Introduction to Corporate Ether Treasuries

Corporate ether treasuries have become a significant trend in the balance sheet strategies of public companies. As of mid-2025, a growing number of companies are shifting their main reserve for treasury from cash or Bitcoin (BTC) to Ether (ETH). What sets this trend apart is the approach companies are taking, where instead of just buying ETH, they are holding, restoring, and publishing regular investor updates to achieve a steady income.

Key Takeaways

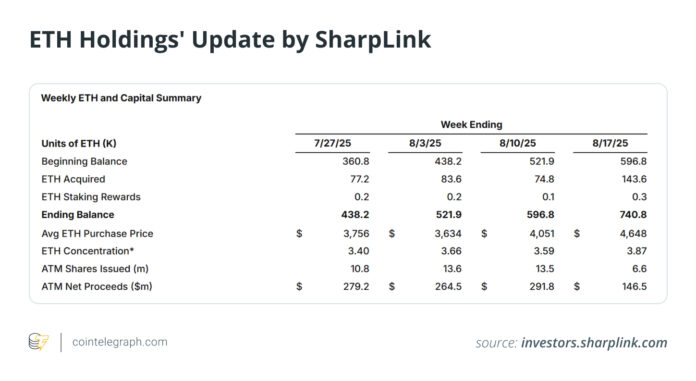

Companies like Bitmine, Sharplink, and Coinbase are leading the way in corporate ether treasuries. These companies are not only holding ETH but also generating income through various strategies. For instance, Bitmine has become the largest corporate owner of ETH, with over 1.5 million ETH, while Sharplink is the fastest riser in the ETH treasury cohort, with an aggressive accumulation plan financed through AT-the-Market (ATM) and direct offers.

Corporate Ether Treasury Holdings

The seven largest finance ministries in ether will be discussed in this article. Companies like Bitmine, Sharplink, Coinbase, Bit Digital, Ethzilla, Btcs, and Basic Global/FG Nexus are making significant investments in ETH. For example, Bitmine’s ether holdings rose to 1,523,373 ETH, part of a crypto position of $6.6 billion, which also includes a small amount of BTC and cash. Sharplink acquired 143,593 ETH in the previous week, bringing its total holdings to 740,760 ETH.

Importance of Corporate Ether Treasuries

Corporate ether treasuries are important because they add more than just another asset to a company’s balance sheet. They affect the ETH market and ecosystem. Large corporate acquisitions reduce the circulating supply, creating upward price pressure, especially when combined with Ether’s deflationary tokenomics. These reservations also strengthen Ethereum’s network by contributing to security and decentralization through validator management.

How Corporate Possessions Turn the Market

Corporate ether treasuries are now one of the biggest signals for ETH adoption. Companies are buying, holding, and restoring ETH to create a constant income. They are also publishing weekly updates, providing real-time transparency to investors. The scale of corporate possessions, such as Bitmine’s over 1.5 million ETH, can influence market structure and liquidity.

Risks Associated with Corporate Ether Treasuries

While corporate ETH reserves bring legitimacy and demand, they also introduce risks that investors should be aware of. These risks include market volatility, regulatory uncertainty, concentration risk, operating and custody risks, and equity exposure limits. For instance, a sudden downturn in ETH prices can reduce the value of company treasury holdings and trigger shareholder concerns.

Conclusion

In conclusion, corporate ether treasuries are a significant trend in the balance sheet strategies of public companies. Companies like Bitmine, Sharplink, and Coinbase are leading the way in this trend, generating income through various strategies. While there are risks associated with corporate ether treasuries, they also bring legitimacy and demand to the ETH market and ecosystem. For more information, visit https://cointelegraph.com/news/7-largest-ether-treasury-companies-by-holdings?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound