Cryptoma Markets Experience Volatility in August 2025

The cryptoma markets swung dramatically in August 2025, with Bitcoin reaching a new all-time high before a whale sale sent it back near $113,000. In the midst of this changed professional managers, the strategies tacitly, reduced exposure to Bitcoin and added them to Ethereum and Defi token. According to Finestel, a platform for Crypto Auto Trading and Client Management, professional investors calmly changed their strategies last month, concentrating on the reduction of exposure to Bitcoin (BTC) and instead promoting Ethereum (ETH) and Defi tokens.

A few months in crypto, a roller coaster ride feel like a roller coaster ride. And August 2025 was no exception. With price fluctuations, regulatory updates, and whale-driven dumps, the month was anything but boring for dealers. Bitcoin, which started with weak US job data and tariff messages in August with $112,000 to $119,000, reached a new all-time high with $124,400 and the crypto market over $4 trillion. However, the rally still ended abruptly after a whaling, which spent a sale of $900 million in liquidations and Bitcoin after the month after the month after the $113,000.

A Big Whale and Market Volatility

Despite this up and down, Finestel found that Bitcoin made the month with a modest profit of 2.5%. Ethereum was the main outperformer last month, rising by 12.8% to $4,600. ETH was achieved by ETF inflows, institutional setting of 29.4%, and the expansion of the Defi activity, and managed to steal the spotlight after Bitmain Tom Lee announced plans to collect ETH for the company’s balance sheet. In Defi-tokens, platforms such as Pendle and Hyperliquid recorded the total value that set the total value of $6.75 billion or $3.38 billion, while the ETH launch between 5 and 10% for managers who were looking for predictable income.

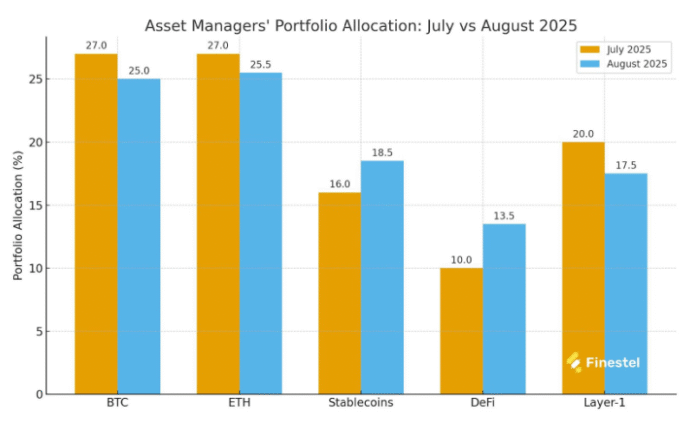

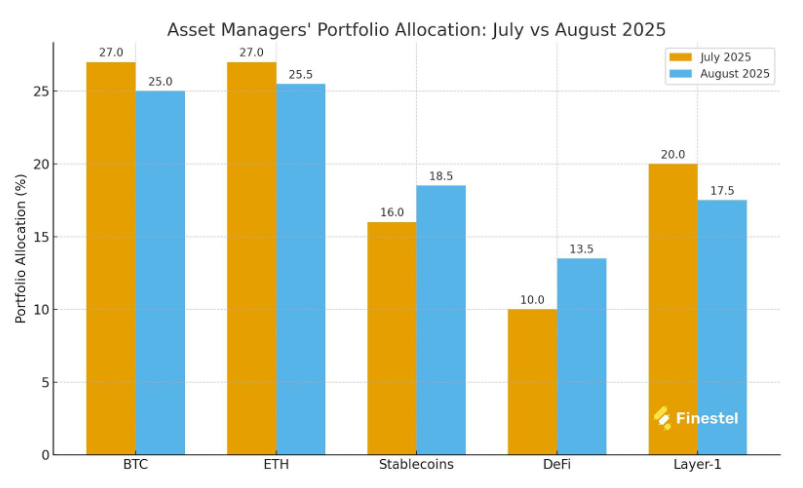

Altcoins also had their moments. For example, Solana (SOL) rose by 15% to $200, while XRP (XRP) received 10% to $3 in its SEC victory, and Chainlink (Link) increased by 18%. However, not all boats were floating when Memecoin had lost favor when managers began to transform “into compliant assets”, said Finestel. During the same period, stable coins tacitly received their share, whereby the market capitalization rose to $280 billion and the assignment of portfolios rose from 16% to 18.5%, as the data show.

Asset Manager ‘Crypto Portfolio Allocation | Source: Finestel

Asset Manager ‘Crypto Portfolio Allocation | Source: Finestel

Institutional and Regulatory Developments

The institutional and regulatory steps also defined August. Spot Bitcoin-Tfs recorded daily inflows of $219 million, Ethereum-Tfs $900 million, and corporate shaft such as Google and Wells Fargo, which reveal crypto purchases. In the United States, for example, 401(K) approvals and new StableCoin rules have opened the way for a large liquidity instrument. As already reported by Crypto.news, BitWise analysts suggest that even an inflow of 401(K) could increase its price to around $193,970. An allocation shift of 10%, the theoretical purchasing power of around $1.22 trillion, could – if the relationship scaled linearly – transferred the prices of $868,700.

Finestel came to the conclusion that it was less about chasing upside down in August, and much more about “building defenses and remaining adaptable”. Their recommended allocations for a historically bad September indicate that Bitcoin and Ethereum indicate around 50%, stable coins near 19%, Defi and RWAs in 14%, and other layer 1 altercoins. And when July was full of life, August was more like a month, the analysts said and added that survival in crypto had to adjust quickly and decide data. For more information, visit https://crypto.news/asset-managers-shift-from-btc-to-eth-amid-volatile-aug/