Pye Finance Secures $5 Million Seed Round to Revolutionize Solana Staking

Pye Finance has announced a $5 million seed round led by prominent industry players, including Variant, Coinbase Ventures, and Gemini. The investment aims to transform billions of dormant SOL shares into an active yield market. According to the press release, the round also saw participation from Solana Labs, In the making, and other notable investors.

Pye Finance has announced a $5 million seed round led by prominent industry players, including Variant, Coinbase Ventures, and Gemini. The investment aims to transform billions of dormant SOL shares into an active yield market. According to the press release, the round also saw participation from Solana Labs, In the making, and other notable investors.

Pye Finance is building bond markets for validators and stakers on Solana (SOL), enabling validators to draw and retain stakes while offering rewards to over a thousand validators. The platform achieves this by creating transferable, time-limited staking positions with transparent reward distribution. This approach is expected to open up new DeFi use cases, including lending and debt restructuring, as well as fixed-return products for the $60 billion committed.

Unlocking New Opportunities for Stakers and Validators

According to Brian Long, CEO of Blocklogic and Triton, “Stake trading opens up new opportunities for both stakers and validators that are desperately needed.” Alana Levin, investor at Variant, adds that Pye’s betting market “could fundamentally change the way betting on Solana works. By allowing validators and stakers to better align their preferences – for example, by allowing validators to offer higher yields in exchange for longer lock-up periods – Pye is creating a more efficient, transparent and incentivized betting ecosystem.”

Pye Finance is the brainchild of Alberto Cevallos, co-founder of the Bitcoin yield aggregator on Ethereum, BadgerDAO, and Erik Ashdown, a manager with experience in structured products in traditional markets. Ashdown notes that “Validators have become the underlayer of Web3,” and Pye is building a financial infrastructure that allows validators to act like asset managers, offering structured products and predictable returns.

Passive Billions Turning into Active Yield Market

The team at Pye argues that staking is shifting from a passive earning mechanism to a programmable financial layer. Institutional investors are seeking transparent reward structures, customizable terms, and the ability to trade or borrow against locked positions. Pye’s solution is an upgrade to Solana’s native staked accounts, giving validators control over their staking rewards and time locks. Validator agreements are transferred on-chain as a “transferable locked stake” – they are locked but can be traded on secondary markets.

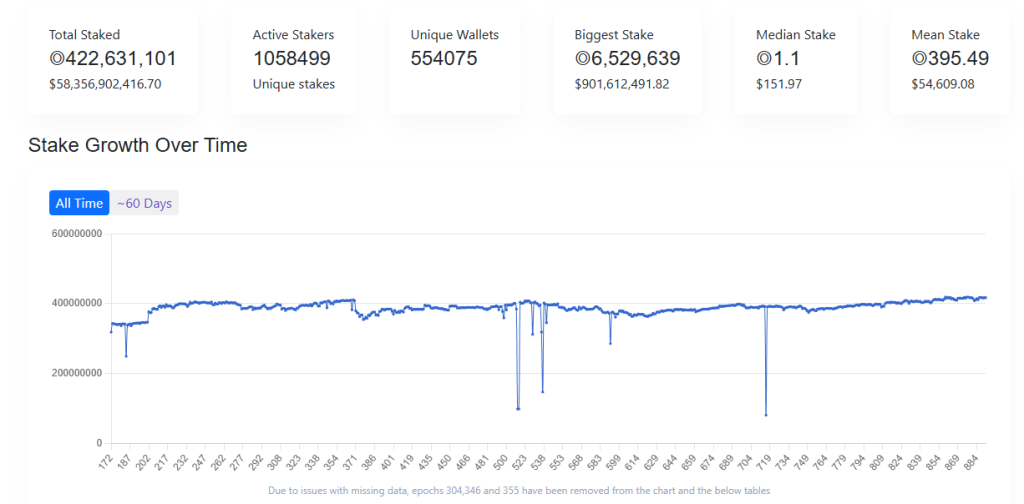

Source: Solanacompass

Source: Solanacompass

The total stake currently stands at 422.6 million SOL, or almost $59 billion. Pye’s goal is to enable validators to offer more flexible and dynamic products, unlocking additional revenue opportunities while providing greater utility to stakers. The team plans to launch a private beta in the first quarter of 2026, with early access currently available for validators and bookmakers. For more information, visit https://cryptonews.com/news/variant-coinbase-ventures-gemini-and-more-invest-5m-in-solana-staking-transformer-pye-finance/