The Bitcoin market is bracing itself for a crucial test as the $13.8 billion options expiry approaches on August 29. This event could determine whether the recent 9.7% correction marks the end of Bitcoin’s bull run or just a temporary setback. With the decline to $112,100 on Thursday, Bitcoin has reached its lowest point in six weeks, reinforcing bearish dynamics ahead of the monthly options expiry.

Bearish Pressure Intensifies

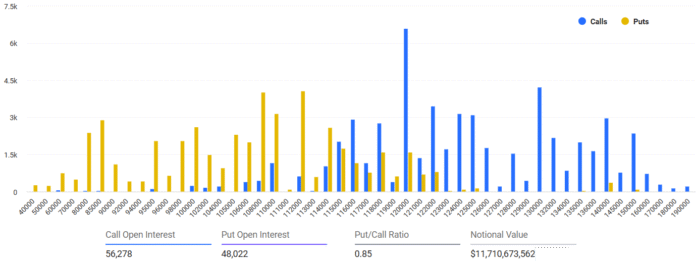

The open interest for call (buy) options stands at $7.44 billion, 17% higher than the put contracts at $6.37 billion. However, the actual outcome on August 29 will depend on various factors, including the performance of Bitcoin in the lead-up to the expiry. Deribit dominates the market with an 85% share, followed by CME at 7% and OKX with 3%. Bulls may have been overly confident, with some bets placed at $125,000 or higher, but this optimism has quickly eroded after the decline of Bitcoin, shifting the dynamics in favor of bearish instruments.

Deribit options open interest in August 29, BTC. Source: Deribit

Key Price Levels to Watch

Only 12% of call options were placed at $115,000 or less, leaving most of the money at the current level. In contrast, 21% of put options are at $115,000 or higher, with significant clusters at $112,000. This suggests that bears will continue to exert downward pressure on the Bitcoin price ahead of the monthly expiry. While it may be too early to declare bullish options strategies completely lost, traders are eagerly awaiting comments from US Federal Reserve Chairman Jerome Powell on Friday, as any hint of increased probability of interest rate cuts could support asset prices.

Five Probable Scenarios

Based on current price trends, here are five possible scenarios for the Bitcoin price ahead of the options expiry:

-

Between $105,000 and $110,000: Calls of $210 million (buy) compared to puts (sell) of $2.66 billion. The net result favors put instruments by $2.45 billion.

-

Between $110,100 and $114,000: Calls of $420 million compared to $1.94 billion, which prefer puts by $1.5 billion.

-

Between $114,100 and $116,000: $795 million calls compared to $1.15 billion, which prefer puts by $360 million.

-

Between $116,100 and $118,000: $1.3 billion calls compared to $830 million, which prefer calls by $460 million.

-

Between $118,100 and $120,000: $1.7 billion calls compared to $560 million, which prefer calls by $1.1 billion.

For bullish strategies to succeed, the Bitcoin price would need to rise above $116,000 by August 29. However, the most critical challenge is $114,000, where bears are most motivated to push prices lower. Ultimately, the fate of Bitcoin will be decided by broader macroeconomic trends, including concerns about expenses in the artificial intelligence sector. After a warning from Morgan Stanley, investors are becoming increasingly cautious about the ability of major tech companies to finance share buybacks, which could lead to a decrease in risk appetite.

This article serves general information purposes and should not be regarded as legal or investment advice. The views, thoughts, and opinions expressed here are solely those of the author and do not necessarily reflect the views and opinions of Cointelegraph. For more information, visit https://cointelegraph.com/news/bitcoin-s-13-8b-options-expiry-puts-bulls-on-edge-ahead-of-key-test?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound