Solana Price Surges to 6-Month High, Driven by Rising Network Activity and ETF Inflows

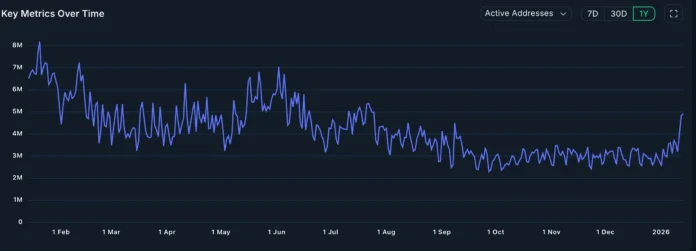

Solana (SOL) has continued its impressive rally, reaching its highest level since November last year, with a 25% increase from its December lows. This surge is largely attributed to rising network activity and significant inflows into its exchange-traded funds (ETFs). According to recent data, the number of active addresses on the Solana network has risen to its highest level in six months, with over 4.8 million active addresses, compared to 2.4 million in December.

Active Solana Addresses | Source: Nansen

Active Solana Addresses | Source: Nansen

The increase in network activity is further supported by the rise in transactions on the Solana network, with over 97.2 million transactions recorded, the highest level since August last year. Moreover, the network processed over $121 billion worth of transactions in the last 30 days, surpassing the combined transactions of Ethereum, BSC, and Base Blockchain. These strong metrics suggest that Solana’s ecosystem is thriving, led by decentralized finance (DeFi) and real-world asset tokenization.

Strong Demand from Institutional and Retail Investors

Solana is also experiencing strong demand from American institutional and retail investors, with cumulative inflows into its ETFs reaching over $833 million and net assets totaling $1.18 billion. This growth can be attributed to Solana’s strong performance in key areas, including DeFi and real-world asset tokenization, where it is the second-largest chain after Ethereum.

The upcoming Alpenglow upgrade, scheduled for release this quarter, is expected to be a significant catalyst for Solana’s growth. The upgrade will introduce faster speeds and major changes to its architecture, further enhancing the network’s capabilities.

Technical Analysis of Solana Price

SOL price chart | Source: crypto.news

SOL price chart | Source: crypto.news

From a technical perspective, the SOL token has formed a rounded bottom pattern and is approaching the 23.6% Fibonacci retracement level. The token has also crossed the 50-period Exponential Moving Average (EMA) and flipped the Supertrend indicator from red to green, indicating a potential recovery. Based on this analysis, the next key target for Solana price is the 50% retracement level at $185, representing a 40% increase from current levels.

For more information on Solana’s price and network activity, visit https://crypto.news/solana-price-eyes-40-active-addresses-6-month-high/