Introduction to Canary Capital’s American-Made Crypto ETF

On August 25, Canary Capital, a digital asset and crypto fund manager, applied for three new crypto ETFs with the US SEC, including a crypto ETF produced by America. The registration document states that the new investment ETF is speculative and carries high risk. This development has sparked speculation about an “old coin season” or gains in the US-made crypto category. In this article, we will analyze the effects of Canary’s American crypto ETF on tokens such as XRP, Cardano, Chainlink, Solana, and Stellar, the five most important cryptocurrencies in the “Made-in-USA” category.

Canary Capital’s SEC Filing for Proposed ETFs

The Digital Asset Fund Manager’s SEC registration reveals plans to invest in a portfolio of crypto assets that track the blockchain index for Made-in-America. The index will track cryptocurrencies that were originally created in the United States, where a large part of the token offering was shaped in the USA, and a significant part of the protocol’s operations is based in the USA. The trust plans to generate rewards by validating transactions in the native blockchain network of the token, according to the submission. The other submissions by Canary Capital, one for a Trump-themed ETF and the other for an ETF specified, show that the digital asset manager is exploring several crypto-related investment products on the US market.

How Bitcoin and Ethereum ETFs Have Impacted Prices

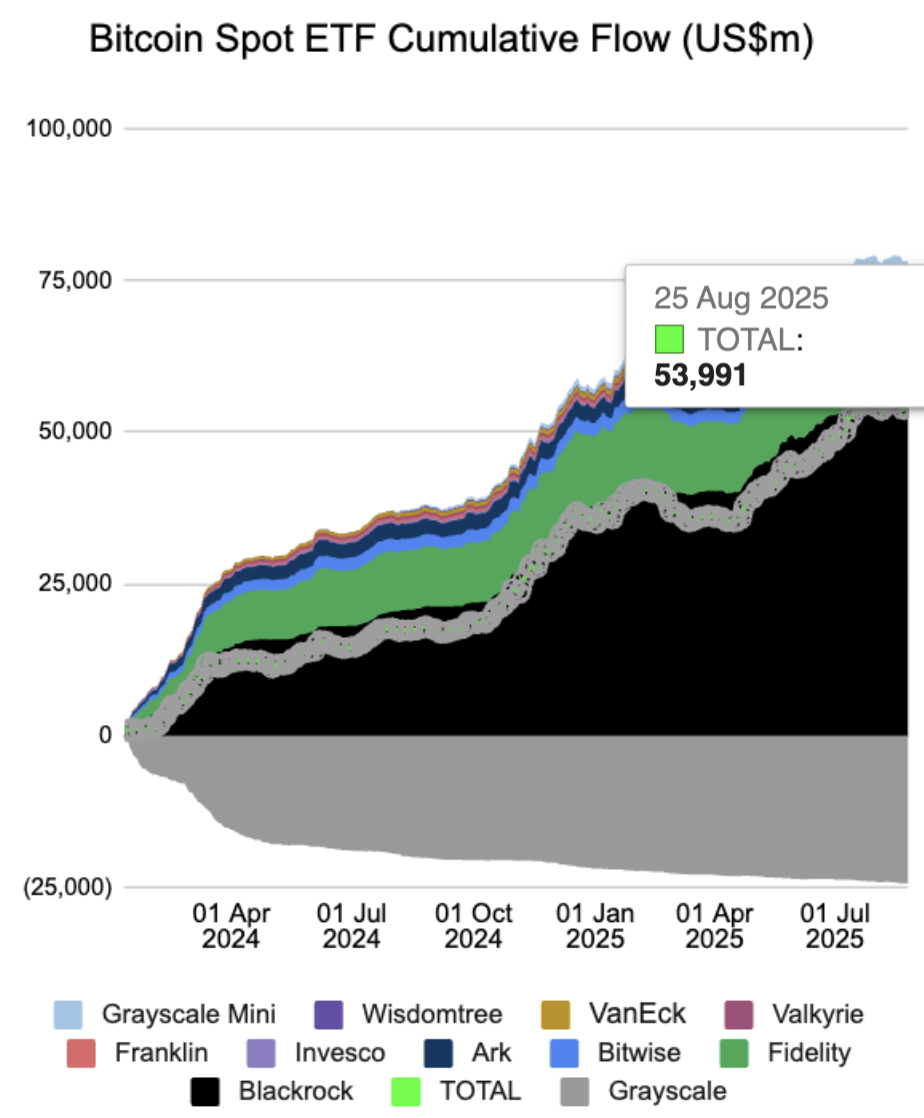

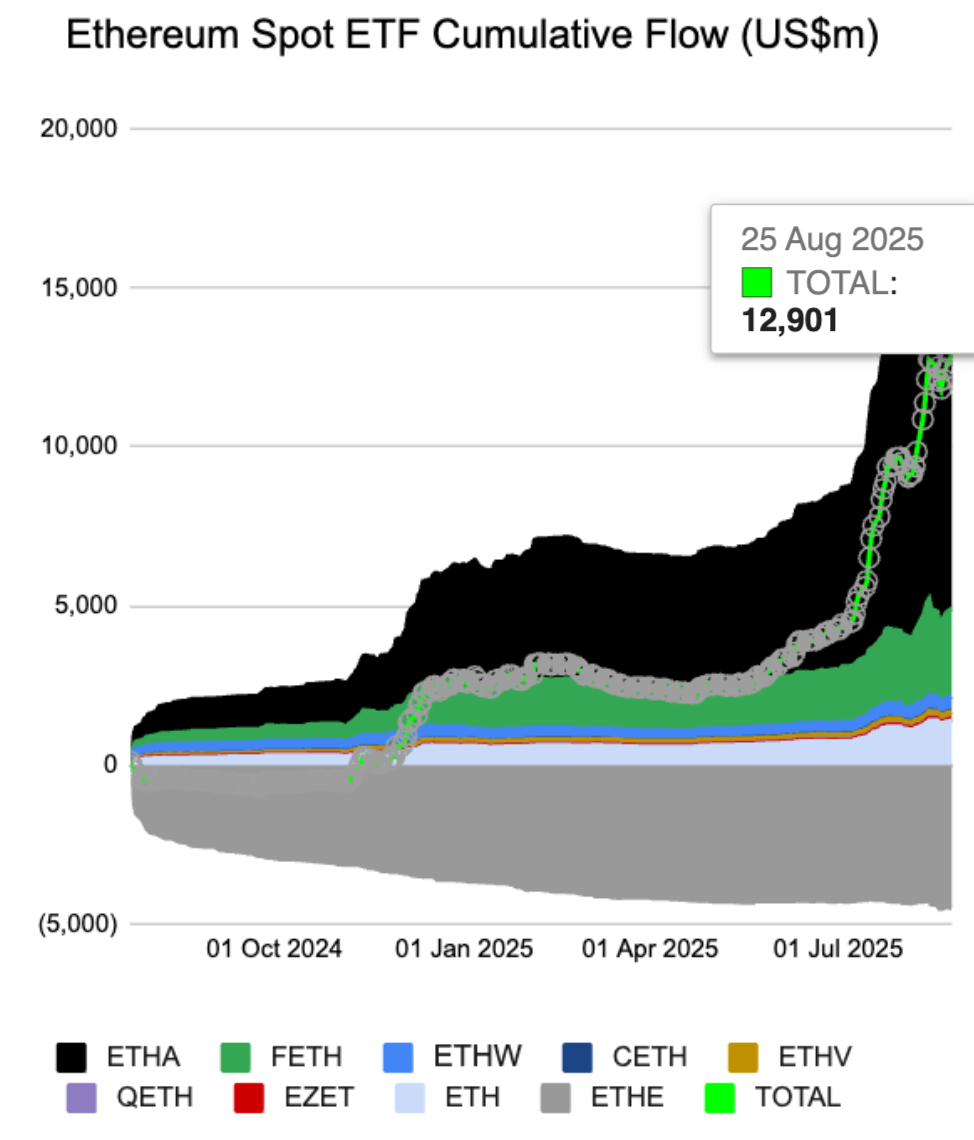

To determine the effects of an ETF on the price of the underlying asset, we can draw a parallel to Bitcoin (BTC) and Ethereum Spot ETFs in the US. Data shows that a total of $53.99 billion in capital has flowed into Bitcoin ETFs since their inception. Ethereum has attracted a total of over $12.90 billion. The Bitcoin price rallied with rising inflows and institutional demand, catalyzing profits in the crypto. While it took longer for the demand to fuel a rally in Ethereum, the token’s price rose in August 2025 and reached a new all-time high.

Bitcoin Spot ETF Cumulative Inflow | Source: Farside investors

Ethereum Spot ETF Cumulative Inflow | Source: Farside investors

Altcoin Season Catalysts

The submission of Canary Capital is likely the first in a series of crypto-oriented ETFs to be submitted to the SEC. This could be a catalyst for the Altcoin season, which begins when 75% of the top 50 cryptocurrencies by market capitalization consistently outperform Bitcoin for 90 days. The most important catalysts for the Altcoin season are Bitcoin dominance, which is on a plateau or decline, an increase in Altcoin market capitalization, and institutional demand for tokens.

