Introduction to Privacy Tokens

Despite the overall decline in the cryptocurrency market, with a loss of over $1 trillion in the last six weeks, one segment has seen a significant surge: privacy tokens. Zcash, in particular, has experienced substantial gains, with its market capitalization rising from under $1 billion in August to a peak of over $7 billion in early November. This increase has led to Zcash briefly overtaking Monero as the largest privacy coin by value. But what’s behind this surge, and how does it relate to the current regulatory landscape?

Key Insights

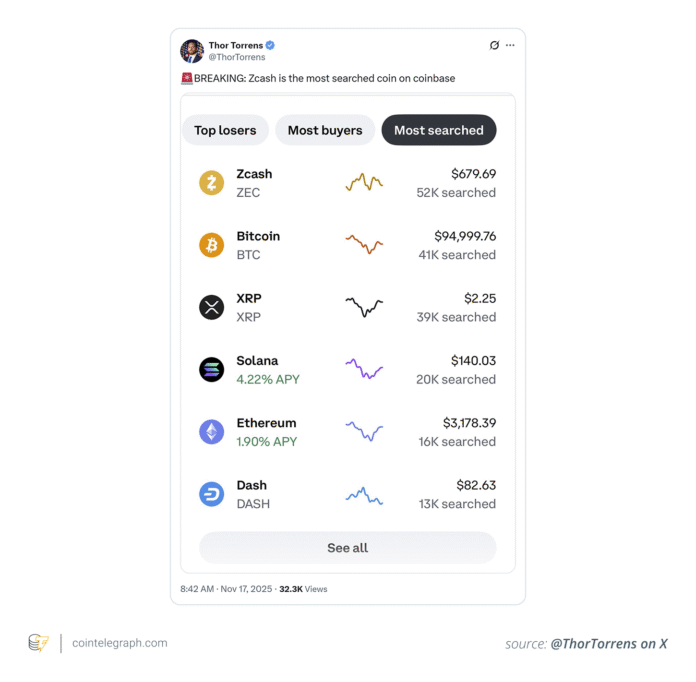

The rally of privacy tokens like Zcash comes at a time when the overall market capitalization of cryptocurrencies and Bitcoin has fallen sharply. The total market capitalization has declined from highs above $4.3 trillion in early October to just over $3.1 trillion, a decline of about 25% to 28%. Bitcoin has fallen nearly 30% since its all-time high of over $126,000 in early October and is now trading as low as $90,000.

Analysts are divided on whether the move is a protest trade against surveillance or a fragile late-cycle rise in a shrinking, risky corner of the market. The explanations for the rally can be divided into two broad camps: one focusing on structure and technology, including declining emissions as halvings progress and the planned NU6.1 upgrade, and another pointing to the narrative and market structure, including extremely optimistic public price forecasts and concerns about surveillance.

Regulatory Pressure

The surge in privacy tokens is happening against an intensifying political backdrop, with FATF pressure, new EU AML rules, and a growing list of privacy coin delistings. The Financial Action Task Force (FATF) has applied its full Anti-Money Laundering and Counter-Terrorist Financing (CFT) standards to virtual assets and Virtual Asset Service Providers (VASPs), including the Travel Rule. In Europe, new EU-wide AML rules will ban anonymous crypto accounts and privacy coins on licensed platforms by 2027.

Crypto asset service providers must apply bank-like AML controls, verify the beneficial owners behind wallets that interact with their services, and phase out support for fully anonymous instruments. This does not mean that owning these assets becomes illegal everywhere, but it does mean that across much of the regulated financial system, the infrastructure is being redesigned under the assumption that privacy tokens will be restricted or excluded.

Delistings and Shrinking Venues

The regulatory backdrop has already begun to change where and how privacy tokens are traded. There were nearly 60 delistings of privacy tokens from centralized exchanges in 2024, the highest number since 2021. Monero accounted for the largest share of removals, with Dash and others also affected as exchanges revised their AML policies. Binance has restricted or removed trading of XMR, ZEC, and DASH for users in several European jurisdictions, citing local rules and compliance.

Kraken announced at the end of 2024 that it would cease Monero trading and deposits for customers in the European Economic Area (EEA), with a year-end withdrawal deadline and a clear reference to European Union regulatory changes, including the Markets in Crypto Assets (MiCA) framework. These steps can lead to a classic liquidity dilemma, where thin markets can trigger strong moves during rallies with comparatively small inflows.

Sanctions and Enforcement Actions

Sanctions and enforcement actions have created another layer of uncertainty for privacy tokens. In 2022, the US Treasury Department’s Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash, saying the Ethereum-based mixer had laundered billions of dollars, including funds linked to North Korea. In late 2024, a US appeals court found that sanctioning immutable smart contracts exceeded the Treasury Department’s authority, and in March 2025, OFAC officially withdrew the designations.

However, the legal risk has not gone away. Tornado Cash’s developers have faced criminal charges in multiple jurisdictions, and a co-founder has been convicted on charges related to operating an unlicensed money transfer business. A separate case involving Samourai Wallet sent a similar signal, with the founders sentenced to several years in prison in the United States after pleading guilty to conspiring to operate an unlicensed money transfer company.

Conclusion and Future Outlook

Analysts are watching the situation closely, with some seeing the rally as a protest against increasing on-chain surveillance, data sharing rules, and sanctions review, while others view it as a late-cycle speculative surge in a shrinking niche driven by leverage and narrative rather than long-term demand. Important milestones on the political side include EU anti-money laundering rules coming into full force around 2027 and the FATF continuing to publish implementation reports.

On the technical side, upgrades like Zcash’s NU6.1 funding change and experiments with optional privacy layers on large networks could test whether greater privacy can go hand in hand with regulators’ demands for traceability. Currently, privacy tokens are caught between a long-standing debate over financial privacy and an intensifying global AML and sanctions regime. To understand how this segment works, it is essential to be aware of the legal, liquidity, and enforcement risks.

For more information, visit https://cointelegraph.com/news/what-s-behind-the-surge-in-privacy-tokens-as-the-rest-of-the-market-weakens?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound