Solana (SOL) has been making headlines in the cryptocurrency market, with recent data indicating a rare bullish bias among retail traders. According to on-chain analytics platform Hyblock, approximately 76% of retail accounts are currently net-long on Solana, a threshold that has historically been consistent with positive forward returns. This phenomenon has sparked interest among investors and analysts, who are now weighing in on the potential for a rebound to $200.

Historical Bullish Signal

Hyblock’s backtest of the signal shows that whenever the true retail long percentage (TRA) exceeds 75%, SOL’s seven-day average and median forward return increase from around +2.25% to over +5%, while average drawdowns decrease. The analysis added that the risk-reward ratio (RR) almost doubles in these cases, indicating greater upside execution and lower downside volatility. This historical data suggests that the current market conditions may be ripe for a bullish turnaround.

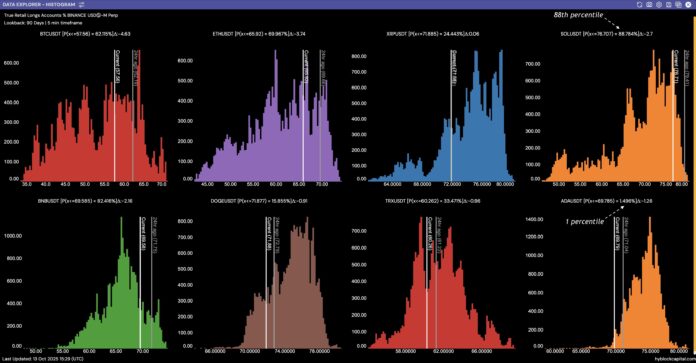

Solana retail long position analysis. Source: Hyblock Capital/X

Altcoin Capitulation and Accumulation

Crypto analyst Darkfost expressed optimism and pointed to a broader altcoin capitulation as a possible accumulation phase. The trader said that only 10% of altcoins listed on Binance remain above their 200-day moving average, indicating widespread fear and disinterest. Historically, such conditions have preceded notable market rallies. Darkfost said: “The best time to get involved in altcoins is often when no one wants them anymore.” He emphasized that in previous cycles, similar constellations were resolved in strong short-term recoveries.

Percentage of altcoins above the 200D SMA on Binance. Source: X

Institutional Accumulation

Currently, corporate digital asset treasuries appear to be taking advantage of SOL prices below $200. Solana finance firm Solmate (Nasdaq: SLMT) purchased $50 million worth of SOL from the Solana Foundation at a 15% discount, with ARK Invest announcing a new stake of 11.5%. Solmate had previously raised $300 million to build its digital asset treasury. Meanwhile, treasury firm SOL Strategies (Nasdaq: STKE) acquired an additional 88,433 SOL, including 79,000 locked SOL, from the foundation at an average price of $193.93 per coin, bringing its total holdings to 523,433 SOL. These moves highlight the coordinated accumulation of institutional players at current price levels.

Technical Analysis

While SOL’s long-term outlook remains constructive, its recent decline and daily close below $190 marked the first bearish structural break since February, suggesting a possible shift in momentum to higher time frames. Although SOL briefly reclaimed its 200-day exponential moving average (EMA), it is now trading between the 50-day and 100-day EMA. This compression typically reflects indecision, where short-term momentum weakens while intermediate-term support holds, often preceding a major directional move.

SOL one-day chart. Source: Cointelegraph/TradingView

Whale Activity and ETF Decision

Despite the short-term bearish sentiment, market analyst Pelin Ay said whale order activity on SOL is increasing again, a trend that has preceded rallies of 40-70% in the past. The analyst said whales are positioning ahead of Thursday’s spot SOL ETF decision, which could lead to stronger spot demand. Combined with SOL’s high stake rate and potential inclusion in multiple exchange-traded indices, a favorable ETF outcome could tighten supply and restore SOL’s uptrend above $200.

SOL Spot Average Order Size. Source: CryptoQuant

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/data-shows-76percent-of-retail-traders-are-long-sol-will-a-rebound-to-dollar200-hold