Introduction to Hodling Crypto

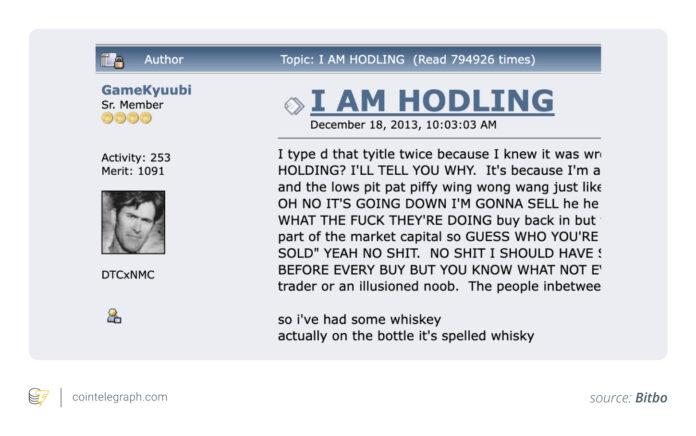

Hodling crypto refers to the practice of holding onto cryptocurrency, particularly Bitcoin, for an extended period, regardless of market fluctuations. This strategy has gained popularity over the years, especially among long-term investors who believe in the potential of Bitcoin to increase in value over time. The term “hodling” originated from a 2013 forum post on Bitcointalk, where a user, GameKyuubi, inadvertently typed “I AM HODLING” instead of “I am holding.” The typo stuck, and the concept of hodling has since become a widely accepted investment strategy in the crypto community.

The Concept of Hodling

Hodling is often seen as a psychological defense mechanism against the volatility of the crypto market. It is based on the principle of loss aversion, which states that people tend to feel the pain of losses more strongly than the pleasure of equivalent gains. In the context of crypto, where daily price swings of 20% are not uncommon, this emotional bias can lead to irrational decisions, such as panic selling or FOMO buying. Hodlers, on the other hand, reject this impulse and instead focus on long-term conviction, committing to their investment strategy even when the market turns red.

In 2025, the concept of hodling has evolved, with many investors viewing Bitcoin as a store of value. According to CoinShares, over 70% of Bitcoin’s circulating supply has not moved in more than a year, indicating intentional holding by long-term investors, including exchange-traded funds (ETFs), pension funds, and sovereign wealth vehicles. This mentality aligns closely with how Bitcoin is increasingly positioned in 2025: as a macro asset, with institutions like Fidelity and BlackRock describing it alongside gold in asset allocation reports.

Ideas Behind Hodling Bitcoin in 2025

The idea behind hodling Bitcoin in 2025 is to adopt a long-term strategy, focusing on the potential for growth and increased value over time. This approach is supported by the stock-to-flow model, which puts long-term price targets in the six-figure range. ARK Invest has modeled a potential Bitcoin price of over $1 million by 2030 in its bull case, while Fidelity has projected strong long-term growth based on network adoption. With over 94% of Bitcoin’s total supply already mined, leaving less than 1.05 million BTC to be created, the scarcity of Bitcoin is expected to drive up its value in the long term.

As of May 2025, Bitcoin has reached new heights, hitting an all-time high of nearly $112,000. Institutional interest has played a significant role in this growth, with BlackRock’s iShares Bitcoin Trust (IBIT) seeing impressive inflows, and Fidelity and ARK Invest contributing to this trend. Collectively, US spot Bitcoin ETFs have amassed over $94.17 billion in assets under management.

2025 Market Context: Should You Hodl Bitcoin?

In 2025, the crypto market is still volatile, with regulation and environmental concerns being major factors to consider. However, with the rise of institutional interest and the increasing adoption of Bitcoin as a store of value, the case for hodling is stronger than ever. While it’s not going to be smooth sailing ahead, with potential challenges from central bank digital currencies (CBDCs) and ESG pressure, the long-term potential of Bitcoin remains promising.

So, is it still worth hodling? Plenty of people think so, with many experts projecting strong long-term growth. The key is to adopt a long-term strategy, focusing on the potential for growth and increased value over time, rather than getting caught up in short-term market fluctuations.

Bitcoin for Long-Term: Tools and Platforms in 2025

In 2025, there are various tools and platforms available to support long-term Bitcoin investors. These include cold and hot wallets, institutional-grade custody solutions, and yield options. Cold wallets, such as Ledger, Trezor, or air-gapped devices like the Ellipal Titan, remain the go-to for serious long-term storage, while hot wallets like Sparrow, BlueWallet, or browser-based wallets on Nostr clients have improved dramatically in security.

Cold vs. Hot: How Hodlers Store Their Bitcoin

Cold wallets are ideal for people who don’t plan to touch their coins for years, while hot wallets offer accessibility and improved security features, such as multisig setups and decentralized identity systems for recovery.

Institutional-Grade Custody and Yield Options

Platforms like Fidelity Digital Assets, Coinbase Custody, and BitGo offer secure vaulting solutions with compliance baked in, often with additional perks like portfolio insurance, automated rebalancing, or integration with trust and estate planning. Yield options, such as Lido, Liquid, and Babylon, allow users to earn yield on wrapped BTC positions or secure sidechains without losing custody.

- Lido has expanded into Bitcoin staking derivatives, letting users earn yield on wrapped BTC positions without losing custody.

- Platforms like Liquid and Babylon are experimenting with Bitcoin-native staking models, allowing BTC to secure sidechains or earn validator-like rewards without being rehypothecated.

- Tokenized T-bill vaults and BTC-backed stablecoins now allow users to generate yield while maintaining Bitcoin exposure.

Automation Tools

Services like Swan Bitcoin and River Financial let users set up recurring buys and auto-withdraw to cold storage, while platforms like Casa and Unchained Capital offer multisig setups with built-in inheritance planning and emergency recovery workflows. Tools like Zaprite or Timechain Calendar help hodlers track portfolio growth without connecting directly to wallets, an ideal option for those who want visibility without exposure.

For more information on hodling in 2025, visit the original source: https://cointelegraph.com/explained/hodling-in-2025-the-most-widely-used-bitcoin-strategy-explained?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound