Bitcoin Price Faces Resistance as 17,000 BTC Flows into Exchanges

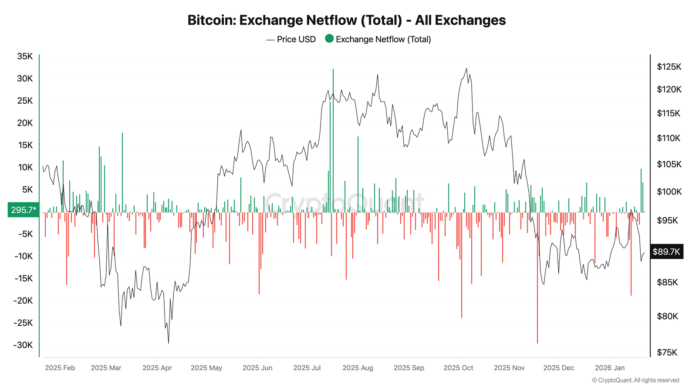

The recent surge in Bitcoin (BTC) price to $90,000 was short-lived, as a significant inflow of 17,000 BTC to exchanges has raised concerns about a potential deepening of the sell-off. According to data from CryptoQuant, this atypical exchange inflow occurred between January 20 and 21, with 9,867 BTC on January 20 and 6,786 BTC on January 21, sharply contrasting the average daily net inflow of -2,000 to +2,000 BTC in January.

Bitcoin researcher Axel Adler Jr. noted that the accumulated inflows are resulting in excess supply near current levels, making the current move towards $89,000-$90,000 an important test of resistance. This is consistent with Bitcoin’s short-term holder SOPR, which tracks whether current buyers are selling for a profit or a loss. The seven-day SMA is 0.996, below the important breakeven level of 1.0, indicating that short-term holders are selling at a loss.

Bitcoin exchange net flows. Source: CryptoQuant/Axel Adler Jr.

Improving Spot Market Signals

Despite the concerns raised by the significant inflow of BTC to exchanges, Glassnode data shows improvement in Bitcoin spot markets. The cumulative volume delta (CVD) of Binance and the overall exchange has turned back towards buy-dominated conditions, while selling pressure on Coinbase has stabilized. This reduction in overhead supply should technically stabilize prices, but current purchasing levels are not enough.

Spot CVD bias for all exchanges. Source: Glassnode

Stablecoin Metrics Support Bottoming Process

Crypto analyst Darkfost added that stablecoin metrics support a possible bottoming process. Following the Bitcoin correction, the stablecoin supply ratio (SSR) experienced the largest decline of the cycle, indicating that Bitcoin’s market cap fell faster than stablecoin liquidity.

Stablecoin supply ratio oscillator. Source: CryptoQuant

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information. For more information, visit https://cointelegraph.com/news/17k-bitcoin-inflow-to-exchanges-raises-alarm-will-btc-s-sell-off-deepen