Introduction to Universal Finance

The financial landscape is undergoing a significant transformation, with the boundaries between banks and stock exchanges disappearing. A few years ago, there was a heated debate in the market about the merits of centralized versus decentralized finance. However, today, more and more market participants are realizing that both ultimately have the same goal: a faster, safer, and more user-centric financial landscape. The old boundaries that separated finance into CeFi, DeFi, or TradFi are already crumbling, and in their place, a new reality is emerging – one in which the best qualities of all three learn to coexist.

The Convergence of Traditional and Digital Finance

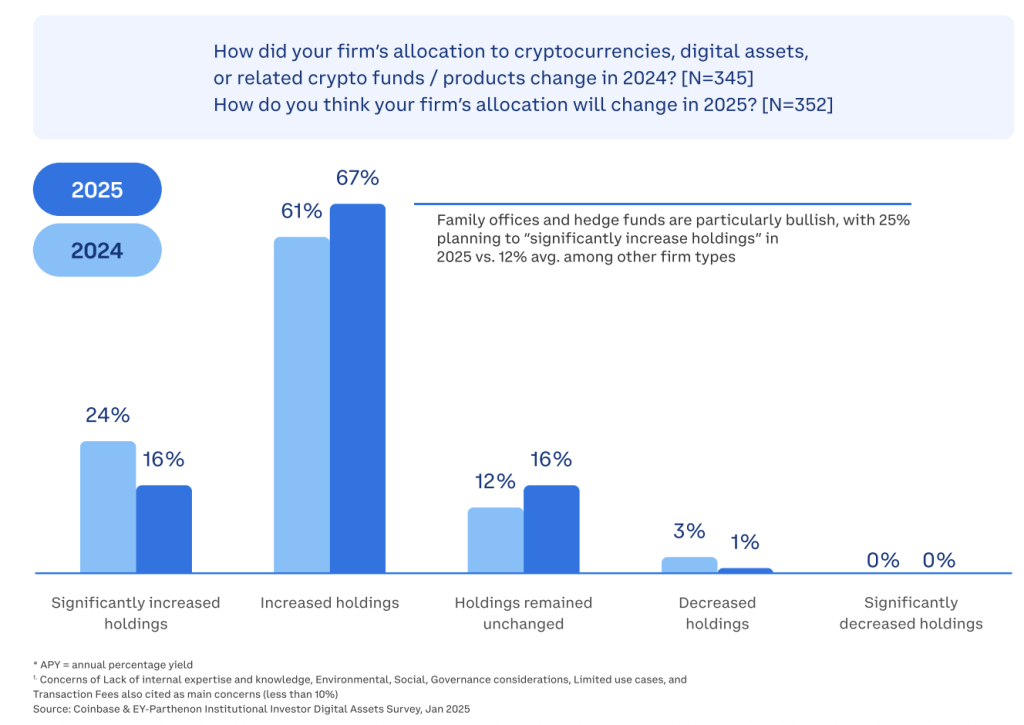

According to an institutional investor survey conducted in early 2025, 86% of respondents either already had allocations to digital assets or planned to invest throughout the year. This is a clear sign that traditional financial players are moving into what was once pure “crypto/DeFi” territory.

