USX Stablecoin Faces Brief Depegging Due to Secondary Market Sell Pressure

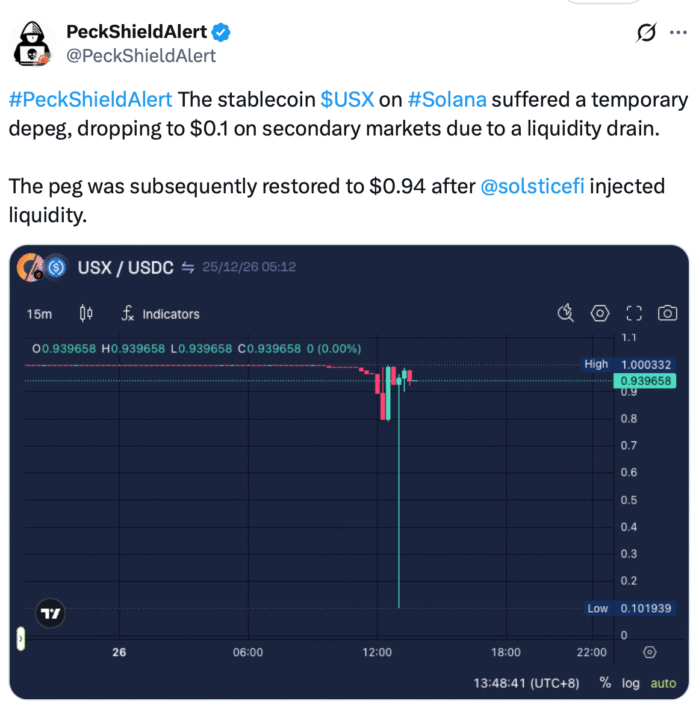

USX, a U.S. dollar-pegged stablecoin native to Solana, experienced a brief depegging on decentralized exchanges early Friday due to heavy selling pressure overwhelming available liquidity in Orca and Raydium. According to PeckShieldAlert, USX briefly traded as low as $0.10 on secondary markets before recovering, a move attributed to isolated trades at a time of extremely low liquidity.

Source: PekShieldAlert

Source: PekShieldAlert

Aggregated DEX data shows a less extreme move, with a 15-minute USX/USD chart from GeckoTerminal’s Orca pool indicating USX fell to around $0.80 before recovering and stabilizing around $0.99 as liquidity returned.

Source: GeckoTerminal.com

Source: GeckoTerminal.com

Issuer Intervention and Market Recovery

Solstice Finance, the issuer of USX, stepped in with liquidity support, injecting liquidity around 04:30 UTC, which helped prices recover back toward pegging. The company stated that USX’s reserves remain over-collateralized, primary market redemptions are unaffected, and it has requested a third-party certification to verify its collateral.

Solstice also announced that 1:1 redemptions remain available to institutional partners with access and that it is working with partners to deepen secondary market liquidity to reduce the impact of similar incidents in the future. The volatility had no impact on eUSX positions or its YieldVault products, and trades executed during the episode are final.

Risk and Regulation in the Stablecoin Market

The global stablecoin market has grown significantly since July, when the US passed the GENIUS Act to create a regulatory framework for dollar-pegged tokens. However, critics warn that the rapid growth of stablecoins could also pose new risks to financial stability. Dutch central bank governor Olaf Sleijpen stated that the European Central Bank may eventually need to view stablecoins as a potential source of macroeconomic shocks, rather than just a regulatory issue.

Stablecoin market cap. Source: DefiLlama

Stablecoin market cap. Source: DefiLlama

According to Defillama, the market cap of stablecoins stands at $308.5 billion, up from around $260 billion on July 18, when the GENIUS Act took effect. The International Monetary Fund (IMF) released a report examining the rapid growth of the stablecoin market and the way major jurisdictions regulate it, warning that global supervision remains fragmented.

For more information, visit https://cointelegraph.com/news/usx-stabilizes-after-brief-depeg-secondary-market-sell-pressure?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound