Introduction to Tokenized Markets

The future of investing has arrived, where buying shares in a private company can be done with ease, just like using an app. No paperwork, no minimum investment requirements, and no geographical restrictions. Primary offerings and real-world assets, such as stocks, bonds, and real estate, are being tokenized and moved on-chain. Recently, Coinbase Global announced a deal to acquire investment platform Echo for almost $375 million in cash and stocks, pushing for blockchain-based capital formation.

However, this progress comes with a hidden problem: the underlying systems, which track ownership records, verify identities, apply compliance rules, and manage investor onboarding, are not keeping up. While trading interfaces, platforms, and smart contracts are rapidly evolving, these systems remain fragmented and cumbersome. As a result, tokenized offerings are slower to develop, cost more, and are largely left out, rather than becoming mainstream.

The Current Bottleneck

When an issuer decides to tokenize an asset, the biggest obstacles often lie behind the scenes. Cap table software, identity/KYC systems, compliance workflows, and transfer agent coordination are often separate, unconnected modules. This fragmentation creates tension for everyone involved, from issuers facing delays and higher compliance costs to investors experiencing slow onboarding and limited secondary liquidity.

Regulators also face greater risks due to inconsistent audit protocols and difficulty in monitoring. Despite the growth of tokenized assets, trading volume remains low, and most tokens are held rather than actively traded. The bottleneck is not the smart contract or listing but the infrastructure behind issuance, ownership tracking, transfers, and verification.

How Next-Generation Platforms Solve the Problem

The true value in tokenized markets lies not in the moment of issuance but in the lifecycle: issuance, investor onboarding, holding, secondary transfer, audit/reporting, and rotation. To make this lifecycle efficient, a platform is needed where onboarding, compliance, cap table updates, broadcast rights, and audit reporting are seamlessly connected rather than patched together.

The solution is not another exchange or token standard but a connection between existing systems. This is achieved through a workflow where identity verification, token issuance, compliance rules, and audit reporting are integrated, allowing for real-time updates and automated reviews.

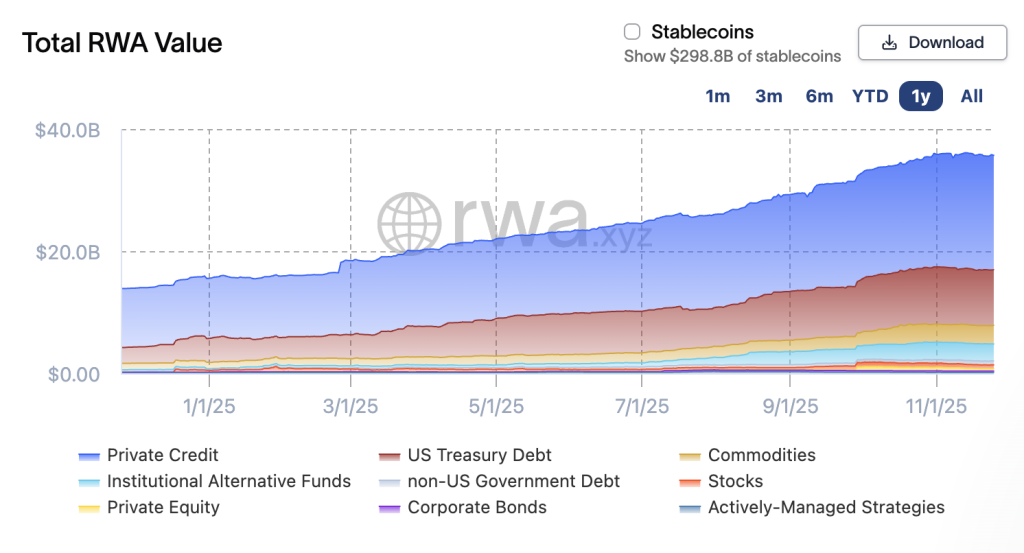

Source: rwa.xyz

Why This Matters for Markets and Investors

When the backend infrastructure operates smoothly, the impact is profound. Tokenized assets can become truly liquid, regulated, accessible, and investable at scale. For investors, this means access to previously illiquid asset classes with lower minimum amounts, clearer ownership structures, and better tradability.

It is also crucial for regulators and the ecosystem as a whole. Tokens that anchor ownership, compliance, and auditing in the infrastructure create transparency and trust. This is essential if on-chain assets are to sit alongside traditional financial markets rather than in isolated sandboxes. The global potential is enormous, with tokenization reported to be worth trillions of dollars as these systems evolve.

Final Thoughts

The future of investing could be faster, fairer, and more accessible, but only if the underlying infrastructure is addressed. While tokens represent the forefront of innovation, real progress happens behind the scenes, where identity, compliance, and ownership converge. Once the infrastructure catches up, tokenized markets will not only become possible but unstoppable.

For more information on the future of tokenized markets and their infrastructure, visit https://cryptonews.com/exclusives/tokenized-markets-are-ready-but-their-infrastructure-isnt/