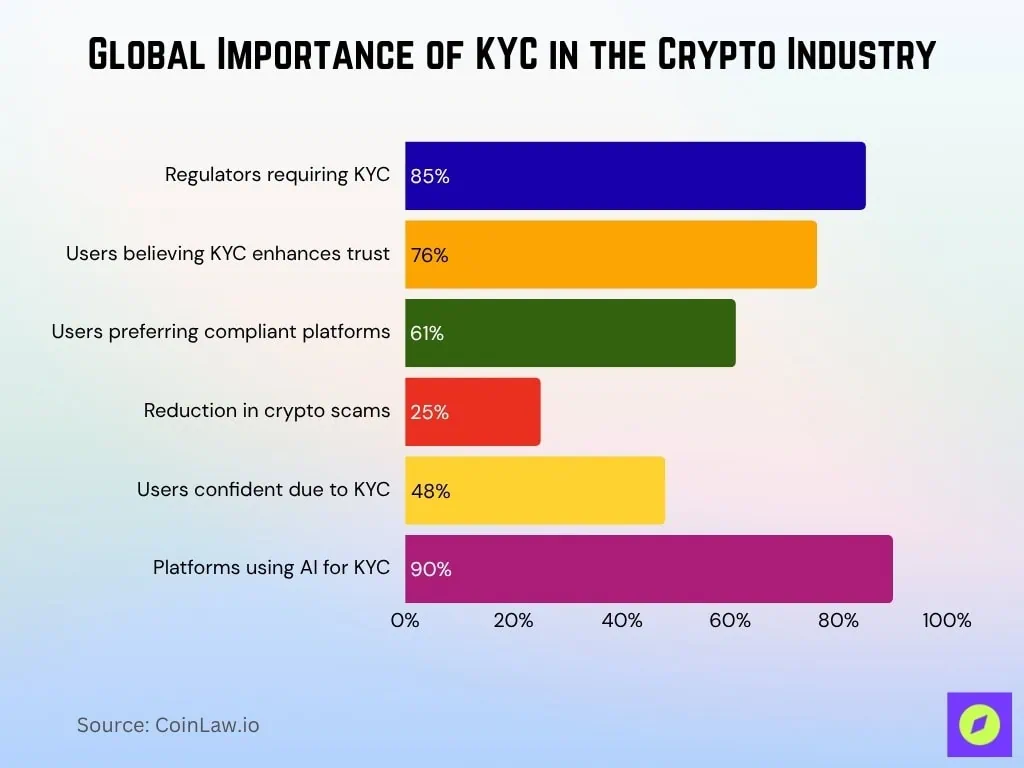

Therefore, from the perspective of the future of finance, it makes more sense to view all of these systems not as rivals, but as compatible parts that can come together to create something even better. The debate between CeFi and DeFi is becoming obsolete, and the lines themselves are blurring. Centralized exchanges are now integrating on-chain elements such as non-custodial wallets and tokenized assets. At the same time, DeFi protocols are introducing KYC processes and compliance tools to attract institutions.

The Emergence of Universal Finance

A wealth of evidence clearly shows that we are moving towards interoperability. How efficiently liquidity, governance, and value flow across systems will be the central point of discussion from now on. To prove this point, research looking at cross-chain arbitrage trades between CEXs and DEXs over the period 2023-2025 found that over $230 million has already flowed freely between centralized and decentralized trading venues.

The Future of Finance

As this new landscape becomes fully established, we will see banks behaving like exchanges and conducting on-chain operations with tokenized assets, while exchanges in turn will behave like banks, offering savings, payments, and lending services.

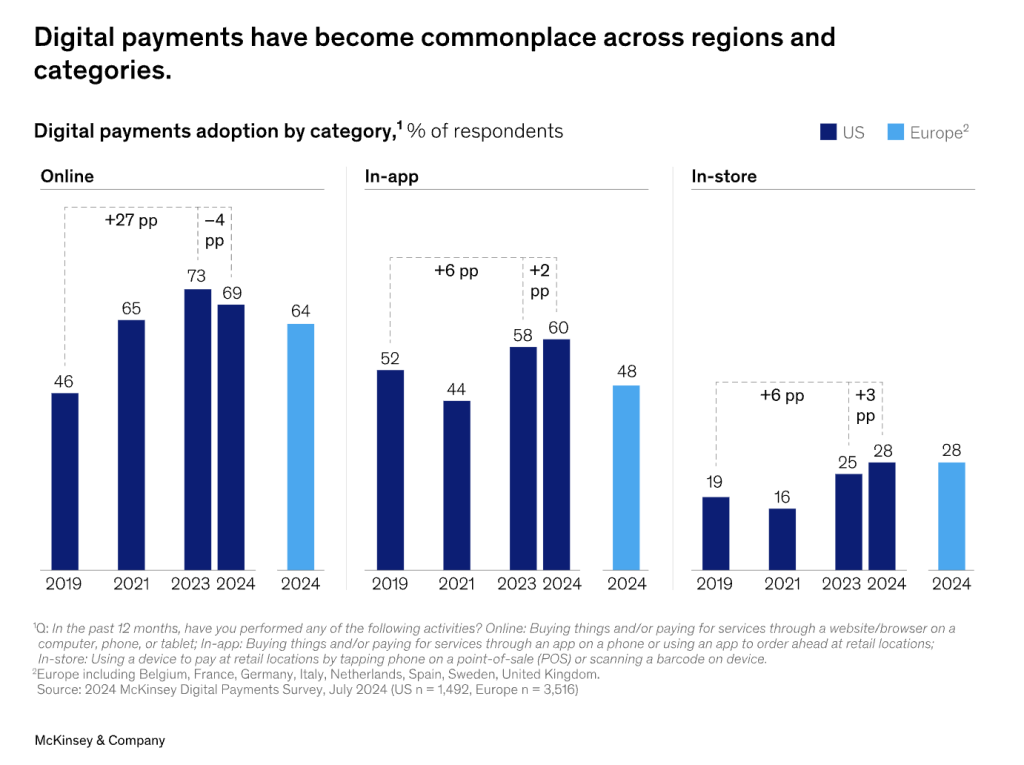

According to McKinsey, by 2024, over 90% of consumers in the US and Europe will have made some type of digital payment. Additionally, about 60% of Generation Z said they expect to use digital wallets more frequently in 2025. They expect financial services to be instantaneous, allowing them to move value across borders, assets, and platforms on a virtually daily basis.

Conclusion

The topic of universal exchanges is also inevitably linked to the topic of super apps – platforms that can do everything in one place, including trading, saving, investing, and paying bills. These super apps will be the face of the next financial revolution. Market reports show that the super apps sector was already worth nearly $128 billion in 2025 and is expected to exceed $440 billion by 2030.

For regulators, this impending financial merger represents both a challenge and an opportunity. The challenge is to find consistent frameworks for hybrid platforms that work across traditional and decentralized systems. Admittedly not an easy matter. But the profit is also enormous. If successful, the world will have a unified financial environment that is safer, faster, and more transparent than anything before.

For more information, visit https://cryptonews.com/exclusives/universal-finance-the-next-step-beyond-cefi-defi-and-tradfi/