Understanding Crypto Swaps, Bridges, and Conversion Tools

The world of cryptocurrency has evolved significantly, and as we approach the end of 2025, crypto swaps have become increasingly popular. But what exactly are crypto swaps, and how do they differ from traditional exchanges or bridging? In this article, we will delve into the world of crypto swaps, exploring their advantages, risks, and the various options available for cross-chain swaps.

Decentralized exchanges (DEXs) have seen a significant increase in spot trading volume, with a 25.3% rise in the second quarter of 2025, reaching over $876 billion. In contrast, centralized exchanges (CEXs) experienced a decline of almost 28%, ending the quarter at $3.9 trillion. This trend suggests that more people are opting for direct crypto swaps rather than the traditional method of selling to fiat and then buying again.

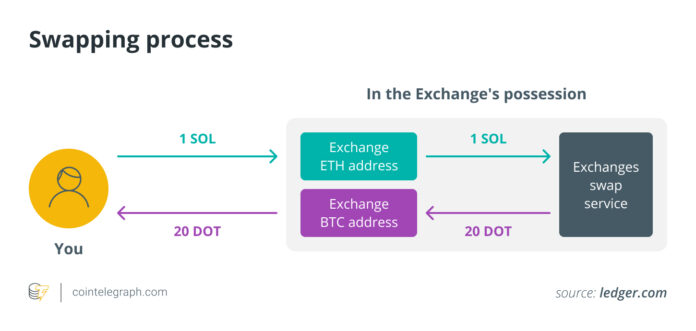

A crypto swap is a direct, peer-to-peer exchange of one digital asset for another, without the need for order books or third-party custodians. Instead of selling your Bitcoin (BTC) for dollars and then buying Ether (ETH), you can exchange BTC for ETH in a single step. This process bypasses the problems associated with traditional exchanges, such as hidden fees, delays, or intermediaries.

Advantages of Crypto Swaps

So, why do many users prefer decentralized swaps over traditional trading? Here are some of the key advantages:

-

Lower fees: Swaps often avoid high trading fees and markups, with users only paying small network costs or smart contract gas fees.

-

Better liquidity access: Swaps tap into liquidity pools, making transactions smoother and avoiding thin order books and price slippage.

-

Non-custodial control: Users maintain control of their private keys, eliminating the need for know-your-customer (KYC) processes and central exchange trust.

-

Faster transactions: On-chain swaps are often almost instantaneous, eliminating the need for multi-stage conversions or waiting for fiat settlements.

Risks of Crypto Swaps

While crypto swaps offer several advantages, there are still risks to be aware of:

-

Smart contract vulnerabilities: If a DEX or bridge uses incorrect code, users’ funds can be put at risk.

-

Market impact: Larger swaps can still move the market, especially for pairs with low liquidity.

-

Limited advanced features: Swaps are not designed for complex trading strategies.

To mitigate these risks, the best cross-chain bridges and swap platforms in 2025 focus on security audits, deep liquidity pools, and protective measures such as front-running prevention.

Evolution of Crypto Swaps in 2025

Crypto swaps have come a long way, with the best platforms now scanning chains, bridges, and rollups to offer better rates with less risk. For example, Symbiosis.finance combines the liquidity of layer 1s, layer-2 bridges, and both Ethereum Virtual Machine (EVM) and non-EVM networks to tighten rates and reduce risks.

This means that users can perform cross-chain swaps without ever touching a separate bridge interface. One of the most notable upgrades is that Symbiosis has built its own blockchain (the sister chain) for internal administration and bridge logic exchange. This has two major advantages:

-

Consistent, predictable fees instead of fluctuating bridge fees

-

Faster, more reliable execution for cross-chain transactions

Security remains decentralized, with the network running on a delegated proof-of-stake (POS) model, where token holders can act as validators or delegate to others.

Other Modern Options for Cross-Chain Swaps

While platforms like Symbiosis have set a high standard for crypto swaps and bridging, different providers are taking varying technical approaches to achieve the same goal: enabling users to shift assets between blockchains quickly, safely, and inexpensively.

Uniswap V4: Focus on In-Chain Swaps

Uniswap V4 focuses more on in-chain swaps than cross-chain interoperability. Its architecture provides deep liquidity and ultra-low gas fees in Ethereum and supported layer 2s, although crypto swaps between chains are not native.

With its Hooks Framework, developers can insert custom logic at specific points in the lifecycle of a swap, such as:

-

Real-time fee adjustment based on market conditions

-

Adding new order types, such as TWAP or limit orders

-

Integration of on-chain oracles for precise pricing and slippage control

4-Swap: Peer-to-Peer Atomic Swap Protocol

4-Swap takes a different approach, using Hashed Time-Locked Contracts (HTLCs) to enable direct swaps between two parties across various blockchains, without pooled liquidity or bridging contracts.

The main attractiveness of 4-Swap is its maximum trustlessness and privacy, but it comes with compromises: swaps depend on finding a suitable counterparty, and prices are more likely to be set by an automated market maker (AMM).

This article does not contain investment advice or recommendations. Every investment and trading move carries risk, and readers should conduct their own research before making a decision.