Stablecoins Facilitate High-Value Property Transactions in the UK, France, and Malta

Stablecoins have emerged as a preferred mode of payment for high-value property transactions in the UK, France, and Malta, with deals ranging from $500,000 to $2.5 million. According to a report, Lithuania-licensed crypto payment app Brighty has brokered over 100 such deals, allowing wealthy customers to bypass traditional banking channels and conduct faster and more efficient transactions.

The trend signals growing confidence in cryptocurrencies as a legitimate vehicle for large-scale investments, especially as traditional banks remain reluctant to process such deals. Brighty’s platform serves between 100 and 150 affluent customers whose average monthly spending reaches $50,000, with residential property purchases accounting for the higher end of transaction volumes in European target countries, including Cyprus and Andorra.

Euro Stablecoins Gain Popularity for European Deals

Nikolay Denisenko, co-founder and CTO of Brighty App, explained that crypto transactions offer significant advantages over traditional methods such as SWIFT, the global interbank payment network used by over 11,000 banks. Converting stablecoins like USDC to Euros eliminates the complexities and delays associated with traditional transfers, making the process more efficient for both buyers and sellers.

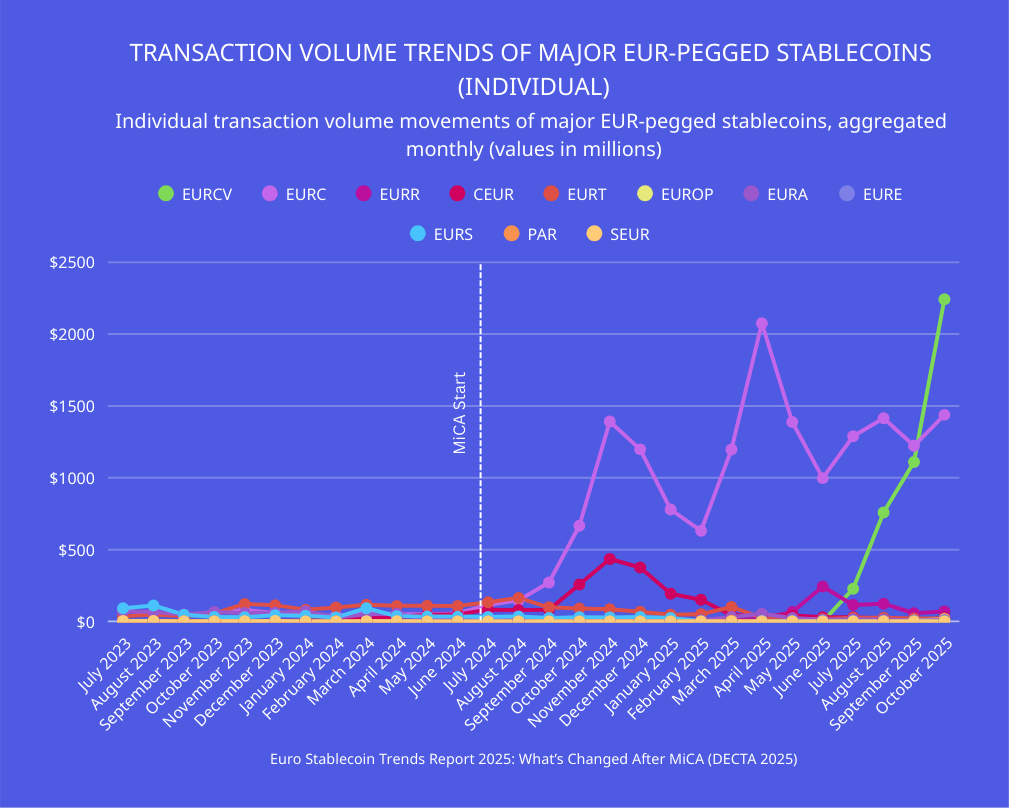

Notably, euro-pegged stablecoins have overtaken USDC in European deals, as buyers prefer to avoid conversion costs when purchasing European real estate. Brighty observed an increase in average euro-backed transaction volume from €15,785 in the third quarter to €59,894 in the fourth quarter as high net worth individuals completed larger transactions in Circle’s EURC rather than USDC.

Real Estate Sector Embraces Cryptocurrencies Amid Banking Hesitancy

Demand for crypto-based real estate deals has increased as traditional financial institutions continue to shun such transactions, creating opportunities for specialized platforms. Denisenko said Brighty is now working with real estate agencies to familiarize them with transparent, legally acquired crypto assets as payment methods.

Other companies, such as luxury brokerage Christie’s International Real Estate, have also launched their own crypto divisions to cater to the growing demand. CEO Aaron Kirman told the Times that “cryptocurrency is here to stay” and that the division will enable business “without banks or fiat.”

For more information, visit https://cryptonews.com/news/stablecoins-power-500k-2-5m-property-deals-across-uk-france-and-malta-report/