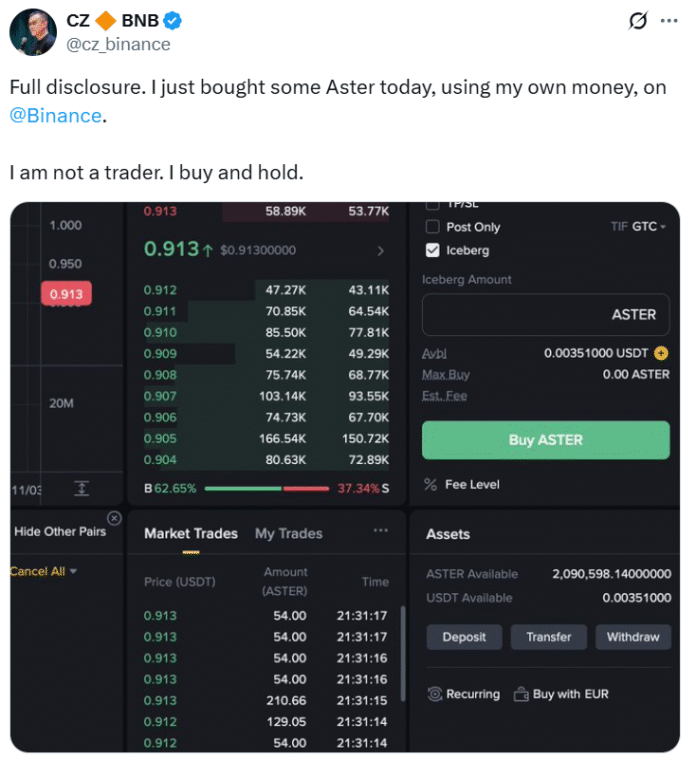

The cryptocurrency market has witnessed a significant surge in the native token of decentralized exchange protocol Aster, with its price rising over 30% on Sunday. This sudden increase was triggered by the revelation that Changpeng “CZ” Zhao, the co-founder of Binance, has acquired over $2.5 million worth of Aster tokens. CZ shared his wallet holdings on X, stating that he “bought a few Aster with my own money on Binance today” and emphasizing that he is not a trader, but rather a long-term holder.

The news of CZ’s investment in Aster led to a notable increase in the token’s trading volume, with data from DefiLlama showing a rise from $224 million to over $2 billion in the last 24 hours. The token’s market capitalization also grew, increasing from $1.8 billion to over $2.5 billion. This surge is reminiscent of the recent price increase of Zcash, which rose 30% after crypto entrepreneur Arthur Hayes predicted that the token would eventually hit $10,000.

Market Reaction to CZ’s Investment

The market reaction to CZ’s investment in Aster was swift, with the token’s price jumping from $0.91 to a high of $1.26, according to CoinGecko. At the time of publication, the price was $1.22. A dealer named “Gold” commented on the situation, stating that CZ’s purchase of Aster with personal funds was a significant factor in the price increase. CZ himself addressed the situation, saying that he was hoping to buy more tokens at low prices and that he rarely invests in tokens, with the exception of Aster and BNB eight years ago, which he still owns.

However, not everyone is convinced that the rally will last. Two whales have bet against CZ and shorted Aster, hoping that the price will fall. According to blockchain analytics platform Lookonchain, one trader built his Aster short sale to 42.97 million tokens worth $52.8 million, with a liquidation price of $2. Another trader also increased his short position to 15.3 million Aster worth $19.1 million, with a liquidation price of $2.11.

CZ’s Connection to Aster

CZ’s connection to Aster dates back to September, when he congratulated the project on its progress. It is also known that CZ’s family office, YZi Labs, invested in Aster’s predecessor Astherus last year. Aster was created in late 2024 from a merger between Astherus and the decentralized perpetuals protocol APX Finance. A BNB Chain representative told Cointelegraph that Aster had received support from BNB Chain and YZi Labs, but did not disclose whether CZ was directly involved.

The situation highlights the influence of prominent figures in the cryptocurrency market, with their investments and endorsements having the potential to significantly impact token prices. As the market continues to evolve, it will be interesting to see how Aster and other tokens perform in the coming weeks and months.

Conclusion

In conclusion, the surge in Aster’s price following CZ’s investment highlights the significant impact that prominent figures can have on the cryptocurrency market. As the market continues to evolve, it is essential to stay informed and up-to-date on the latest developments. For more information on this and other cryptocurrency-related news, visit https://cointelegraph.com/news/aster-token-surges-after-cz-buys-two-million-tokens?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound