White House Considers Withdrawing Support for Crypto Market Structure Bill

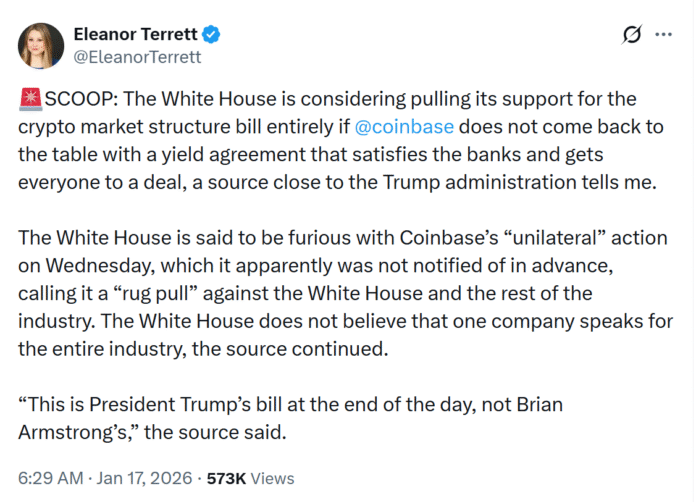

The White House is considering withdrawing its support for the crypto market structure bill after crypto exchange Coinbase made a similar move, according to Fox Business reporter Eleanor Terrett, citing a source close to the Trump administration. This development comes after Coinbase CEO Brian Armstrong announced that the exchange could not support the Senate Banking Committee’s bill in its current form, arguing that it would do more harm than good.

Terrett reported that the White House is said to be angry about Coinbase’s “unilateral” action, which it apparently was not informed of in advance, calling it a “rugger” against the White House and the rest of the industry. The source added that the government may abandon the bill entirely unless Coinbase resumes negotiations and agrees to a compromise on stablecoin yield provisions that meets banking interests. “This is ultimately President Trump’s bill, not Brian Armstrong’s,” the source said, according to Terrett.

The crypto industry is divided over the CLARITY Act market structure bill, with some expressing support for Coinbase’s stance and others arguing that the exchange is overreaching. Armstrong cited several concerns, including what he described as a de facto ban on tokenized stocks, sweeping restrictions on decentralized finance (DeFi), and expanded government access to financial records, which he said could compromise user privacy.

Coinbase Names Risks for DeFi and Stablecoins

Armstrong also warned that the proposal would weaken the Commodity Futures Trading Commission while concentrating more power at the Securities and Exchange Commission, an agency that has been widely criticized by the crypto industry in recent years for its enforcement-heavy approach. Another hotspot is stablecoins, with Armstrong saying the bill risks “destroying stablecoin rewards,” reflecting industry fears that the bill is aimed at protecting banks from competition.

Banks have argued that the possibility that users could earn around 5% returns on stablecoins could lead to large deposit outflows from traditional savings accounts. However, some experts have dismissed these concerns as “unfounded myths.” The crypto community remains divided, with many users expressing support for Coinbase’s stance and accusing lawmakers and banks of prioritizing incumbents over innovation.

Crypto Community Reaction

Many users expressed support for Coinbase’s stance, with Nic Carter, co-founder of Coin Metrics, writing on X, “Then banks should stop trying to screw everyone over.” Others argued that Coinbase was overreaching and should not have veto power over legislation with industry-wide implications. “Coinbase is not crypto. Coinbase is a crypto exchange,” one user wrote.

For more information on the crypto market structure bill and its implications, read the full article on Cointelegraph: https://cointelegraph.com/news/white-house-considers-dropping-crypto-bill-after-coinbase-withdrawal