Bitwise Solana Staking ETF Sees Impressive Debut with $55.4 Million Trading Volume

The cryptocurrency market has witnessed a significant milestone with the launch of the Bitwise Solana Staking ETF (BSOL), which achieved a remarkable $55.4 million in trading volume on its first day. This impressive debut surpasses the launches of other notable crypto ETFs, including REX Osprey’s XRP (XRP) and Solana (SOL) staking ETFs, according to Bloomberg ETF analyst Eric Balchunas.

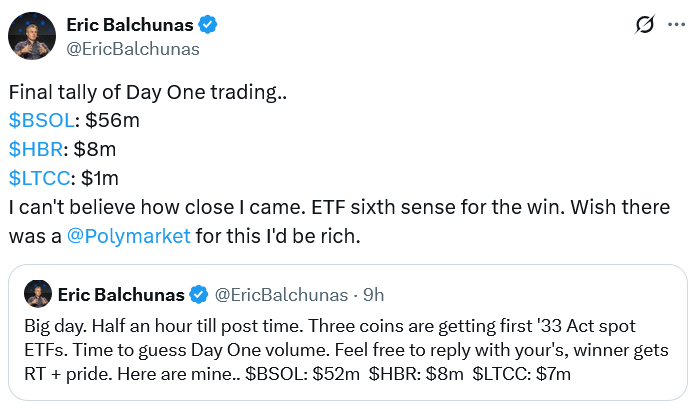

The BSOL’s trading volume exceeded Balchunas’ pre-launch estimate of $52 million, demonstrating a strong institutional commitment to participating in staking. Staking is a reward mechanism for individuals who lock cryptocurrencies on the blockchain to validate transactions. The ETF attracted around $223 million in assets before its launch, further highlighting the growing confidence in this investment strategy.

Source: Eric Balchunas

The launch of the BSOL ETF is a testament to the expanding appetite for cryptocurrencies beyond market leaders Bitcoin (BTC) and Ether (ETH). Asset managers are now exploring the launch of exchange-traded products tied to riskier cryptocurrencies or novel mechanisms like staking. This trend is expected to continue, with more investors seeking to diversify their portfolios and capitalize on the growth potential of the cryptocurrency market.

Performance of Other Altcoin ETFs

In addition to the BSOL ETF, two other altcoin ETFs were launched by Canary Capital, including the Canary Capital HBAR ETF (HBR) and the Canary Capital Litecoin ETF (LTCC). The HBR ETF closed its first day of trading at $8 million, in line with Balchunas’ forecast, while the LTCC ETF reached $1 million, below the estimated $7 million.

Source: Bitwise

While the BSOL ETF’s trading volume was impressive, it was still a fraction of the $1.08 billion trading volume recorded by the nine spot Ether ETFs launched in July. The Ether ETFs, including those from Grayscale and BlackRock, attracted significant investment, with outflows from Grayscale’s converted Ethereum ETF Trust accounting for $458 million and BlackRock’s iShares Ethereum Trust ETF receiving $248.7 million.

Market Trends and Future Outlook

The launch of the BSOL ETF and other altcoin ETFs marks a significant milestone in the growth of the cryptocurrency market. As institutional investors continue to show interest in cryptocurrencies, we can expect to see more innovative products and investment strategies emerge. With the market expanding beyond Bitcoin and Ether, investors are now exploring alternative opportunities, including staking and other novel mechanisms.

For more information on the Bitwise Solana Staking ETF and the growing cryptocurrency market, visit https://cointelegraph.com/news/bitwise-solana-staking-etf-55-million-debut-trading-volume?utm_source=rss_feed&utm_medium=rss_tag_litecoin&utm_campaign=rss_partner_inbound