Introduction to Tokenized Equities

The concept of tokenized equities has gained significant attention in recent times, particularly with the launch of US shares and ETFs on the Robinhood investment platform for European customers. This move has sparked a wave of interest in tokenized shares, with analysts predicting a bright future for this emerging sector. The potential to merge traditional finance (TradFi) with decentralized finance (DeFi) has opened up new opportunities for asset ownership and exchange.

However, the true potential of tokenized shares lies not only in putting traditional assets on a blockchain but also in making these assets composable within the DeFi ecosystem. This could unlock completely new applications for companies and their investors. According to a statement by Openai, “These ‘Openai tokens’ are not open equity. We did not team up with Robinhood, were not involved and do not support it. A transfer of Openai’s own capital requires our approval – we have not approved a transfer.”

The Promise and Pitfalls of Early Equity Tokenization

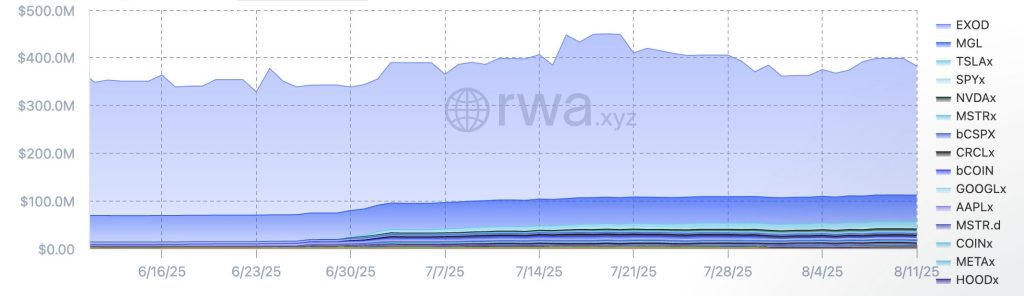

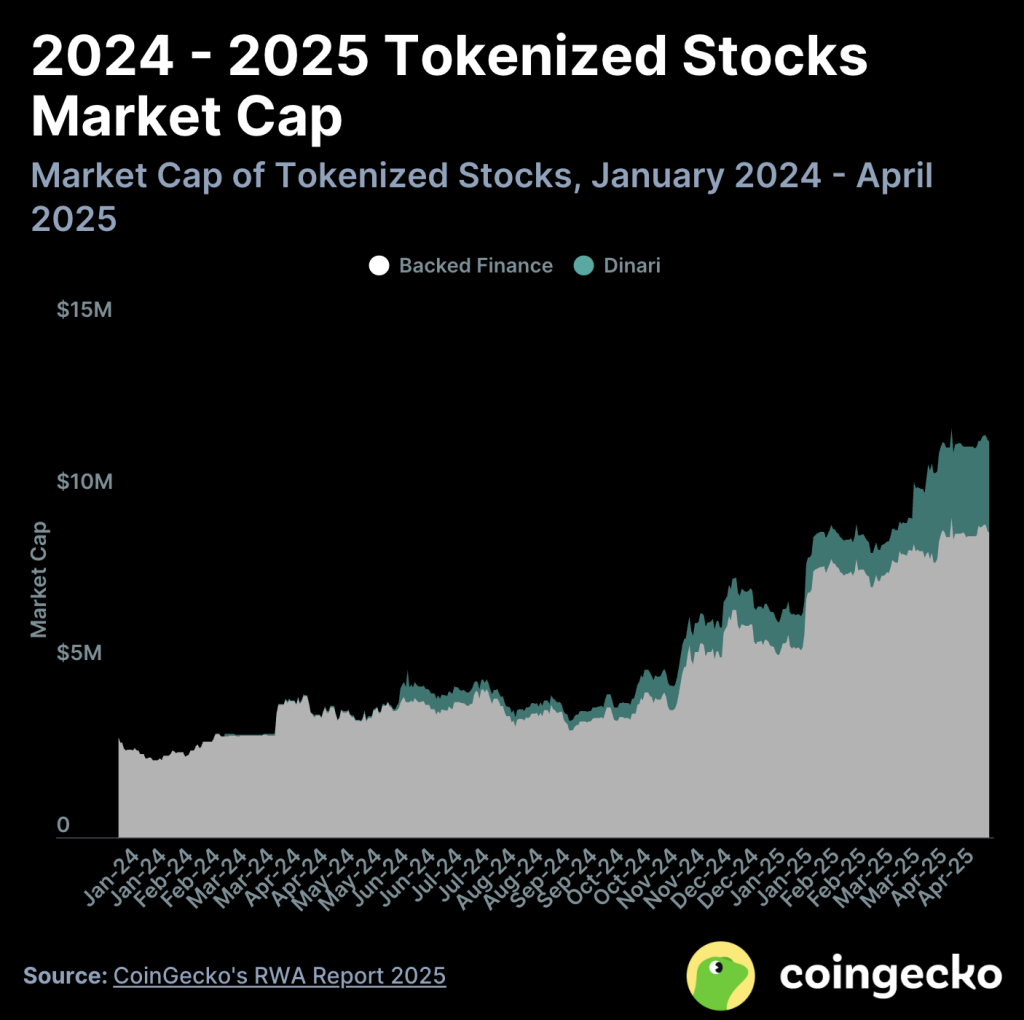

The market for tokenized shares is experiencing rapid expansion, with the total value of all tokenized shares in circulation rising by over 20% to $465 million, according to data published on RWA.XYZ. The monthly transmission volume of these assets increased by more than 280% and reached over $287 million. Formerly published data by Coingecko showed that the tokenized share sector from Real World Assets (RWAS) had grown by almost 300% – an increase of over $8.6 million since the beginning of 2024.

Despite this impressive growth and increasing institutional engagement, equity tokenization, in itself, only offers limited value beyond digital representation. The benefits of tokenized equity remain limited if it cannot be seamlessly integrated into broader decentralized protocols. In fact, early steps in tokenized shares offer little or nothing more than traditional markets, missing the basic innovation that DeFi has to offer.

Composability as a New Equity Income Engine

In the crypto industry, developers have long focused on building modular tools that interact seamlessly with an on-chain ecosystem. This is the promise of composability, and it could also distinguish tokenized stocks if they are used as more than just digital replicas of traditional shares. Composability enables different DeFi protocols to interact and build on one another, generating new income flows and allowing for complex financial strategies in traditional financing.

For example, an investor could purchase a tokenized Amazon share and put it on a decentralized stock exchange like Curve in an Amazon/USDC liquidity pool. In addition to Amazon dividends, the investor could receive native protocol tokens such as CRV and CVX from this position. This interplay of protocols and assets emphasizes how the composability of interpretation generates benefits and presses beyond simple tokenization.

Building the Future of Tokenized Equities

While the US government continues to move along its current pro-crypto agenda, the convergence between traditional and decentralized financial ecosystems is to be continued. The enormous growth that we have already seen in the RWA sector will not slow down, and we will increasingly enter tokenized shares in crypto. The key is to make this inflow of capital useful. By converting shares into truly composable digital assets, the industry could improve the stability and resilience of DeFi.

Ultimately, the future of tokenized shares is not just about digitizing existing assets. Rather, it is in their strengthening through decentralized financing. By concentrating on composability, we can unlock unprecedented financial strategies and create a more dynamic, accessible, and resilient financial landscape. Such a development could represent a significant step towards the convergence of TradFi with DeFi, ensuring that tokenized shares get even greater than the sum of their parts.

For more information on tokenized equities and their potential impact on the financial industry, visit https://cryptonews.com/exclusives/opinion-tokenized-equities-are-only-the-sum-of-their-parts/