Germany’s Bitcoin Debate Heats Up Amid MiCA Conflict

The debate over Bitcoin in Germany is gaining momentum, with lawmakers questioning whether the country’s strict adherence to European Union (EU) rules could hinder innovation and financial independence. The Alternative for Germany (AfD) party has proposed exempting Bitcoin from strict regulation and taxation under the EU’s Markets for Crypto Assets (MiCA) framework, which could redefine Berlin’s approach to digital money.

The AfD’s proposal, entitled “Recognizing the strategic potential of Bitcoin – preserving freedom through restraint in taxation and regulation,” argues that Bitcoin is a fundamentally independent asset class, describing it as “decentralized, non-manipulable, and limited.” The motion insists that Bitcoin should not fall under MiCA’s regulatory scope, warning that excessive supervision could drive capital and companies abroad, weaken Germany’s competitiveness, and threaten its digital sovereignty.

Is Germany Ready to Treat Bitcoin Like Money, Not a Speculative Asset?

According to the application, Bitcoin differs from other cryptocurrencies due to its technological and monetary characteristics, making it more comparable to a digital form of gold than to speculative tokens. MPs called on the federal government to maintain a 12-month tax-free holding period for Bitcoin and classify private mining and Lightning Node activities as non-commercial activities.

They also called for a strategic declaration that recognizes Bitcoin as “free, digital money in the 21st century” and considers its impact on energy policy, digital freedom, and monetary sovereignty. Germany was one of Europe’s most crypto-friendly jurisdictions, combining national regulations with the new EU-wide MiCA framework.

Germany’s Bitcoin Debate Mirrors France’s Proposal to Reject the Digital Euro

The AfD’s move comes as the French National Assembly recently passed a resolution opposing the European Central Bank’s digital euro while supporting Bitcoin and euro-based stablecoins as alternatives. French lawmakers warned that a centrally managed digital currency could endanger privacy and financial freedom and instead called for a national strategy to accumulate Bitcoin reserves.

As Germany proposes breaking away from European Union supervision, German National Bank President Joachim Nagel has defended the digital euro as essential to preserving Europe’s financial sovereignty and warned that without it, the continent could become dependent on foreign-controlled payment systems.

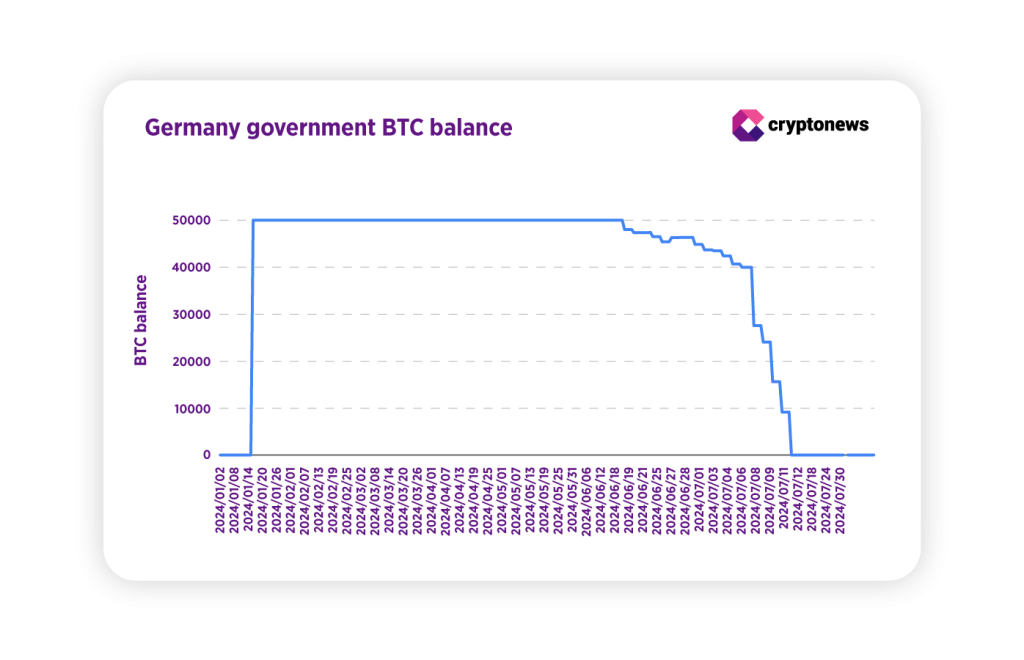

By August 2025, the price of Bitcoin had more than doubled, meaning the holdings would now be worth over $6 billion, which would equate to more than $3 billion in lost profits. Since then, Cotar has called on the government to treat Bitcoin as a strategic reserve asset instead of selling it.

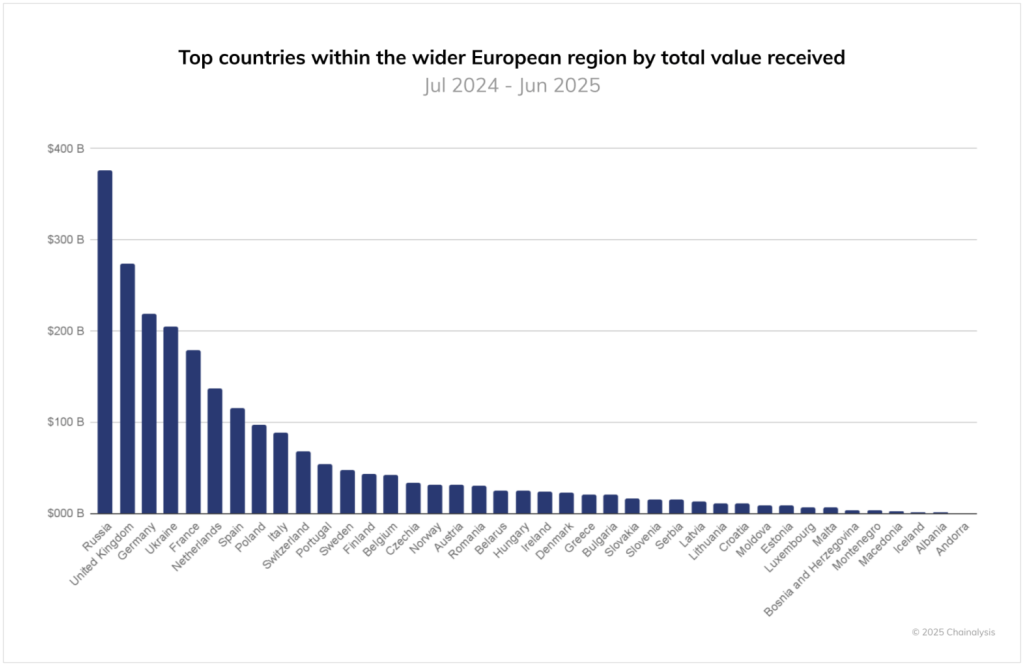

Nevertheless, the German crypto economy remains strong. Chainalysis data shows that the country recorded $219 billion in crypto transaction volume between July 2024 and June 2025, making it one of the largest markets in Europe.

Source: Chainalysis

For more information, visit https://cryptonews.com/news/germany-pushes-for-bitcoin-could-berlin-be-the-next-to-adopt-btc/