Cryptocurrency Whales Capitalize on Hyperliquid Tokens Amidst Growing Concerns

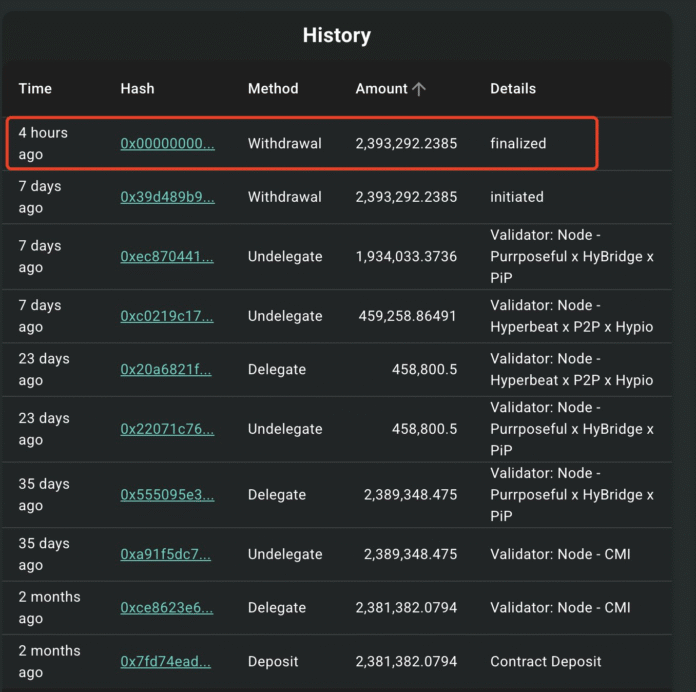

Large cryptocurrency investors, often referred to as whales, are taking advantage of the hyperliquidity of local tokens, particularly in the face of growing concerns about an upcoming vesting schedule. This schedule, worth around $11 billion, is set to unlock, potentially impacting the market. A significant example of this activity is the whale wallet “0x316f,” which recently withdrew Hyperliquid (Hype) tokens worth $122 million. These tokens were purchased at approximately $12 per token, indicating a substantial investment.

According to blockchain data, this whale had previously purchased the tokens at a value of around $90 million about nine months ago. The decision to sell now, with the tokens valued at $122 million, suggests that the sale is likely “for profit.” This move comes at a time when the Hype token reached a new all-time high of $59.29 on Thursday but faces its first major test in November when team tokens begin vesting.

Source: Lookonchain

Related: The institutional demand is growing with new crypto state bonds and SEC reforms: Finance redefined

Unlock Schedule and Market Impact

The Hyper Foundation has announced that 23.8% of the total token supply will unlock on November 29, marking a year since the project’s Genesis event. This vesting schedule will distribute approximately $11.9 billion to the team over 24 months, potentially introducing a significant supply of tokens into the market. According to Melstrom, a fund by BitMEX co-founder Arthur Hayes’ Family Office, this could be the “first real test” for the token’s resilience.

Hype-token distribution. Source: hyperfnd.medium.com

This scheduled unlock has been described as a “sword of Damocles,” with monthly unlocks worth around $500 million. Research by Maelstrom indicates that only about 17% of these unlocks are absorbed by buyback purchases, leaving approximately $410 million in potential supply. This significant influx of tokens could impact the market price, especially if demand does not keep pace with the increased supply.

Source: Maelstrom

Related: The ‘Diamond Hand’ investor costs $ 1,000 in $ 1 million, since BNB outperforms 1,000 US dollars

Hayes Sells Hype Stash for Ferrari Before Vesting Schedule

Arthur Hayes, the co-founder of BitMEX, has sold his entire stash of Hype tokens, reportedly to pay for a new Ferrari. This sale was documented on social media, with Hayes mentioning the need to pay the deposit for a Ferrari 849 Testarossa, which can sell for up to $590,000.

The Ferrari 849 Testarossa is sold for up to 590,000 US dollars. Source: Ferrari YouTube channel

Other significant investors, or whales, seem to be shifting their attention to Aster, a decentralized perpetual exchange and an emerging competitor to Hyperliquid. One whale, identified by the wallet address “0x220,” purchased Aster tokens worth $10.5 million, now holding an unrealized profit of over $6 million, according to Lookonchain.

Top Dex token after market capitalization. Source: Coinmarketcap

The Aster token has seen a significant surge, rising over 1,700% to become the fourth-largest Dex token with a market capitalization of $2.5 billion. In contrast, the Hype token has fallen 7.9% over the same period, trading at $49.34 at the time of writing.

Magazine: Altcoin season 2025 is almost there … but the rules have changed

For more information on cryptocurrency market trends and the impact of vesting schedules on token prices, visit https://cointelegraph.com/news/whale-withdraws-122m-hype-token-unlock-concerns?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound