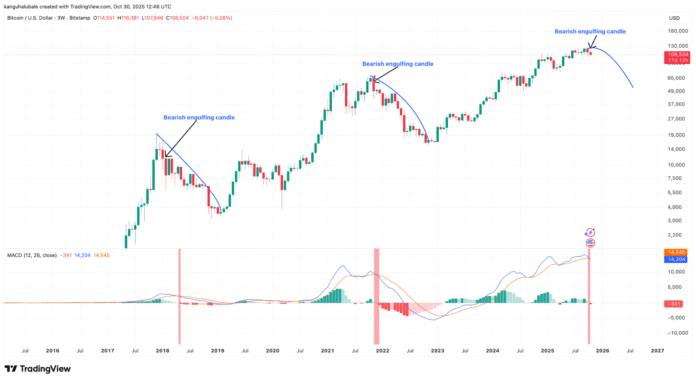

Bitcoin’s (BTC) recent price action has sparked intense debate among market analysts, with some suggesting that the top of the current bull cycle may have been reached. A bearish MACD crossover on the three-week chart, combined with a bearish engulfing candle, has led some to believe that the peak of the Bitcoin bull cycle is imminent.

Technical Indicators Suggest a Cycle High

According to crypto analyst Jesse Olson, a bearish MACD crossover is imminent on Bitcoin’s 3-week chart, with the histogram also showing a longer-term bearish divergence. This crossover was confirmed when the Moving Average Convergence Indicator (MACD) fell below the signal line, a pattern that has historically marked the peak of Bitcoin’s bull cycles in 2017 and 2021. The same three-week chart shows the formation of a “bearish engulfing candle,” similar to those seen at the peaks of the 2017 and 2021 bull cycles.

BTC/USD three-week chart. Source: Cointelegraph/TradingView

Declining Network Activity and Halving Cycle

Declining network activity, as indicated by a 30% drop in daily active addresses on the Bitcoin network in October, also suggests weakening network engagement and user demand. Data from Nansen shows that the number of daily active addresses fell from 632,915 to 447,225. This decrease in activity often precedes price corrections or a prolonged consolidation. Furthermore, pseudonymous trader and investor Mister Crypto points out that Bitcoin has reached a point where it is “historically peaking” based on its four-year halving cycle, with the price typically peaking between 518 and 580 days after the halving event.

Active Bitcoin addresses. Source: Nansen

Bitcoin: Days since last halving. Source: Mister Crypto

Contrasting Views on Bitcoin’s Boom

While some analysts believe that Bitcoin’s four-year cycle is dead, arguing that prices are currently being driven by monetary policy and liquidity rather than halvings, others see a diminishing effect of the halving and argue that a positive interest rate cycle, institutional adoption by ETFs and Bitcoin treasuries, and maturation as a mainstream asset could lead to more upside for Bitcoin in 2026. Analysts such as Jelle and Mags believe that Bitcoin has even more room to rise based on technical indicators, with Jelle stating that Bitcoin has “formed a higher low and the range remains intact” and Mags noting that Bitcoin is trading within a “bullish megaphone pattern” that has led to an upward breakout in the past.

BTC/USD daily chart. Source: Jelle

As Cointelegraph reported, the Bitcoin Mayer Multiple showed that BTC is still rather “oversold” at current levels, suggesting that the $180,000 target is still in play. For more information, read the full article on Cointelegraph.