Market Capitalization Bitcoin Dominance Chart | Source: Tradingview

Crypto Overall Market Capitalization without Bitcoin | Source: Tradingview

Top 5 Altcoins Likely to Gain

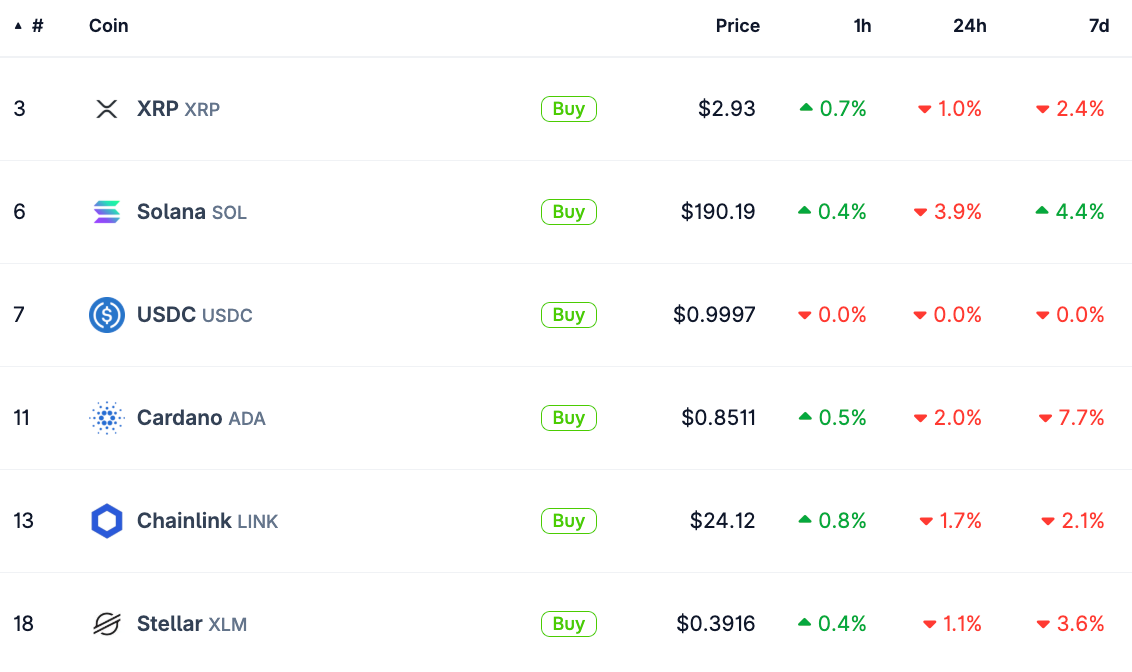

XRP, ADA, Link, XLM, and SOL are the top contenders from the ETF submission of Canary Capital, subject to the approval of the investment product by the SEC. If the US financial regulator gives the ETF the green light, it could open the way for similar investment products and offer institutional investors the opportunity to fuel demand for old coins in the US. Coingecko data shows that the market capitalization of the “Made-in-USA TOKEN” category is over $518.99 billion, and the 24-hour trading volume is over $53.12 billion.

Top five tokens by market capitalization in the Made-in-USA category | Source: Coingecko

Why Investors Could Be Wary of Canary Capital’s ETF

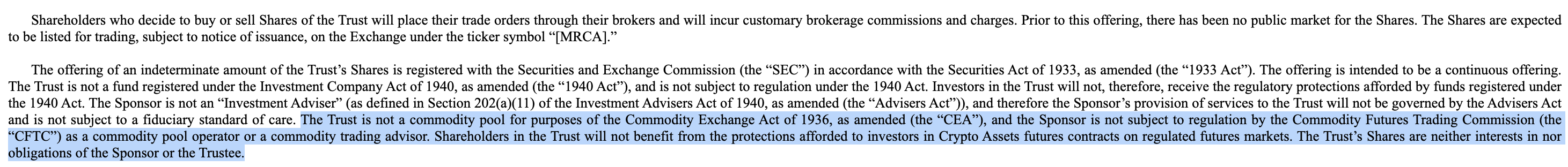

The ETF of Canary Capital raises concerns about capital loss among investors. The registration emphasizes that the investment is high-risk and that investors could lose their investments. The ETF is not regulated by the Commodity Exchange Act, an important federal law that regulates commodity futures and option markets. The ETF of Canary Capital is not regulated by the CFTC, and investors in the product are not covered by the protection that investors have for crypto futures markets.

SEC Filing of Canary Capital | Source: sec

Disclosure: This article does not contain investment advice. The content and materials presented on this page only serve for educational purposes. For more information, visit https://crypto.news/what-canary-american-made-crypto-etf-means-for-altcoins/