World Liberty Financial Enters Crypto Lending Market with USD1 Stablecoin

World Liberty Financial, a decentralized finance project linked to the family of former US President Donald Trump, has launched its crypto lending product, World Liberty Markets. This move marks the project’s second major product launch, following the successful introduction of its USD1 stablecoin last year. The USD1 stablecoin has gained significant traction, with a market capitalization of approximately $3.48 billion and its entire issued supply already in circulation.

The new web-based application, World Liberty Markets, allows users to lend and borrow digital assets on a single on-chain marketplace powered by USD1 and its governance token, WLFI. Users can deposit collateral, including Ether, a tokenized version of Bitcoin, and major stablecoins such as USDC and USDT, with the underlying infrastructure powered by Dolomite. According to the company, the launch of World Liberty Markets is designed to provide users with transparent, high-performance liquidity markets and expand the utility of USD1.

On-Chain Lending Recovers as World Liberty Financial Builds on USD1 Momentum

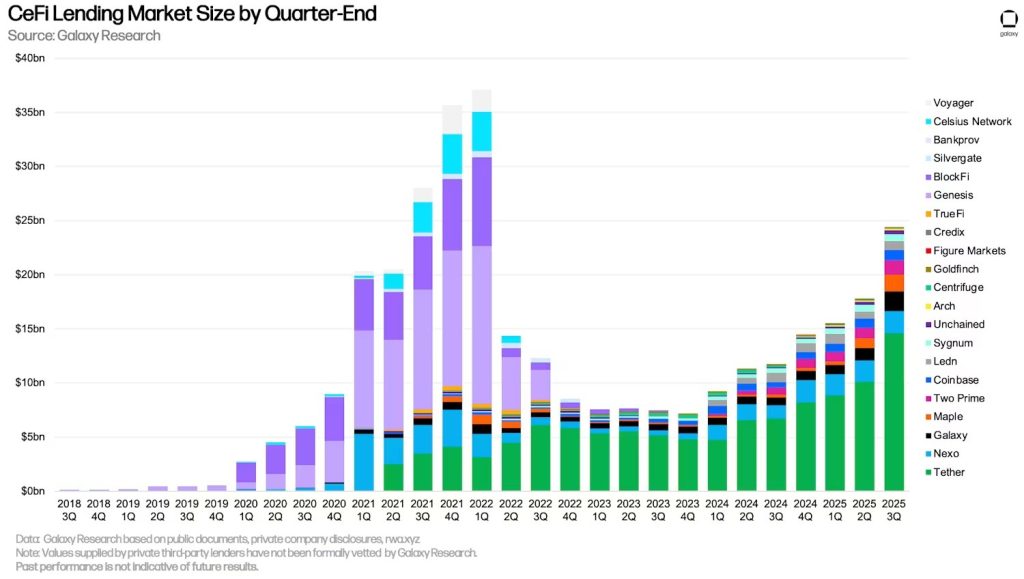

According to Galaxy Research, crypto-collateralized lending reached an all-time high of $73.59 billion at the end of the third quarter of 2025, surpassing the 2021 peak. DeFi lending applications accounted for $40.99 billion of this total, representing 55.7% of the total lending market and growing by almost 55% quarter-on-quarter. Unlike the last cycle, the growth was driven by fully collateralized loans, transparent liquidation mechanisms, and on-chain risk management.

Source: defillama

The Role of USD1 Expands Across Banking and Crypto Markets

The launch of World Liberty Markets comes at a time when institutional and regulatory engagement around stablecoins is increasing. Earlier this month, World Liberty Financial confirmed that its trust company has submitted an application to the Office of the Comptroller of the Currency for a U.S. national bank charter. USD1 has also gained visibility through high-profile market activity, including Binance’s launch of a time-limited “USD1 Boost Program” offering increased returns of up to 20% APR on the stablecoin.

Source: Galaxy Research

For more information on World Liberty Financial’s crypto lending launch and the growth of USD1, visit https://cryptonews.com/news/world-liberty-financial-crypto-lending-usd1-launch/