Understanding the NFT Market: Insights from the Cancellation of NFT Paris

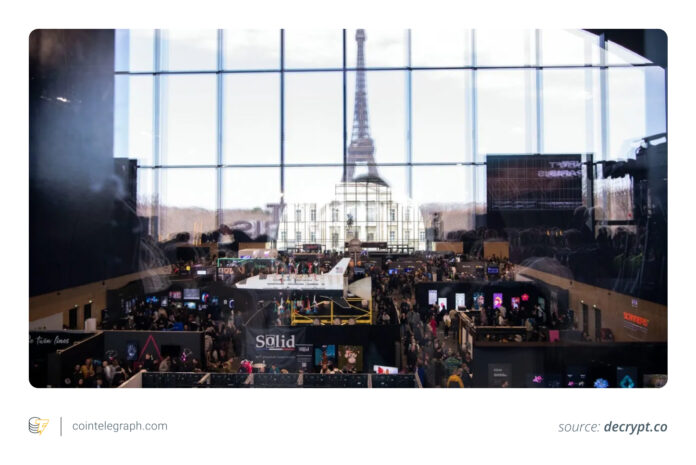

The recent cancellation of NFT Paris, a prominent non-fungible token (NFT) gathering in Europe, has sparked discussions about the current state of the NFT market. This event, along with its sister conference RWA Paris, was scheduled to take place on February 5-6 but was abruptly canceled about a month before its commencement. The cancellation not only highlights the decline in NFT prices but also underscores the pressure on sponsor budgets, which are crucial for the economic viability of such events.

The NFT market has experienced significant fluctuations in recent times, with trading activity and valuations well below previous highs. According to CryptoSlam’s NFT Global Sales Volume index, the NFT sales volume for November 2025 was $320.2 million, down from $629 million in October 2025. This decline indicates a weakening market, where demand is more price-sensitive, and volumes are lower. Despite this, NFT activity is expected to continue in 2026, albeit with a shift towards utility and infrastructure, moving away from hype-driven formats.

Did you know? NFT Paris has been positioned as one of Europe’s leading NFT conferences, bringing together artists, marketplaces, brands, and Web3 startups for panels, exhibitions, and deal-making. The cancellation of such an event provides valuable insights into the market’s health, beyond what sales charts can reveal.

What Led to the Cancellation of NFT Paris?

The organizers of NFT Paris cited the “market collapse” as the reason for the cancellation, stating that “drastic cost cuts” were not enough to salvage the event. This situation raises questions about the funding of the event, particularly regarding sponsorships, which are essential for covering venue, production, and programming costs. The fact that some sponsors mentioned they would not receive refunds, despite the event’s ticket refund schedule, suggests a significant impact on marketing budgets and expected returns from NFT-focused visibility.

Large Web3 conferences like NFT Paris typically rely heavily on sponsorship. If this underwriting disappears, it may signal a decline in marketing budgets and expected returns from NFT-focused visibility. This shift could indicate a broader change in how companies view the NFT market and its potential for brand engagement and customer interaction.

Signals from the NFT Market for 2026

Aggregate market data for NFTs has been weak compared to previous cycles. The decline in sales volume and the shift towards lower-priced NFTs suggest a market that is compressed and price-sensitive. DappRadar’s 2025 coverage highlighted a pattern where sales numbers increased, although average prices and headline volumes remained subdued. This trend indicates that while there is still activity in the NFT market, it is characterized by lower valuations and a focus on utility rather than speculation.

The “state of the NFT market” in 2026 appears to be one of caution, with liquidity concentrated in fewer places and a significant decrease in sponsor-friendly hype. This environment makes it challenging for events like NFT Paris to secure the necessary funding to proceed, highlighting the economic realities faced by the NFT industry.

Why Conference Cancellations Matter

A conference cancellation like that of NFT Paris offers insights into the NFT market that sales charts cannot. It reflects the industry’s willingness to invest in events, which depends on ticket demand, exhibitor spending, and especially sponsorship budgets. The Professional Convention Management Association (PCMA) notes that a “healthy” revenue mix for events includes significant shares from registration, trade shows, and sponsorships. When an event like NFT Paris cancels due to market conditions, it signals a broader issue with the economics surrounding NFTs, beyond just the assets themselves.

NFTs in 2026: Shift Towards Utility and Infrastructure

Despite the challenges, NFTs have not disappeared but have shifted into narrower, utility-driven niches. An example is ticket sales and fan access, where NFTs are used as credentials rather than collectibles. Ticketmaster’s “token-gated” sales and Coachella’s Coachella Keys experiment illustrate this shift, tying NFT ownership to tangible benefits like pre-sales, upgraded seating, or package experiences.

However, several well-known consumer brands have scaled back or canceled their NFT loyalty pilot programs, indicating a reevaluation of NFTs as a marketing tool. Starbucks ended its Odyssey program, and Reddit announced the closure of parts of its Collectible Avatars stack. These moves suggest a more cautious approach to NFTs, focusing on utility and infrastructure rather than speculative collectibles.

Market Consolidation and the Future of NFTs

The NFT economy is no longer focused solely on NFT marketplaces as a distinct category. OpenSea, for example, has repositioned itself as a broader “trade-everything” model. The dealer-led market era, exemplified by Blur, has changed how volume is generated, with some activity linked to incentive-driven programs that may not reflect new end-user demand. Regulatory uncertainty surrounding NFTs and large platforms adds to the caution, resulting in a market that appears more consolidated and less willing to fund large NFT-only events.

Did you know? Blur is an NFT marketplace for professional traders, and its use of points and token airdrops briefly dominated NFT trading volume in 2023, illustrating how incentives can increase activity without signaling broader user demand.

What’s Next for NFTs?

The cancellation of NFT Paris serves as a snapshot of the current market economy. While it is not an indication of the finality of the market, it reflects the challenges faced by the NFT industry in 2026. Looking ahead, analysts will likely observe signals such as whether volumes can hold without stimulus peaks, whether brands and sponsors return with measurable product goals, and whether NFTs appear as “invisible infrastructure” in games, ticketing, or loyalty programs.

Cointelegraph retains full editorial independence. The selection, commissioning, and publication of features and magazine content are not influenced by advertisers, partners, or business relationships. For more insights into the NFT market and its developments, visit https://cointelegraph.com/news/what-the-nft-paris-cancellation-says-about-the-current-state-of-the-nft-market?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound