Bitcoin’s Market Structure Undergoes Significant Shift as New Whales Enter the Scene

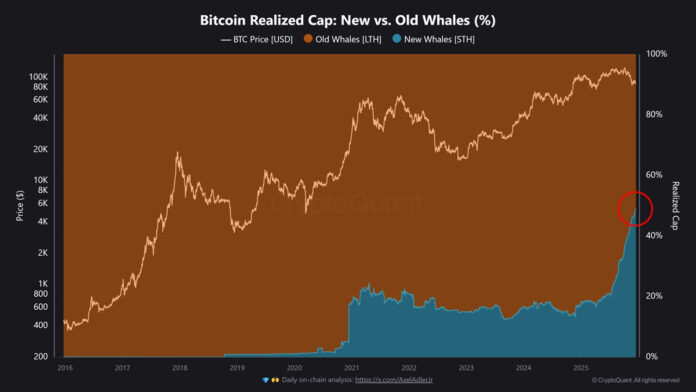

Recent on-chain data suggests that Bitcoin’s (BTC) market structure is undergoing a significant transformation, driven by the emergence of new whales. According to data from CryptoQuant, nearly 50% of Bitcoin’s realized cap is now attributed to these new whales, indicating a structural realignment of the network’s cost base. This shift reflects a change in where capital is entering the network, rather than who owns the most coins.

The realized cap measures the value of BTC at the price at which each coin last moved. This metric provides valuable insights into the market’s underlying dynamics, allowing analysts to gauge the level of demand and supply. The fact that new whales now account for almost 50% of Bitcoin’s realized cap is a significant development, as it indicates that large amounts of capital are being deployed at higher price levels.

Short-Term Demand on the Rise as Whale Buying Intensifies

The net position change of short-term holders (30 days) has reached an all-time high of almost 100,000 BTC. This metric tracks the net change in supply of coins less than 155 days old and reflects the aggressive accumulation of new market entrants. Such expansions occur during periods of high momentum, when demand exceeds available supply, even if volatility remains high.

Meanwhile, recent Binance inflow data suggests that coins older than 155 days remained largely inactive, confirming that long-term holders have not passed them on. Instead, it was mostly selling by short-term investors reacting to price weakness. More importantly, about 37% of BTC sent to Binance came from whale-sized wallets (1,000-10,000 BTC), suggesting that large capital was actively trading and seeking liquidity during the move.

Cumulative Volume Delta Indicates Whale Dominance

Data from Hyblock supports the view that whales are driving the market’s momentum. The cumulative volume delta (CVD), which measures whether buyers or sellers dominate, shows that whale wallets ($100,000 to $10 million) recorded a positive delta of $135 million this week. In contrast, retailers ($0-$10,000) and mid-sized retailers ($10,000-$100,000) experienced negative deltas of $84 million and $172 million, respectively.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/new-bitcoin-whales-rewrite-btc-s-market-structure?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound