Introduction to JPMorgan’s On-Chain Fund

JPMorgan Asset Management has made a significant move by launching a tokenized money market fund called My OnChain Net Yield Fund (MONY) on the Ethereum blockchain. This development marks a notable milestone in the integration of traditional financial products with blockchain technology. The fund, which was launched on December 15, 2025, operates on JPMorgan’s Kinexys Digital Assets platform and allows investors to access the fund through Morgan Money, with ownership shares issued as blockchain tokens delivered directly to their on-chain addresses.

MONY invests in U.S. Treasury securities and Treasury-backed repos, offering daily dividend reinvestment, and permits qualified investors to subscribe and redeem with cash or stablecoins. The decision to utilize Ethereum as a settlement layer makes this launch even more significant, as it brings a traditional product into the realm of public blockchain, alongside stablecoins, tokenized treasuries, and existing on-chain liquidity.

Key Insights

The launch of MONY is substantial because money market funds are a common vehicle for institutions to invest short-term cash, designed for liquidity and consistent income, typically secured by simple assets. By tokenizing such a fund and placing it on Ethereum, JPMorgan opens up new possibilities for transparency, peer-to-peer transfers, and the use of these positions as collateral in blockchain-based markets.

It’s worth noting that a Treasury-backed repo is essentially a short-term, secured loan, where one party provides cash, and the other provides U.S. Treasury bonds as collateral, agreeing to reverse the trade later at a slightly higher price, with the difference representing the interest.

What MONY Brings to Market

MONY is an on-chain money market fund where investors purchase fund shares backed by a conservative cash portfolio of U.S. Treasuries and repurchase agreements fully collateralized by Treasury securities, with ownership represented as a token sent to the investor’s Ethereum address. This setup runs across two JPMorgan systems: Morgan Money, the interface for subscriptions, redemptions, and position management, and Kinexys Digital Assets, the tokenization layer that issues and manages the on-chain representation of these fund interests.

The idea behind tokenization is to improve transparency, support peer-to-peer transfers, and open the door to using these positions as collateral in blockchain-based markets. On the product side, MONY maintains familiar mechanics, with daily reinvestment of dividends and subscriptions and redemptions handled via Morgan Money using cash or stablecoins.

Why Public Ethereum Matters

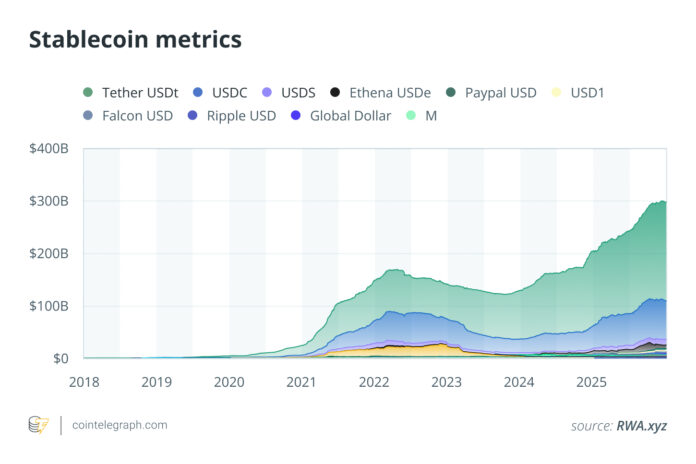

JPMorgan’s choice of Ethereum as the platform for MONY is interesting because it connects to on-chain systems that counterparties already use, including stablecoins for settlement, custody, and reporting workflows, analytics, compliance tools, and distribution channels. Ethereum is where cryptocurrency cash activity is concentrated, with stablecoins valued at approximately $299 billion, forming the liquidity base with which tokenized funds interact for settlement and cash management.

Tokenized treasuries total $8.96 billion, and a money market-like product fits naturally alongside these assets and behaviors that investors use to park funds, move liquidity, and deposit collateral. The RWA.xyz network chart shows Ethereum holding about two-thirds of the total tokenized RWA value, which is significant for a regulated product needing to move between approved counterparties.

Implications of On-Chain Cash

Once high-yield cash is on-chain, it can be integrated into other workflows, such as 24/7 treasury operations, where positions can sit alongside stablecoin balances and other tokenized assets. This creates a tighter loop for institutions handling parts of their cash and settlement flow on-chain.

Collateral Mobility and Tokenized Markets

JPMorgan emphasizes the potential for broader use of collateral, as well as transparency and peer-to-peer portability. A tokenized money market fund share provides permitted parties with an easier way to pass value, transact faster, and enforce who can hold it through on-chain rules. This can also serve as the cash component for tokenized markets, where tokenized securities, funds, and real-world assets need a place to park liquidity between trades and settlements.

Competitive Landscape

MONY enters a lane already crowded with serious players, including BlackRock’s BUIDL, a tokenized fund on Ethereum, and Franklin Templeton’s on-chain money market fund, where BENJI tokens represent shares in FOBXX. The market infrastructure layer also sees involvement from BNY Mellon and Goldman Sachs, discussing approaches to record tokenization aimed at facilitating the movement of existing money market fund shares through institutional workflows.

Estimates suggest that tokenized financial assets will amount to about $2 trillion by 2030, excluding crypto and stablecoins, according to McKinsey, with Calastone noting over $24 billion in tokenized assets under management as of June 2025, primarily in money market and government bond funds.

Practicality and Impact

MONY brings a regulated cash product to public Ethereum, although access remains strictly restricted to qualified investors through a Rule 506(c) private placement, distributed via Morgan Money. The focus on suitability tests and a narrowly defined investor base determines how the token can move, with embedded transfer rules, compliance gates, and operational controls.

The Ethereum mainnet is the launch location, and usage patterns may change depending on economic conditions, with mainnet fees and operating expenses affecting how often assets move and influencing decisions about scaling paths over time.

What Now?

Three signals will indicate how far this development goes: whether MONY tokens emerge as usable collateral in broader on-chain workflows, whether other global systemically important banks follow JPMorgan into public chains, and whether stablecoin settlement expands beyond subscriptions and redemptions to secondary transfers and deeper integrations.

If MONY is accepted as collateral and settled via secondary transfers, it becomes part of the settlement cycle. If other GSIBs launch similar cash products on Ethereum, it would indicate a potential default location for tokenized cash products.

For more information, visit https://cointelegraph.com/news/why-jpmorgan-s-onchain-fund-is-a-big-signal-for-ethereum?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound