Crypto Market Decline: Understanding the Current Trends

According to data from CoinMarketCap, the crypto market is experiencing a decline, with the total cryptocurrency market cap falling by 3.0% to $3.78 trillion. The 24-hour trading volume stands at $192 billion, indicating reduced activity as major cryptocurrencies fall into the red. This downturn has sparked concerns among investors and traders, who are seeking to understand the underlying factors driving this trend.

Crypto Winners and Losers

At the time of writing, 8 of the 10 cryptocurrencies by market cap are down in the last 24 hours. Bitcoin (BTC) fell 3.5% and is now trading at $109,373, giving it a market cap of over $2.18 trillion. Ethereum (ETH) fell 3.6% to $3,868, while BNB (BNB) fell 0.5% to $1,107. The biggest drop in the top 10 came from Dogecoin (DOGE), which fell 4.4% to $0.1872.

Altcoin Performance

Despite the general downturn, some altcoins recorded impressive gains. Aurora (AURORA) rose 65.1% to $0.08555, while Jelly My Jelly (JMJ) and Anvil (ANVL) increased by 50.6% and 44.0%, respectively. In contrast, PepeNode (PNODE) and BlockchainFX (BFX) topped trending tokens despite declines of 19.7% and 5.7% respectively, showing strong retail interest amid market volatility.

Bitcoin Holds Strong as Altcoins Lag

The Federal Reserve’s recent 25 basis point interest rate cut went as expected, briefly sending Bitcoin down to $109,000. However, the real market driver was the Fed’s confirmation that quantitative tightening (QT) will end in December, signaling the return of liquidity that could boost risk assets. Analysts say this could set the stage for an “alt season,” although past patterns show this optimism often fades quickly.

Market Sentiment and Outlook

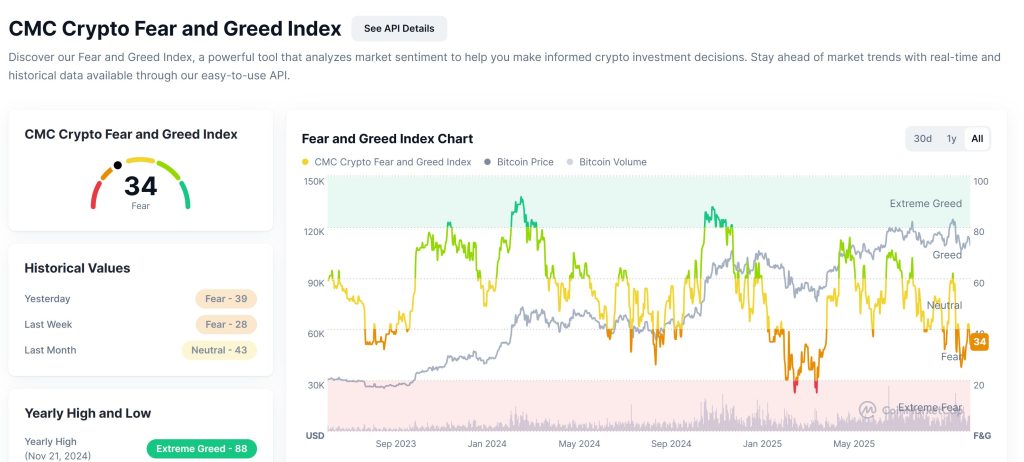

Market sentiment has become slightly more pessimistic, with the Crypto Fear and Greed Index falling to 34, signaling “fear.” The index was at 39 yesterday and 43 a month ago, indicating a steady decline in confidence as traders remain cautious amid price volatility. The shift reflects ongoing uncertainty in the market as participants hold back from aggressive positions and wait for clearer signals from macroeconomic developments.

ETF Outflows and Regulatory Actions

US Bitcoin spot exchange-traded funds (ETFs) experienced a significant turnaround on Wednesday, recording $470.7 million in outflows. Total cumulative net inflows now stand at $61.87 billion, with total net assets estimated at $149.98 billion, representing 6.75% of Bitcoin’s market capitalization. Meanwhile, Australia’s financial intelligence agency AUSTRAC on Thursday fined crypto ATM operator CryptoLink AU$56,340 (US$37,085) for delayed reporting of large cash transactions and