Introduction to the AI Revolution in Finance

The advent of Artificial Intelligence (AI) is transforming the financial landscape, raising questions about the future of traditional investments like stocks and newer ones like Bitcoin. As AI continues to accelerate innovation and efficiency across various sectors, it’s crucial to understand its impact on these financial instruments. In this article, we’ll explore how AI affects stocks and Bitcoin, and which one is more likely to survive and thrive in the next 50 years.

Key Takeaways

Before diving into the details, here are the key points to consider:

-

Shares can survive AI disruptions if they quickly adapt to changing technological and economic requirements.

-

New companies stimulated by AI, such as those in robotics, biotech, or space, are expected to drive growth, and shares that reflect such progress will have a better chance of survival.

-

AI is redesigning work and markets, and the next few years will be crucial for adapting to this new technology.

-

The future of Bitcoin depends on its ability to prove itself as a real store of value and evolve into a medium of exchange, which AI can facilitate through improvements in scalability and transaction processes.

-

As a decentralized system, Bitcoin is not affected by internal politics, but it must stay up-to-date with new technologies to remain relevant.

The Case for Stocks

The argument for stocks is rooted in their long history, dating back to the founding of the Dutch East India Company in Amsterdam. Stocks represent ownership of companies, and their values fluctuate based on corporate performance and market conditions, including the ability to adapt to technological changes like AI. Companies that have committed to technological progress over the centuries have survived economic cycles, wars, and disruptions brought about by technology.

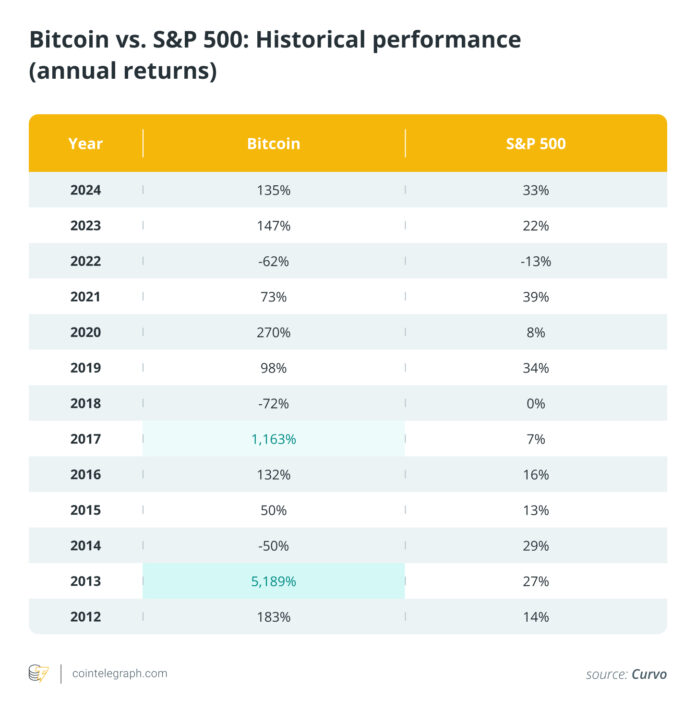

In particular, companies that utilize AI through automation, data analysis, and new business models are likely to be successful. Market indices like the S&P 500 have delivered around 7-10% annual returns, adjusted for inflation, over the decades. However, compared to the S&P 500, Bitcoin’s performance has been exceptionally higher, as shown in the table below:

The Case for Bitcoin

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, is a relatively new invention. The case for Bitcoin goes beyond its role as an investment tool or store of value; it encompasses a genuine revolution that challenges traditional financial instruments like gold. Its decentralized design resists central control and inflation common in fiat systems, and its fixed supply of 21 million coins entitles those who hold it to protection against cash devaluation.

Over the years, Bitcoin has established itself as a store of value and an alternative currency, pursuing its original goal of becoming a widely accepted medium of exchange. The transparency and security of blockchain technology align with the need for AI to process verifiable data.

How AI Affects Stocks and the Stock Market

According to analyst and investor Jordi Visser, the next 50 years could question the survival of the stock exchange as an institution, as “artificial intelligence accelerates innovation cycles and makes public companies inefficient investment vehicles.” AI-controlled disruptions leave little room for complacency, and companies that do not adapt risk decline. This applies particularly to tech giants like the FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google), which, while being among the largest investors in AI, must keep pace with rapid developments and use them effectively.

AI will also impact the stock market, from the rapid analysis of large datasets to predicting market movements and automating decision-making processes for faster and more efficient transactions. AI will have enormous effects on how investors approach trading and investment strategies.

How AI Influences Bitcoin

Visser sees Bitcoin as a better future investment, comparing it to gold, which has been a store of value for thousands of years. Bitcoin is well-positioned for the future of finance beyond its role as a store of value. The combination of AI and blockchain can disrupt traditional financial systems, bringing more capital and participants to the digital economy.

AI is expected to improve Bitcoin’s security and trading strategies, enhancing crypto trading through automated tools, improved data analysis, and market pattern forecasting. These changes can also trigger better system efficiency. Bitcoin mining will benefit from AI in terms of efficiency and better resource allocation by predicting optimal times for mining activity to reduce costs and maximize performance.

Conclusion: Which Will Survive the Next 50 Years?

Predicting the future 50 years in advance is practically impossible. Both Bitcoin and stocks have unique strengths and weaknesses, and their future ultimately depends on economic, technological, and social changes. Stocks will probably exist if they adapt to AI-controlled economies. Investors can mitigate the risk of individual corporate failures by investing in diversified portfolios such as index funds, which appear safer. Shares in robotics, biotech, space, and AI can perform better than less technologically advanced assets.

The emergence of quantum computing is often discussed in relation to Bitcoin’s security model, although most experts agree that the risk is still theoretical and distant. In combination with AI, the effects could be positive or negative, depending on the development of technology and how the Bitcoin network adapts. As long as the Bitcoin community remains ahead of the curve with quantum-resistant upgrades, the net effect could be positive.

For more insights into how AI is impacting financial markets and the future of Bitcoin and stocks, visit Cointelegraph.