Understanding the Dynamics of Crypto Markets: Narratives vs. Reality

Crypto markets are often driven by narratives, with political developments, regulatory headlines, institutional acceptance, and cycle-based expectations dominating price action during volatile times. However, over the past year, price stability has been driven by measurable capital flows, liquidity conditions, and on-chain behavior rather than the headlines themselves.

Key takeaways from the past year’s market trends include the impact of open interest in futures, spot ETF inflows, and stablecoin exchange inflows on Bitcoin’s price. For instance, Bitcoin’s 56% rally after the US election was accompanied by a sharp increase in open interest in futures, but weak spot follow-throughs limited the duration of the trend.

Narrative-Driven Rallies: A Closer Look

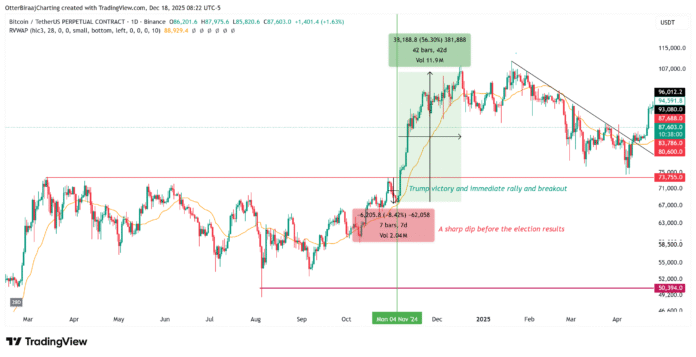

Narratives act as accelerators rather than primary drivers of price action. Political events, particularly crypto-friendly leadership changes, triggered a rapid revaluation of Bitcoin in 2024, with the US election cycle providing a clear example. From March to October 2024, Bitcoin remained in a range between $50,000 and $74,000 despite recurring bullish headlines.

The regime changed in the fourth quarter as the possible election victory of US President Donald Trump was priced in. In the week leading up to the November 4 election results, Bitcoin fell around 8% due to de-risking ahead of the event. Following the confirmation, BTC rose 56% over the next 42 days and broke the $100,000 mark.

BTC’s narrative breakout after Trump’s victory. Source: Cointelegraph/TradingView

The move coincided with a sharp expansion in futures positioning, with open interest nearly doubling in the fourth quarter after remaining capped for most of the year. However, implementation proved to be limited. Despite hitting new highs, Bitcoin struggled to maintain momentum.

Bitcoin price and open interest. Source: CryptoQuant

Spot ETF Inflows: A Demand-Based Catalyst

Spot Bitcoin ETFs represented one of the few catalysts where the narrative matched the data. US spot ETFs saw net inflows of about $35 billion in 2024, followed by about $22 billion in 2025. Bitcoin price followed these flows closely.

In the first quarter of 2024, inflows of over $13 billion coincided with Bitcoin’s rally from $42,000 to $73,000. As inflows slowed after the first quarter, Bitcoin entered a sustained consolidation through October. The relationship resurfaced in late 2024, with nearly $22 billion in inflows between October and January, rising from $70,000 to $102,000.

Detect BTC ETF flows that coincide with BTC breakouts and consolidations. Source: SoSoValue

In contrast, ETF flows regularly turned negative during drawdowns, suggesting it was not a buyer of last resort. The conclusion was that spot ETFs are important because they translate narratives into measurable demand, but only as long as inflows remain sustained.

Liquidity: The Dominant Variable

Liquidity, particularly deployable capital, is one of the clearest drivers of price behavior. Inflows to stablecoin exchanges served as an indicator of available purchasing power. As stablecoin inflows increase, markets can absorb supply and maintain trends, as seen in Q4 2024 to Q1 2025.

When inflows decline, rallies become fragile. From recent highs, stablecoin inflows have fallen by around 50%, indicating reduced buying capacity.

Stablecoins (ERC20) exchange inflows. Source: CryptoQuant

In regimes with lower liquidity, narrative rallies tend to fade quickly. Price can still move based on narrative or positioning, but without additional capital, breakouts become difficult to extend and corrections become more likely.

The past year has made one thing clear: narratives move prices, but liquidity moves markets. Headlines create urgency and volatility, but sustainable trends require capital, improving macroeconomic conditions, and selective demand. For more information, visit Cointelegraph.