US Crypto Funds Experience Significant Outflows Amid CLARITY Act Delay

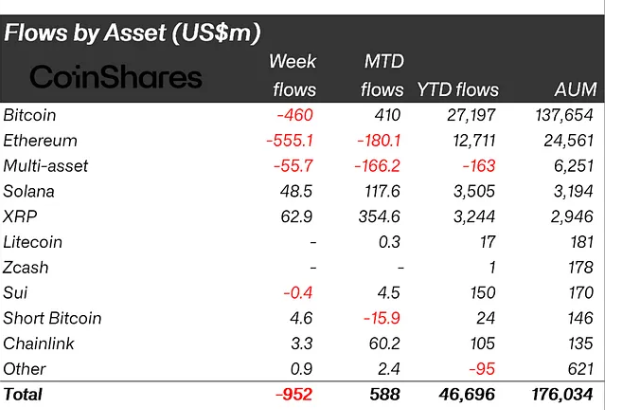

U.S.-focused digital asset mutual funds have recorded their first weekly withdrawals in a month, with a substantial loss of $952 million, following delays related to the long-delayed CLARITY Act, which has increased regulatory uncertainty for crypto firms operating in the United States. According to data from CoinShares, digital asset investment products saw $952 million in net outflows last week, marking the first negative outflow since late November.

The decline was largely due to delays related to the Digital Asset Market Clarity Act, commonly referred to as the CLARITY Act, which has increased regulatory uncertainty for crypto firms operating across America. Fears of continued sales by large shareholders further weighed on sentiment.

Ether and Bitcoin Lead Crypto Fund Outflows, While SOL and XRP Survive

The outflows were mostly concentrated in the US, which accounted for $990 million of them. This was only partially offset by inflows from Canada and Germany, where investors added $46.2 million and $15.6 million, respectively.

Ethereum bore the brunt of the selling, recording $555 million in outflows. Analysts noted that Ether’s sensitivity to regulatory developments is higher than most assets because of its central role in decentralized finance and staking-related products that could be directly affected by US market structure rules.

Bitcoin products followed close behind, recording $460 million in outflows. While Bitcoin still leads the market in absolute terms, year-to-date inflows of $27.2 billion remain below last year’s $41.6 billion. Total assets under management across all crypto exchange-traded products now stand at $46.7 billion, down from $48.7 billion at the same time in 2024.

Crypto Market Bill Faces Fresh Delay as Senate Kicks Vote to January

The market reaction unfolded as lawmakers confirmed further delays to the CLARITY Act. On Thursday, White House AI and crypto czar David Sacks announced that Senate passage of the long-awaited Clarity Act will occur in January 2026, delaying previous expectations that the bill would reach President Trump’s desk before the end of 2025.

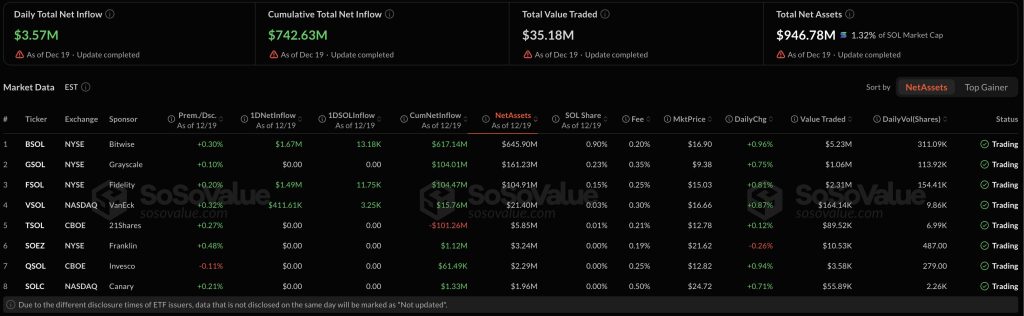

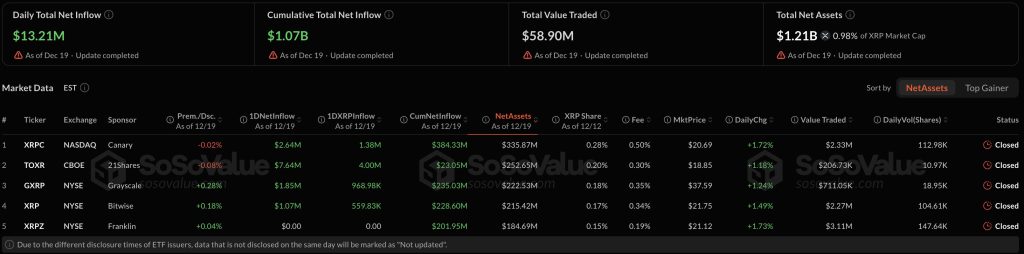

In contrast, Solana and XRP continued to attract fresh capital. Solana investment products recorded $48.5 million in inflows, while XRP products added $62.9 million. The trend was mirrored in US spot ETFs, where XRP funds posted weekly inflows of $82.04 million and Solana ETFs posted gains of $66.55 million over the same period, continuing a multi-month pattern of steady accumulation.

For more information on the US crypto funds outflows and the CLARITY Act delay, visit https://cryptonews.com/news/us-crypto-funds-952m-outflows-clarity-act-delay/