Introduction to CFTC-Approved Spot Crypto Trading

The US Commodity Futures Trading Commission (CFTC) has announced that spot Bitcoin (BTC) and Ether (ETH) products will begin trading on its registered futures exchanges, marking a significant milestone for the top two cryptocurrencies. This development is expected to have far-reaching implications for the crypto market, particularly in terms of institutional investment and liquidity. In this article, we will explore three key reasons why CFTC-approved spot crypto trading is a big deal for Bitcoin and Ethereum.

Key Takeaways and Implications

The CFTC’s decision gives BTC and ETH a level of legitimacy similar to that of gold, opening the door to larger institutional flows. Regulated US trading is also expected to boost liquidity, cut volatility, and shift crypto activity back onshore. According to a joint survey conducted by Coinbase and EY-Parthenon, 86% of institutional investors already have or plan to gain crypto exposure, with most increasing their allocations in 2024 as US regulation improved.

-

CFTC oversight provides BTC and ETH with gold-like legitimacy, paving the way for larger institutional investments.

-

Regulated US trading is expected to increase liquidity, reduce volatility, and bring crypto activity back to US-based exchanges.

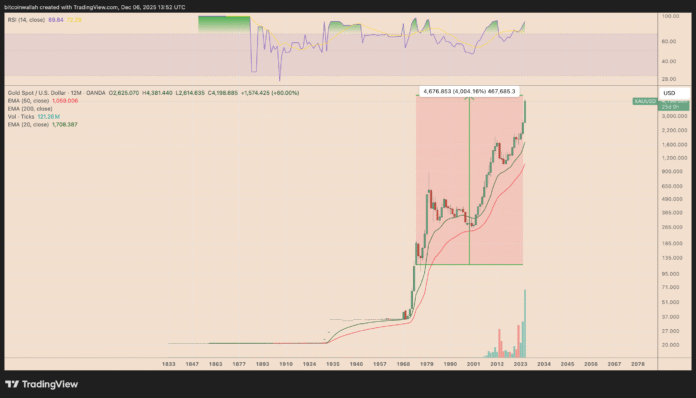

Bitcoin and Ethereum Can Scale Like Gold

The gold market provides a historical parallel for the CFTC’s decision. When gold was formally opened to trading on regulated US futures exchanges in the 1970s, it transformed from a fragmented, over-the-counter commodity into a globally recognized investment asset. Liquidity concentrated on COMEX, institutions entered the market for the first time, and transparent price discovery created a foundation for long-term capital flows. Since its COMEX debut, spot gold prices have gained 4,000%, illustrating the potential impact of regulatory clarity on an asset’s market trajectory.

XAU/USD yearly performance chart. Source: TradingView

CFTC Improves Institutional Exposure for BTC and ETH

Pension funds, banks, and hedge funds that previously sat on the sidelines can now treat Bitcoin and Ethereum like other CFTC-recognized commodities, with standardized rules, surveillance, and custody requirements. A majority of institutional investors prefer accessing crypto through regulated investment rails, such as commodity exchanges or ETFs, rather than offshore venues. Following the CFTC decision, institutions can now access Bitcoin and Ethereum through regulated exchanges, audited custody, and supervised pricing, setting the stage for stronger, more durable mainstream adoption.

Source: X

Bitcoin and Ether May See Better Liquidity Growth

Historical evidence suggests that commodities expand rapidly after debuting on regulated trading venues. The launch of WTI oil futures in 1983 is a case in point, with trading exploding from just 3,000 contracts in the first month to over 100,000 per month within a year, and then to over 2 million contracts per month by the late 1980s. Today, WTI often exceeds a million contracts in daily volume, demonstrating how regulation can foster colossal market growth.

WTI two-week chart. Source: TradingView

Conclusion

In conclusion, the CFTC’s approval of spot crypto trading is a significant development for Bitcoin and Ethereum, with implications for institutional investment, liquidity, and market growth. As the crypto market continues to evolve, it is essential to stay informed about the latest developments and trends. For more information, please visit the original source link: https://cointelegraph.com/news/why-cftc-approved-spot-crypto-trading-is-big-deal-for-bitcoin-ethereum?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound