2025: A Blockbuster Year for Crypto, But What’s in Store for 2026?

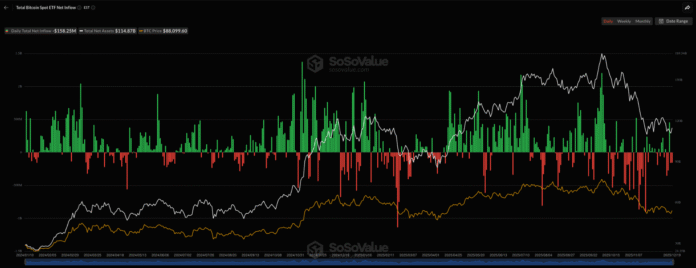

2025 was a remarkable year for Bitcoin (BTC) and the entire cryptocurrency market, with crypto-friendly lawmakers introducing growth-oriented regulation and Wall Street finally accepting Bitcoin, Ether (ETH), and numerous altcoins as a valid asset class. The global supply of Bitcoin, Ether, and Solana’s SOL (SOL) tokens saw significant growth, with total net inflows into spot Bitcoin ETFs reaching $57 billion and total net assets across all ETFs reaching $114.8 billion.

Spot Bitcoin ETF net flows in 2025. Source: SoSoValue.com

Spot Bitcoin ETF net flows in 2025. Source: SoSoValue.com

Looking Ahead to 2026: Key Drivers and Challenges

As we enter 2026, the question on everyone’s mind is: Will the pace of adoption at the institutional, corporate, and government levels continue? Since October, strong inflows to the spot Bitcoin ETF have tapered off, turning into a seller’s market for weeks in some cases, followed by a 30% correction in BTC and 50% in Ether. In an interview with Schwab Network’s Nicole Petallides, Cointelegraph Head of Markets Ray Salmond said that the crypto market’s performance in early 2026 will depend on several factors, including the narratives around AI, Fed rate cuts, a strategic Bitcoin reserve, and ETF flows.

“Given the way the narratives around AI, Fed rate cuts, a strategic Bitcoin reserve and ETF flows have driven the market, I’m curious to see whether the same narratives will drive prices higher in 2026, or will a new narrative need to emerge to bring buyers back into the markets?” Salmond explained. For more market news, visit: https://t.co/PYaqKPRp8C pic.twitter.com/ZCp1EIXyUh

AI Expansion and Its Impact on Crypto Markets

Beyond ETF flows and demand on spot markets like Binance and Coinbase, investor sentiment regarding the immense scale of the AI industry’s expansion and the performance of the tech-heavy S&P 500 is likely to have a direct impact on crypto markets. AI expansion, company valuations, fundraising, IPO performance, and whether data center hyperscalers continue to drive stock markets alongside MAG7 will remain top of mind for everyone.

Bull market for AI, ETFs, and stocks in 2026. Source: Schwab Network

Bull market for AI, ETFs, and stocks in 2026. Source: Schwab Network

Clarity Act and Its Potential Impact on Altcoins and DeFi

An optimistic event to watch as we enter 2026 will be whether or not the Clarity Act goes into effect. The crypto lobby wanted to enact this law before the end of the year, but the long government shutdown delayed progress in drafting it. If passed, the Clarity Act will provide clearer rules and the necessary environment for FinTech innovators to operate sandboxes in the US, and it is hoped that more offshore crypto companies will be headquartered in the US again.

Federal Reserve’s Policy Shift and Its Impact on Crypto Markets

The Federal Reserve’s policy shift is expected to further morph into an easy-money system, and President Trump’s election of the Fed chair in early 2026 is expected to result in interest rate cuts of up to 100 basis points. According to Salmond, “Crypto investors view Fed rate cuts as bullish for risk assets, but we have a Tale of Two Cities scenario where the data clashes with the most bullish outlook.”

Salmond explained: “The labor market is weakening, and this cooling trend is expected to continue in 2026. The ‘temporary’ impact of Trump tariffs has increased the cost of goods and services, health insurance premiums will rise, and retail investor confidence could fall as layoffs are announced, consumer debt rises, and disposable income falls.” At the same time, “investors expect that the Fed’s rate cuts will lead to lower mortgage rates, forcing banks to loosen lending constraints and enticing consumers to buy more things.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information. For more information, visit https://cointelegraph.com/news/wall-street-ruled-crypto-in-2025-what-s-the-demand-outlook-for-2026