US Bancorp Re-Enters Crypto Market with Redesigned Digital Asset Custody Services

US Bancorp has announced the relaunch of its crypto custody services, marking a significant move into the digital asset market. The bank’s institutional investment managers will now have access to a redesigned platform, allowing them to securely store and manage cryptocurrencies, including Bitcoin (BTC). This development comes on the heels of a regulatory shift under the current administration, which has eased restrictions on banks’ involvement in crypto-related activities.

According to Stephen Philipson, head of the US bank’s institutional department, “We had the game book and it opens and it leads it out again.” The bank plans to scale and expand its services as demand for digital assets grows, exploring potential applications in areas such as asset management and consumer payments. US Bancorp initially launched its custody service in 2021 in partnership with Fintech company Nydig, but it was put on hold due to regulatory uncertainties.

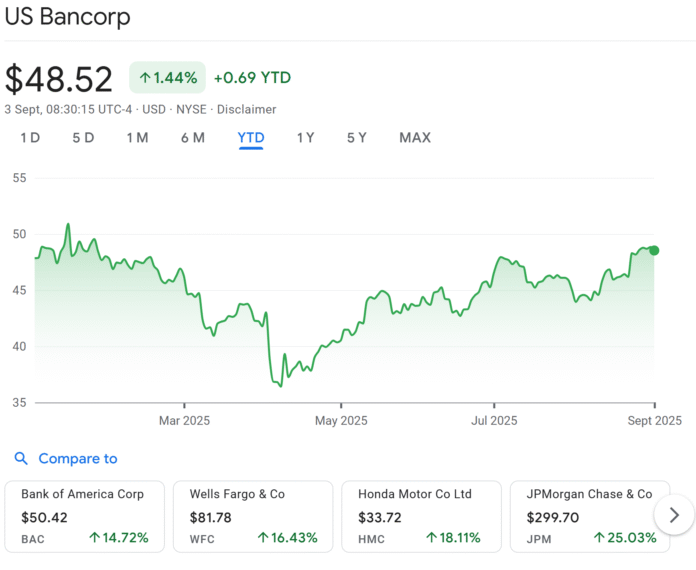

The stocks of US Bancorp have increased 1.44% YTD, according to Google Finance. The bank’s decision to re-enter the crypto market is a significant development, as it follows a growing trend of traditional financial institutions exploring the potential of digital assets.

US Bancorp to Offer Bitcoin Custody Services for Funds

Initially, US Bancorp will offer custody services for Bitcoin (BTC), targeting registered investment funds and Bitcoin ETF providers. The bank may expand its services to include other cryptocurrencies that meet its internal risk and compliance standards. This move is seen as a significant step forward for the crypto industry, as it provides institutional investors with a secure and reliable platform for managing digital assets.

The crypto custody space has been dominated by crypto-native companies such as Coinbase, Bitgo, and Anchorage. However, changes to federal guidelines, particularly from the Currency Competroller Office, have created opportunities for traditional banks to enter the market. In 2022, BNY Mellon launched a digital custody platform to protect selected Bitcoin and Ether (ETH) assets of institutional customers, making it the first large bank in the US to offer custody services for digital assets.

More Banks Explore Crypto Custody Services

A growing number of traditional financial institutions are now exploring the potential of crypto custody services. In July, Germany’s largest bank, Deutsche Bank, announced plans to enable its customers to store cryptocurrencies, including Bitcoin, starting next year. The bank plans to launch a digital assets custody service in partnership with the Bitpanda Crypto Exchange, based in Austria, in 2026.

In August, it was reported that Citigroup is weighing plans to offer cryptocurrency trading and payment services, aiming to capitalize on a market that has been strengthened by regulatory permits and industry legislation. As more banks enter the crypto market, it is likely that we will see increased adoption and growth in the industry.

For more information on US Bancorp’s crypto custody services and the latest developments in the regulatory landscape, visit https://cointelegraph.com/news/us-bancorp-bitcoin-custody-relaunch?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound