Tether’s Record-Breaking Revenue: A Deep Dive into the Stablecoin Giant’s Success

Tether, the company behind the popular stablecoin USDT, has achieved a remarkable milestone, generating an estimated $5.2 billion in revenue in 2025. This impressive figure solidifies Tether’s position as the most profitable crypto company, surpassing its competitors and cementing its dominance in the stablecoin market. According to Coingecko’s latest annual crypto industry report, Tether accounted for 41.9% of all stablecoin sales in 2025, outpacing other major players such as Circle, Hyperliquid, and PancakeSwap.

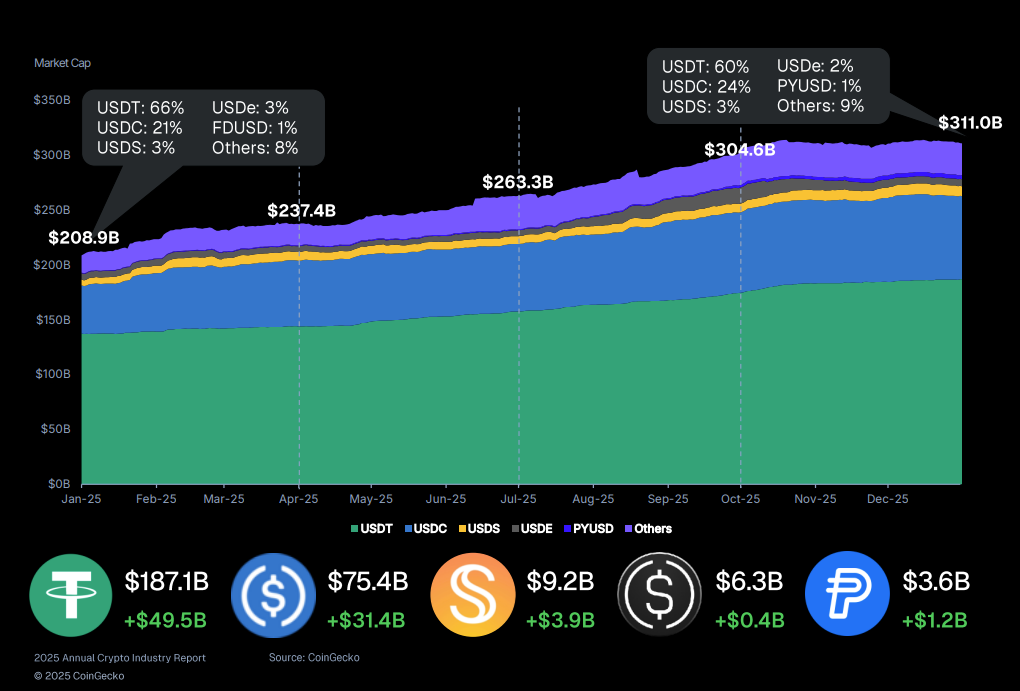

The stablecoin market has experienced significant growth, with a total market capitalization of $311 billion in the fourth quarter of 2025. Tether’s USDT claims a substantial 60.1% share of this market, equivalent to $187.0 billion, followed by Circle’s USDC with 24.2%, or $72.4 billion. This remarkable growth can be attributed to the increasing adoption of stablecoins across various regions and their use as a settlement asset.

Stablecoin Dominance and Market Trends

The stablecoin market’s growth is a testament to the increasing demand for dollar-backed digital currencies. Tether’s USDT has become the industry’s premier settlement asset, with a market value of $186.8 billion, making it the third-largest digital asset in the world. The company’s deep understanding of real-world usage and its aggressive expansion into traditional assets and investments have contributed to its success. Tether’s CEO, Paolo Ardoino, remains confident that USDT will maintain its edge due to the company’s expertise in stablecoin management.

The stablecoin market has also seen significant shifts, with some players experiencing substantial growth while others have faced challenges. Ethena’s USDe, for example, saw its market cap plunge by 57.3% after a weakening of its Binance peg in mid-October. In contrast, PayPal’s PYUSD rose 48.4%, and Ripple’s RLUSD gained 61.8%. These fluctuations highlight the dynamic nature of the stablecoin market and the need for companies to adapt to changing market conditions.

Expanding Investment Empire and Future Prospects

Tether’s success has not gone unnoticed, with the company’s valuation potentially reaching $500 billion. Bitwise CIO Matt Hougan suggests that Tether could become the most profitable company in the world if its development continues. The company’s aggressive expansion into traditional assets and investments, including its recent stake in Italian soccer club Juventus, demonstrates its commitment to growth and diversification. With its deep understanding of real-world usage and its dominant position in the stablecoin market, Tether is well-positioned for continued success.

As the stablecoin market continues to evolve, it is essential to monitor the trends and shifts in the industry. With its impressive revenue and growing investment empire, Tether is likely to remain a major player in the crypto space. For more information on Tether’s record-breaking revenue and the stablecoin market, visit https://cryptonews.com/news/tether-posts-largest-crypto-revenue-in-2025-5-2b-from-stablecoin-dominance/