Introduction to Texas’ Bitcoin Reserve

Texas has made history by becoming the first U.S. state to add Bitcoin exposure to its state-managed investment portfolio. This move marks a significant shift in the state’s approach to digital assets, transforming it from a crypto mining hub to an active investor in the space. In this article, we will delve into the key insights behind this decision, exploring how Senate Bill 21 (SB 21) has enabled the state to invest in Bitcoin and what this means for the future of government crypto policy.

Key Insights into Texas’ Bitcoin Investment

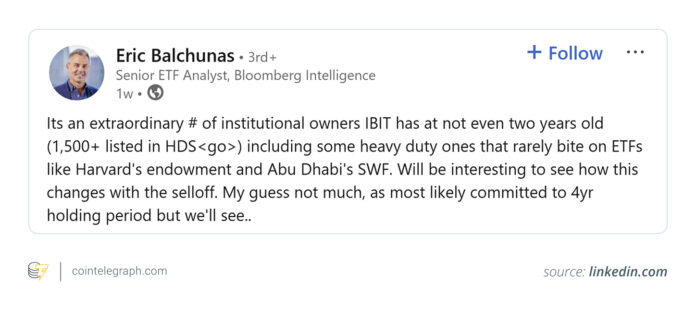

The Texas Treasury Safekeeping Trust Company has purchased approximately $5 million of BlackRock’s iShares Bitcoin Trust ETF (IBIT) through the newly created Texas Strategic Bitcoin Reserve. This investment signals a cautious and exploratory step into the world of digital assets, with the initial allocation being small compared to Texas’ entire investment portfolio. The state’s move differs from federal crypto programs, which primarily deal with seized assets, as Texas has made a proactive and budgeted investment in Bitcoin.

From Mining Hub to Bitcoin Reserve

Texas has long been a major hub for Bitcoin mining due to its cheap energy prices and supportive regulations. However, the state itself did not own any Bitcoin until 2025, when the Texas Treasury Safekeeping Trust Company purchased around $5 million of the IBIT Exchange Traded Fund (ETF). This purchase was made under SB 21, a law passed in June 2025 that created the Texas Strategic Bitcoin Reserve. The law allows the state comptroller to purchase, hold, manage, and sell Bitcoin using funds specifically approved by lawmakers.

How SB 21 Changes Texas’ Approach to Digital Assets

Before SB 21, Texas focused on crypto mining, grid participation, and economic incentives. With SB 21, the state is no longer just the host of the industry, but rather an investor itself. Senator Charles Schwertner, the bill’s lead sponsor, argued that Texas should have the ability to absorb Bitcoin, just as it could invest in land or gold. Proponents of the bill emphasized long-term diversification and protection against inflation, not short-term price increases.

Why This Looks Like a Change in Government Crypto Policy

State governments in the US generally view Bitcoin as either a regulatory issue or a factor affecting the electrical grid. SB 21 changes that view by treating Bitcoin as a permissible long-term store of value that can be held and managed like traditional mutual funds. The Texas Bitcoin Reserve is different from the current federal digital asset programs, which focus on cryptocurrencies seized through law enforcement actions. In contrast, Texas’ reserve is funded directly by a legislature and managed under the same fiduciary standards as other state investments.

What the Texas Bitcoin Reserve Action Doesn’t Mean

It is essential to set clear boundaries so as not to overstate the significance of the Texas decision. Texas does not make Bitcoin legal tender or accept it as a tax payment, and it has not significantly shifted its investment portfolio toward digital assets. The move also does not create a binding precedent for the federal government or other states, nor does it signal a unified national policy.

Political Risks and Open Questions

The inclusion of Bitcoin in the government investment program exposes officials to new risks. Large price drops could provoke political criticism, particularly during budget reviews. Research into the management of public funds shows that high volatility can lead to questions about whether officials have made the right decisions. SB 21 requires adequate record keeping and fiduciary oversight, but specific operating rules remain secret.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/why-texas-bitcoin-reserve-move-signals-a-shift-in-government-crypto-policy?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound