The Solana price has shown remarkable stability this week, largely due to improved sentiment in the crypto industry and investors seizing the opportunity to buy the dip. This resilience is underpinned by several key factors that suggest the SOL token may be on the cusp of a significant surge.

Technical Analysis: Falling Wedge Pattern

A closer examination of the daily time frame chart reveals that the Solana price has formed a falling wedge pattern, characterized by two descending and converging trend lines, since September 25th. Notably, the token has already broken above the upper side of this wedge pattern. Furthermore, top oscillators such as the Relative Strength Index (RSI) and the Percentage Price Oscillator (PPO) have begun to form a bullish divergence pattern. The RSI has moved from an oversold level of 28 to 44 and has also broken above the descending trend line connecting the highest fluctuations since September 18th. The PPO indicator’s two lines have formed a bullish crossover, suggesting an eventual recovery, potentially to the September high of $253, which represents an 80% increase from this year’s low.

SOL price chart | Source: crypto.news

SOL price chart | Source: crypto.news

Improving Fundamentals

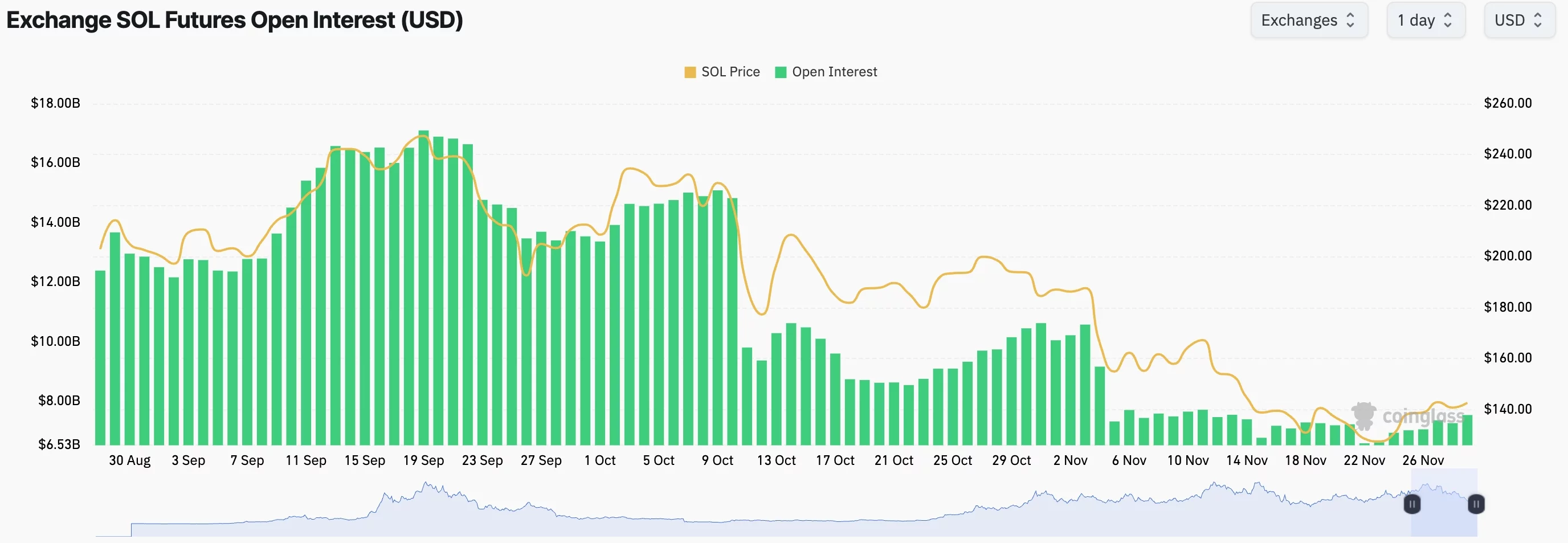

The increase in Solana’s price is also driven by its strong fundamentals. Data compiled by Nansen indicates that Solana is the most active network in the crypto industry, with transactions increasing by 16% to 1.84 billion in the last 30 days. This surpasses the combined transactions of other top chains such as Ethereum, BSC, Base, and Arbitrum. Additionally, active addresses have increased by 13% to over 63.1 million during the same period. Further data from CoinGlass shows that open interest in Solana futures has started to increase, reaching $7.5 billion on Friday, which is well above the monthly low of $6.6 billion. This rise in open interest is a sign that investors are using leverage, a factor that often drives up a coin’s price.

Open interest in SOL is increasing | Source: CoinGlass

Open interest in SOL is increasing | Source: CoinGlass

Institutional Investment and Market Cap

American investors continue to build their exchange-traded funds (ETFs), with spot SOL ETFs collecting over $613 million in inflows, bringing the total to $917 million. Solana ETFs currently hold approximately 1.15% of their market cap. If this were to jump to Ethereum’s 5%, the total holdings would push over $4 billion. This significant potential for growth, combined with the improving technical and fundamental factors, positions Solana for a potential price surge.

For more detailed analysis and to stay updated on the latest developments in the crypto market, visit https://crypto.news/top-4-reasons-why-solana-price-may-pump-80-soon/