friendlier regulations, corporate adoption, and technological advances. The launch of Square Bitcoin combines two core features, Bitcoin Payments and Bitcoin Conversions, alongside a built-in wallet that allows users to buy, sell, hold, and withdraw Bitcoin within their Square Dashboard. Jack Dorsey, who has championed Bitcoin integration for years, said on X that merchants will be able to choose whether to hold Bitcoin or auto-convert it to fiat instantly.

Block’s phased rollout will begin in late 2025 and expand to all eligible merchants by 2026, pending regulatory approval. The company also operates Cash App’s Bitcoin trading feature, Bitkey, a self-custody Bitcoin wallet, and Proto, a suite of Bitcoin mining products. Its open-source division, Spiral, funds development projects aimed at advancing Bitcoin’s use as a tool for economic empowerment. Since the beta rollout of Bitcoin Conversions in 2024, participating merchants have collectively accumulated 142 Bitcoin as of October 1, 2025.

Crypto Payments Gain Momentum as Institutions, Tech Firms, and Regulators Align

The use of cryptocurrency for payments is seeing renewed growth, supported by friendlier regulations, corporate adoption, and technological advances. Tech companies and financial institutions are leading the shift, with Google introducing its Agent Payments Protocol and adding stablecoin support through a partnership with Coinbase. Visa has begun testing cross-border payments funded with stablecoins through Visa Direct, while Mastercard continues to integrate crypto via on-ramp services and crypto-backed cards.

Adoption is also rising globally, with Bitget Wallet integrating Brazil’s Pix system, enabling crypto payments via QR codes, and Finastra partnering with Circle to connect banks to USDC settlements. According to a survey, consumers in the U.S. and U.K. are increasingly viewing crypto as a practical payment method. The announcement coincided with the Bitcoin Conference 2025 in Las Vegas, where Square demonstrated real-time Bitcoin payments through the Lightning Network at the BTC Inc. merchandise store.

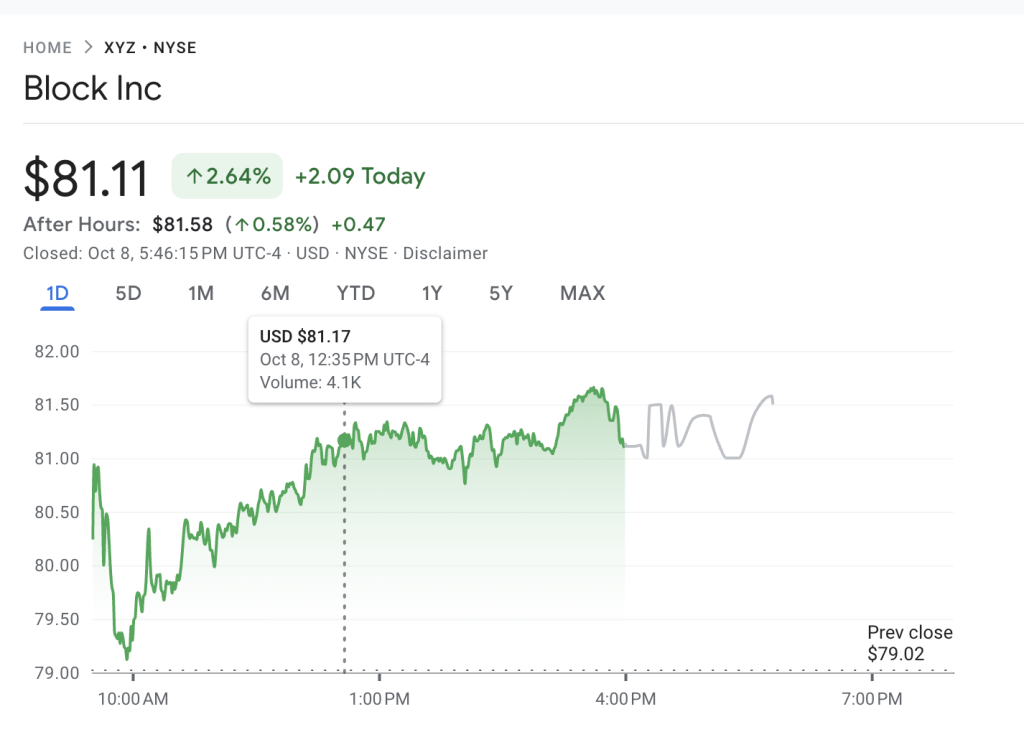

Following the announcement, Block’s stock rose 2.5% to $81, its highest level since February, reflecting investor optimism around the company’s renewed Bitcoin push. For more information, visit the original source: https://cryptonews.com/news/square-unleashes-0-fee-bitcoin-payments-sending-block-stock-to-an-8-month-high/