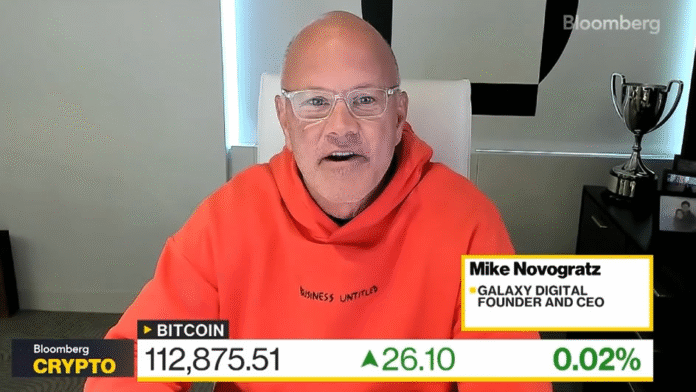

The cryptocurrency market is on the cusp of a new wave of participation, which could potentially disrupt the traditional four-year cycle, according to Mike Novogratz, CEO of Galaxy Digital. In a recent interview with Bloomberg, Novogratz stated that the introduction of two significant crypto regulations in the USA will unleash a massive amount of new investment in the crypto space.

Novogratz specifically mentioned the StableCoin-regulating genius law, signed in July, and the Clarity Act, which defines the roles of regulatory authorities in the crypto industry. These legislative developments are expected to attract new investors, thereby breaking the traditional four-year cycle pattern. “It is a big deal. With these two books of legislation, it will unleash an enormous amount of new participation in crypto,” Novogratz emphasized.

Many crypto investors believe that the market follows a price pattern that coincides with the halving of Bitcoin (BTC) approximately every four years. The last halving occurred in April 2024, leading some to speculate that the current bull market may soon come to an end. However, Novogratz countered that this cycle might be different, as investors are less likely to sell at the top this year, unlike in 2017 and 2021.

Novogratz also highlighted the increased adoption of stablecoins, which were previously limited due to regulatory uncertainty. “You couldn’t use stable coins on your iPhones or in social media apps because they weren’t necessarily legal, but now they are,” he explained. This newfound legitimacy is expected to drive a new wave of participation, potentially breaking the traditional cycle.

Clarity Act: A “Freight Train”

Coinbase CEO Brian Armstrong echoed Novogratz’s sentiments on September 17, stating that he was confident Congress would pass the Clarity Act, which defines the roles of financial regulatory authorities in the crypto industry. Armstrong described the bill as a “freight train” that would leave the station, indicating its potential impact on the market.

According to Representative French Hill, the Committee on Financial Services of the House of Representatives hopes to take action on the legislation in October or November. While some Democrats may attempt to push back against the legislation, Novogratz believes that there are now enough Democrats who see the value in crypto to support the bill.

Democrats May Push Back Against the Legislation

Novogratz also addressed concerns about the Trump family’s involvement in the crypto industry, expressing confidence that the Securities and Exchange Commission would pursue any conflicts of interest. However, he noted that Democratic legislators might attempt to delay the legislative template for the crypto market structure, potentially disrupting the progress made so far.

Novogratz also discussed the recent market slump, which wiped out nearly $200 billion from the spot crypto markets. He attributed the decline to “big Chinese mining selling” and Arthur Hayes’ “bearish comments on Hyperliquid.” Despite this, Novogratz remains optimistic, viewing the downturn as a mere “retreat” rather than a sign of a larger trend.

For more information on the latest developments in the crypto market, visit Cointelegraph.