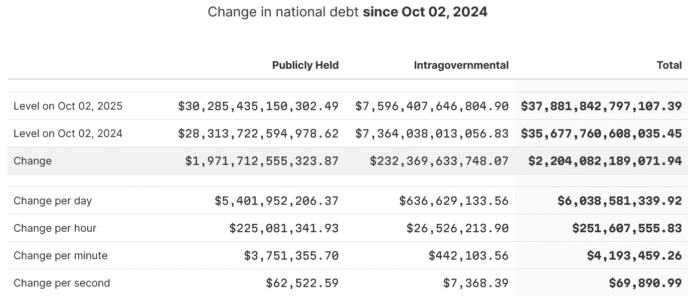

The United States is on the cusp of reaching a record-breaking $38 trillion in public debt, with the current figure standing at $37.9 trillion. This staggering amount has increased by $69,890 per second or approximately $4.2 million per minute over the last year, according to the US Congress Joint Economic Committee. To put this into perspective, the daily increase amounts to around $6 billion, which is more than the gross domestic product of over 30 countries, as reported by Worldometers.

This exponential growth in public debt has sparked concerns among investors, leading them to seek safe-haven assets such as Bitcoin and gold. The US representative Keith Self warned that the debt record is expected to exceed $38 trillion in a matter of weeks and could potentially reach $50 trillion within a decade if drastic measures are not taken. Self emphasized the need for congressional action, stating that “the Congress must now act – call for tax responsibility from its leaders before the gradual film becomes a sudden breakdown.”

Investors Flock to Bitcoin and Gold

In light of the looming debt crisis, investors are turning to alternative assets such as Bitcoin and gold. JPMorgan recently advertised Bitcoin and gold as a “debasement trade,” citing their potential as a hedge against inflation and currency devaluation. This comes as Bitcoin reached a new all-time high of $125,506 on Saturday, while gold achieved a fresh high of $3,920 on Sunday. The fixed supply and decentralized nature of Bitcoin have attracted increased institutional attention, with Larry Fink, CEO of Blackrock, predicting that Bitcoin could reach $700,000 due to fears of currency devaluation.

Ray Dalio, founder of Bridgewater Associates, the world’s largest hedge fund, recommended that investors allocate 15% of their portfolio to hard assets such as Bitcoin or gold to optimize the “best return risk relationship.” Dalio noted that other Western nations, such as the United Kingdom, are also exposed to the same debt problems and that their currencies are still undervalued compared to Bitcoin and gold, which he described as an “effective diversification.”

Global Debt Crisis

The issue of debt is not unique to the United States, as global debt has risen to a record high of $337.7 trillion by the end of the second quarter, driven by quantitative easing and a softer US dollar, according to Reuters. This has led to concerns about a potential “debt doom loop” and the need for investors to diversify their portfolios with alternative assets.

Efforts to Slow Down US Debt

The Trump administration has made efforts to reduce the federal government’s spending and deficit, citing it as a key political priority. Elon Musk, CEO of Tesla, was brought in to support the government’s efficiency efforts, aiming to reduce expenses and save $214 billion. However, the implementation of the “Big Beautiful Bill Act” signed by President Donald Trump in July is expected to cost $3.4 trillion over the next 10 years, further exacerbating the debt crisis.

As the US debt continues to rise, investors are increasingly turning to safe-haven assets such as Bitcoin and gold. With the current prices, the United States is expected to exceed $38 trillion in debt within 20 days. As the situation continues to unfold, it remains to be seen how the government will address the looming debt crisis and what impact it will have on the global economy. For more information, visit https://cointelegraph.com/news/us-debt-nearly-38-trillion-strenghtening-bitcoins-case?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound