Trump-Backed Wlfi Plunges 41% as Buyback Plan Announced to Halt Freefall

World Liberty Financial (Wlfi), a DeFi project linked to former US President Donald Trump, has announced a buyback and burn plan in an effort to stop the freefall of its token value. The move comes after Wlfi’s token lost more than 50% of its value in September, with the price plummeting to $0.19 on Friday, compared to its peak of $0.46, according to CoinmarketCap.

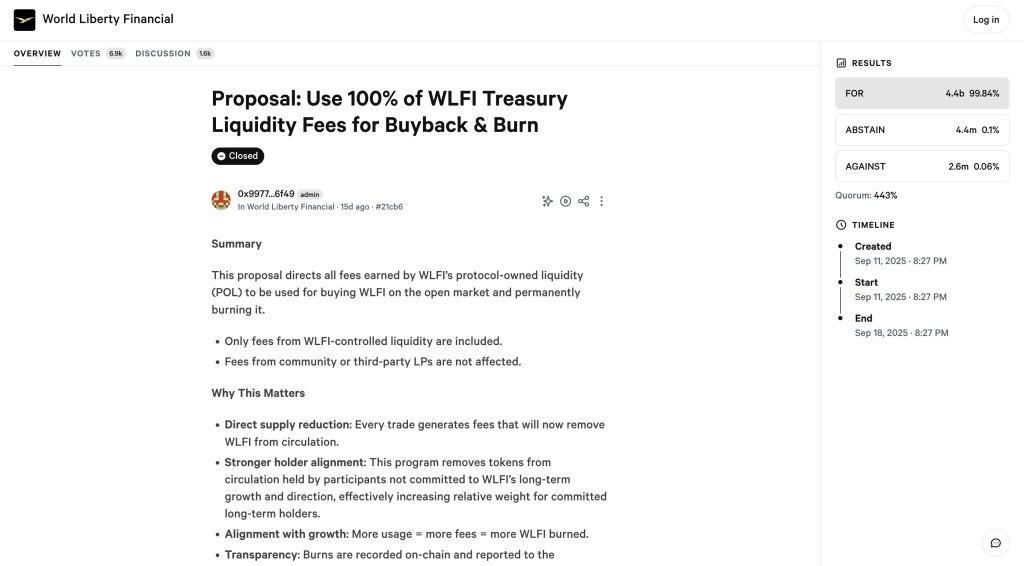

The buyback and burn program, which was presented on Friday, will use 100% of liquidity fees to purchase and burn Wlfi tokens, with the goal of reducing the circulating supply and increasing the token’s value. The community has voted in favor of the plan, which will be implemented this week, with all return purchases and burns to be posted transparently.

The move is not the first attempt by the project to intervene in the market. Just a few days after its launch, Wlfi burned 47 million tokens on September 3 to counter a 31% sale and sent the offer to a verified combustion address.

Wlfi’s Buyback and Burn Plan: A Measurement of Damage Control and Community Belief

According to the governance proposal, Wlfi will apply fees generated from the protocol’s liquidity pools on Ethereum, BNB Chain, and Solana to buy back tokens from the open market. After buying, the tokens will be sent to a combustion address, which means they will be permanently removed from circulation.

The project emphasized that this system connects a reduction directly to platform growth. With increasing commercial activity, more liquidity fees are generated, which heats up larger return purchases and burns. This tries to create a feedback loop in which adoption promotes scarcity and the scarcity strengthens the token value.

Wlfi Joins Hyperliquid, Jupiter, and Sky in Adopting Buyback and Burn Strategies

Wlfi’s decision to adopt a complete buyback and burn strategy is one of the most ambitious tokenomics models in crypto. While a response to the strong September price decline, the move also reflects a trend of DeFi protocols that use their income sources to reduce the offer, align incentives, and strengthen the token value.

Other protocols have taken over variations of this strategy. Hyperliquid shows the model on a scale, with almost all platform fees being transferred to automated replacement of $HYPE via its auxiliary fund, creating a persistent demand. Jupiter directs half of its fees to JUP returns and block tokens for three years. Raydium illustrates 12% of $RAY returns and has already removed 71 million tokens, about a quarter of the circulating offer.

The buyback phenomenon is not limited to DeFi. Increasingly, listed companies with crypto-state bonds are adopting aggressive buyback programs, sometimes to compensate for losses with decreasing digital assets. According to a report, at least seven companies, ranging from games to biotech, have turned to buybacks, often financed by debt, to counter falling share prices.

Read more about Wlfi’s buyback and burn plan and its efforts to halt the freefall of its token value at https://cryptonews.com/news/trump-backed-wlfi-plunges-41-buyback-plan-announced-to-halt-freefall/