Bitcoin’s recent 10% recovery from its October 17 low of $103,500 has stalled at $115,000, leaving analysts to ponder the next move for the cryptocurrency. Despite the stall, several analysts have revealed what needs to happen for Bitcoin to surpass $115,000 in the coming days or weeks.

Key Factors for Bitcoin’s Recovery

To confirm the recovery, Bitcoin needs to hold the support at $114,000, according to Swissblock, a private asset manager. The company explained that price momentum has remained negative since the October 11 flash crash, and the key now lies in “momentum ignition.” For BTC to continue its uptrend, it must generate new buying pressure to defend $114,000 and begin building a new bullish structure from this base.

Crypto analyst Rekt Capital said Bitcoin bulls would need to convert the weekly close at $114,500 into support by retesting it to confirm the breakout. Fellow analyst Daan Crypto Trades emphasized the importance of maintaining the 200-day EMA (Exponential Moving Average) at $114,000 going forward.

On-Chain Activity and Demand

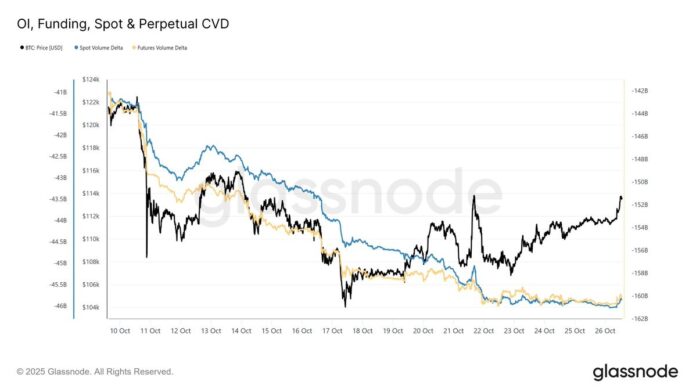

Bitcoin’s ability to rise above $115,000 appears to be limited due to the lack of buyers and low network activity. The chart below shows that Bitcoin’s Spot Cumulative Volume Delta (CVD) and Perpetual CVD remain negative, but have leveled off over the past two weeks.

Bitcoin spot and perpetual CVD. Source: Glassnode

Meanwhile, spot trading volume fell 17.5% to $12.5 billion from $15.2 billion last week, indicating a lack of speculative activity. The decline suggests that Bitcoin’s recent rally to $116,000 “was not supported by widespread participation,” according to on-chain data provider Glassnode.

Bitcoin spot volume. Source: Glassnode

An increase in spot volume would be accompanied by a broader accumulation phase and trigger a strong rally. Additionally, on-chain activity remains subdued, with “a decline in active addresses, transfer volumes and fees indicating a calmer network environment and a consolidating user base,” Glassnode said.

Conclusion and Future Outlook

Until conviction strengthens and demand increases, Bitcoin will likely remain in a teetering consolidation, with cautious optimism beginning to replace defensive positioning. As Cointelegraph reported, consolidation due to favorable RSI signals combined with an expected rate cut by the Federal Reserve could be the trigger for the next rally in the next few days.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/bitcoin-analysts-this-must-happen-btc-price-take-out-115k