The world of finance is complex and multifaceted, with various factors influencing the markets and economies. One crucial aspect that has garnered significant attention in recent times is the relationship between Bitcoin and traditional finance (TradFi) cycles. As we move forward in 2025, it’s essential to understand the potential collision of these cycles in 2026 and their implications for the future of Bitcoin.

Refinancing Cycle: A Stress Test for 2026

According to the Institute of International Finance, global debts have reached approximately $315 trillion in the first quarter of 2024, with an average maturity of seven years. This translates to around $50 trillion that needs to be refinanced every year. The actual test will come in 2026 when the annual “maturity wall” in advanced economies increases by almost 20%, exceeding $33 trillion. This refinancing requirement could absorb market liquidity, leaving less space for risky assets and potentially burdening governments and companies, especially those with weaker credit profiles.

The refinancing wall could be a real stress test for risk assets, including compensation, high-yielding bonds, emerging markets, and crypto. With higher interest rates and close financing conditions, the capital costs may increase, credit spreads may widen, and investors may require higher risk premiums. Risk assets that depend heavily on abundant liquidity and low financing costs could face valuation pressure, reduced inflows, and sharper volatility as refinancing demands increase.

Liquidity Cycles: A Potential Turning Point in 2026

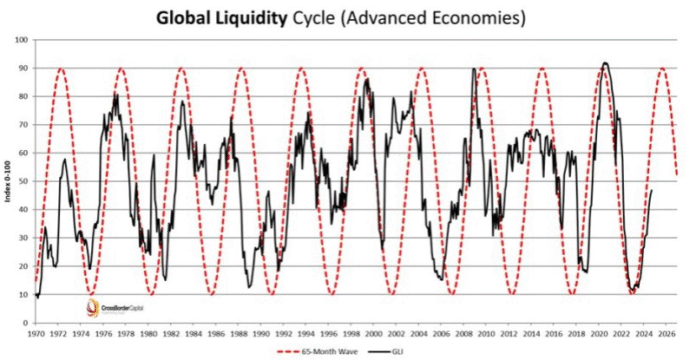

Global liquidity continues to grow, with M2 in the four largest central banks rising by 7% year-over-year to reach $95 trillion in June 2025. However, liquidity also moves in cycles, as shown by the global liquidity index from economist Michael Howell. The index suggests that liquidity may peak by the end of 2025, which could lead to increased volatility and potentially impact Bitcoin prices.

Global liquidity cycle (advanced economies). Source: Michael Howell, cross-border capital

US bank reserves also tell a similar story, with the New York FED indicating that reserves remain “plenty” at $3.2 trillion, although the reduction of the equilibrium leaves aims to get them to a “rich” level. If liquidity decreases in 2026, Bitcoin may feel the effects, potentially deepening the ongoing bear market. However, if central banks inject liquidity, the resulting expansion could give Bitcoin a fresh tailwind.

Secular Trends: A Potential Bull Run in 2028

Long-term market cycles are also crucial beyond liquidity and refinancing. The Kobeissi letter, which uses the CAPE model (cyclically adjusted price-earnings ratio), shows that the current secular bull market started in 2009 and has lasted 16 years so far. The cycle from 1982-2000 rose by 114% before the dot-com crash ended, while the run from 1949-1968 saw smaller tips and deeper backing towards the end.

Secular economic trends. Source: loyalty

According to analysts, today’s market resembles the pattern of the 1960s more than the blowout of the late 1990s. CAPE models indicate that returns could accelerate further before this secular wave ends, which could occur somewhere in 2028 if past cycles are any indication. This could mean a simpler bear market in 2026 and an enthusiastic relaxation in 2027 and 2028, the year of the new halving.

Ultimately, the future of Bitcoin is not defined by a single metric but by the interaction of various forces, including intactile loads, liquidity cycles, political changes, innovation, and investor psychology. As the world becomes increasingly complex, it’s essential to consider the full complexity of the global economy and its potential impact on Bitcoin. For more information, visit https://cointelegraph.com/news/bitcoin-tradfi-cycles-set-to-collide-in-2026-good-or-bad?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound