The Federal Reserve’s recent decision to end its quantitative tightening (QT) program and reinvest in Treasuries has sparked a mix of reactions among analysts and investors, particularly when it comes to the potential impact on Bitcoin (BTC) price. As the central bank prepares to halt the decline in its bond holdings and begin reinvesting maturing debt in short-term Treasury bills (T-bills) starting December 1, market participants are weighing the potential effects of this move on the cryptocurrency market.

Understanding the End of QT and Its Potential Impact on Bitcoin

The Fed’s decision to reinvest maturing debt in Treasury bonds is essentially creating new money, even if the agency avoids labeling it as quantitative easing (QE). When the Fed injects cash into the financial system by purchasing Treasuries, it effectively grants the sellers of those Treasuries (banks, funds) more cash reserves, leading to increased liquidity available to deploy in the markets. This stealthy QE could potentially help boost Bitcoin’s price, with some analysts predicting it could reach $180,000.

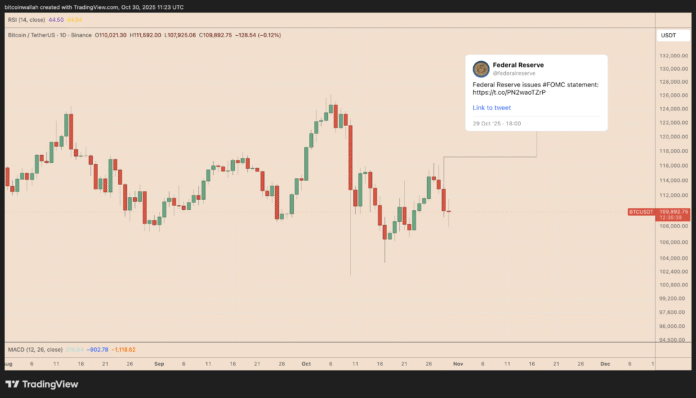

Bitcoin’s price fell 3.67% to $107,925 following the Fed’s announcement, but some analysts believe this could be a temporary setback. Economist Lyn Alden notes that the Fed’s decision to reinvest in Treasuries is actually a form of QE, which could lead to increased liquidity and a subsequent rally in Bitcoin’s price. Meanwhile, analyst Bedouin predicts that Bitcoin’s price could continue to rise toward $130,000 to $180,000 by 2026, driven by growing liquidity and outweighing concerns about BTC’s four-year cycle.

Historical Context and Potential Risks

However, not all analysts are bullish on Bitcoin’s prospects. Analyst Brett points out that Bitcoin fell 35% after the Fed ended its QT program in 2019 and began cutting interest rates, despite the growth in US stock markets at the time. The Bitcoin market only recovered when the Fed initiated widespread QE in early 2020 amid concerns about COVID-19. Brett warns that if history repeats itself, Bitcoin may face downside risks before a new liquidity-driven rally occurs.

Meanwhile, analyst Jesse Olson points to an “impending bearish MACD crossover” on Bitcoin’s three-week chart, a technical signal that preceded a 69% market correction in 2021-2022. This suggests that a bear market may be starting, and investors should exercise caution.

Conclusion and Future Outlook

In conclusion, the Fed’s decision to end its QT program and reinvest in Treasuries has significant implications for the Bitcoin market. While some analysts predict a potential rally in Bitcoin’s price driven by increased liquidity, others warn of potential downside risks. As the market continues to evolve, it is essential for investors to stay informed and conduct their own research before making any investment decisions. For more information on the latest developments in the cryptocurrency market, visit https://cointelegraph.com/news/fed-end-of-qt-what-does-it-mean-for-bitcoin-price?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound