Uniswap Community Approves Historic Fee Switch and Token Burn

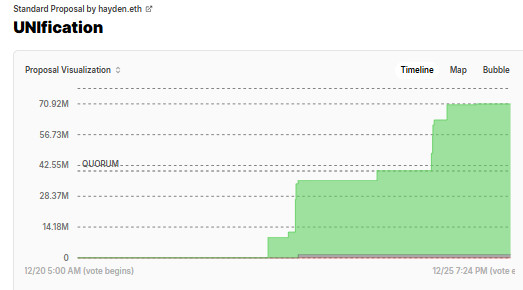

The Uniswap community has overwhelmingly voted in favor of a proposal to activate a fee change and burn a significant portion of UNI tokens, marking a major milestone in the protocol’s history. The “UNIfication” proposal, which has garnered over 69 million votes in support, aims to directly link Uniswap’s protocol activity to the supply dynamics of the UNI token for the first time since its launch.

As of early Monday, the proposal had surpassed the required quorum, with more than 6,000 addresses participating in the voting process. Notably, influential figures in the decentralized finance (DeFi) space, including Variant founder Jesse Waldren and Synthetix and Infinex founder Kain Warwick, have expressed their support for the proposal. The Uniswap community’s decision is expected to have a significant impact on the protocol’s future development and the value of the UNI token.

Implications of the Fee Switch and Token Burn

The proposal’s implementation is expected to introduce a Protocol Fee Discount Auctions system, which aims to improve returns for liquidity providers. Additionally, the Uniswap Foundation will destroy 100 million UNI tokens, reducing the overall supply and potentially increasing the token’s value. The fee switch is also expected to provide UNI holders with a direct payout, addressing a long-standing criticism of the protocol’s token economics.

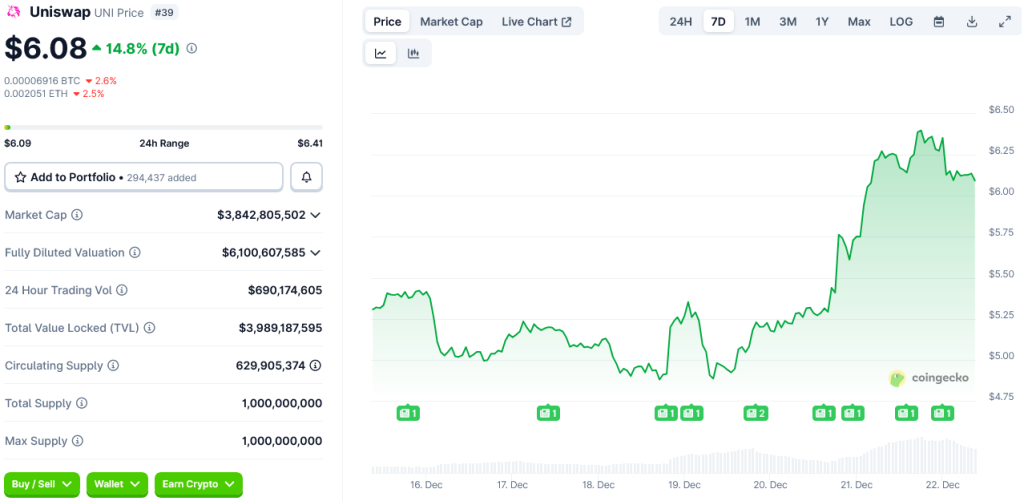

According to Uniswap Labs CEO Hayden Adams, the changes will be subject to a two-day grace period before being implemented. The proposal’s passage has already had a positive impact on the UNI token’s price, which has gained over 25% since voting began. The token’s price has recovered from a month-long slump, reaching $6.08, and some analysts believe it could reach $10 before the end of the year.

Technical Analysis and Market Outlook

From a technical perspective, the UNI token’s price action has rebounded from the lower boundary of a multi-year ascending channel, generating strong demand and potentially leading to higher reaction highs. Analysts note that the token faces resistance in the $6.80-$7.20 range, with larger supply concentrated closer to $9 and above.

According to data from CoinGecko, UNI is currently the 38th largest cryptocurrency by market capitalization, valued at around $3.8 billion. The token’s price has been influenced by the broader DeFi market trends, and its future performance will likely depend on the overall health of the ecosystem.

For more information on the Uniswap fee switch and token burn, visit Cryptonews.