Stablecoins to Disrupt Traditional Banking: Stripe CEO Predicts Banks Will Have to Offer Competitive Interest Rates

Patrick Collison, CEO of payments company Stripe, believes that stablecoins, which are tokenized versions of fiat currencies operating on blockchain technology, will eventually force banks and other financial institutions to offer customers a return on their deposits to remain competitive. This prediction comes in response to a post by VC Nic Carter, discussing the rise of stablecoins and their future implications.

The average interest rate for US savings accounts is currently 0.40%, while in the EU it stands at 0.25%, according to Collison. He argues that depositors should earn a return on their capital that is closer to the market rate. Some lobbies are pushing for further restrictions on rewards connected to stablecoin deposits, which Collison believes is a misguided approach. “The business imperative here is clear: worthy deposits are great, but it feels like a lost position for me,” he stated.

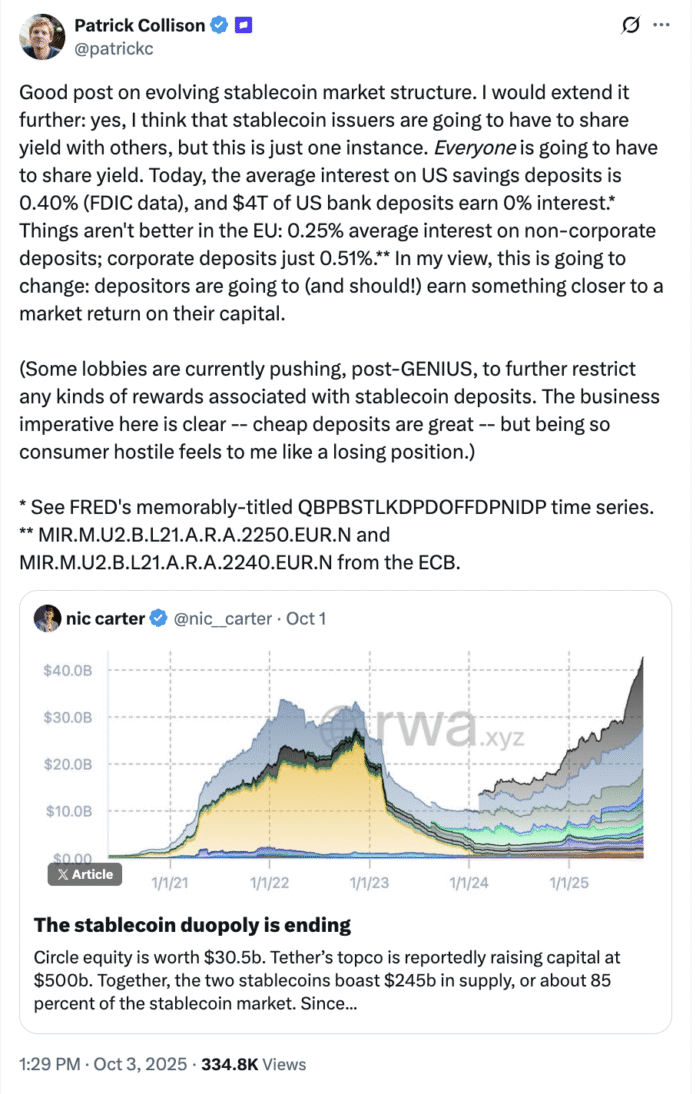

Stablecoins have experienced steady growth in market capitalization and user adoption since 2023, particularly in the United States following the passage of the GENIUS StableCoin Act. While this legislation paved the way for a regulated stablecoin industry, it also banned return sharing. The stablecoin market has continued to expand, with its market capitalization reaching $300 billion, which some experts believe is “rocket fuel” for the crypto rally.

Banking Industry Pushes Back Against Interest-Bearing Stablecoins

The banking lobby has been advocating for restrictions on interest-bearing stablecoins, citing concerns that they could undermine the traditional banking system and erode market share. According to a report by the American Banker, the US legislature is considering provisions to include in the final draft of the GENIUS StableCoin Act. Banks and their congressional allies argue that stablecoins offering interest-bearing opportunities to customers could discourage people from depositing their money in local banks.

Senator Kirsten Gillibrand of New York expressed this concern at the DC Blockchain Summit in March, stating, “Do you want a stablecoin to be able to pay interest? Probably not, because if you pay interest, there’s no reason to put your money in a local bank.” However, crypto industry executives see the rise of stablecoins as a natural progression and predict that they will eventually surpass traditional fiat payments.

Reeve Collins, co-founder of stablecoin issuer Tether, believes that every currency will eventually become a stablecoin, including fiat currencies. “Each currency will be a stablecoin. Even the fiat currency will be a stablecoin. It’s just called dollar, euro, or yen,” he said in an interview with Cointelegraph at Token2049.

Conclusion

The debate surrounding stablecoins and their potential impact on traditional banking highlights the need for a more competitive and innovative financial system. As stablecoins continue to grow in popularity, it is likely that banks and other financial institutions will have to adapt to remain relevant. Whether through offering competitive interest rates or exploring new technologies, the future of finance is likely to be shaped by the rise of stablecoins. For more information, visit https://cointelegraph.com/news/stablecoins-force-everyone-share-yield-stripe-ceo?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound