Tokenized Real-World Assets to Reach $2 Trillion by 2028, Says Standard Chartered

According to a recent report by investment bank Standard Chartered, tokenized real-world assets (RWAs) are poised to experience significant growth, potentially reaching a total value of $2 trillion over the next three years. This surge is expected to be driven by the increasing adoption of decentralized finance (DeFi) and the shift of global capital and payments to more efficient blockchain-based systems.

The report highlights the “trustless” structure of DeFi as a key factor in challenging the dominance of traditional financial systems (TradFi) controlled by centralized entities. As DeFi continues to gain traction in payments and investments, non-stablecoin tokenized RWAs are expected to drive the market cap to $2 trillion by 2028. The breakdown of this projected growth includes $750 billion flowing into money market funds, $750 billion into tokenized U.S. stocks, $250 billion into tokenized U.S. funds, and $250 billion into less liquid segments of private equity, such as commodities, corporate bonds, and tokenized real estate.

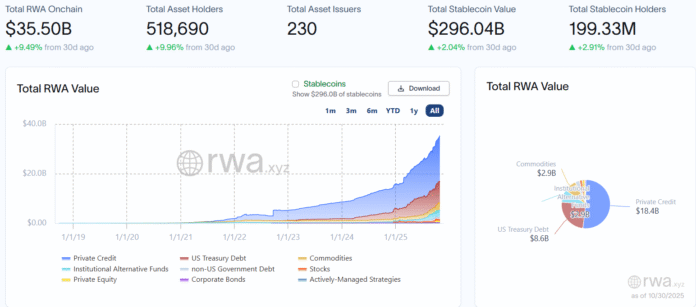

Geoff Kendrick, global head of digital asset research at Standard Chartered, emphasized the crucial role of stablecoin liquidity and DeFi banking in enabling the rapid expansion of tokenized RWAs. Kendrick noted, “We expect RWA to grow exponentially in the coming years.” This anticipated growth represents a significant increase from the current total value of $35 billion, according to data from RWA.xyz, marking a 57x growth over the next three years.

Source: RWA.xyz

Stablecoins Drive DeFi’s Self-Sustaining Growth Cycle

The total stablecoin supply has reached a new record of over $300 billion as of October 3, representing a year-to-date growth rate of 46.8%. Kendrick explained that the expansion of stablecoins strengthens the broader DeFi ecosystem, creating a self-sustaining cycle of growth. “In DeFi, liquidity creates new products, and new products create new liquidity,” he wrote. “We believe a self-sustaining cycle of DeFi growth has begun.”

Despite the optimistic outlook, Standard Chartered notes that regulatory uncertainty remains the biggest threat to the RWA sector. The report warns that progress could stall if comprehensive crypto legislation is not delivered before the 2026 midterm elections. For more information, visit https://cointelegraph.com/news/standard-chartered-2t-tokenized-rwas-2028-stablecoins?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound