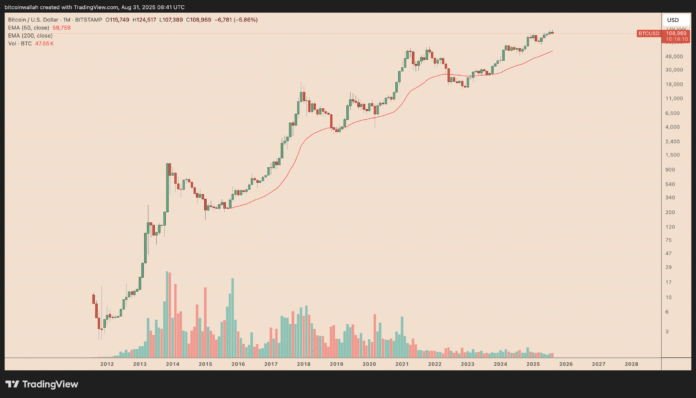

As the month of August comes to a close, Bitcoin (BTC) is poised to end on a sour note, marking its first down-month since April. This downturn has sparked concerns that the decline may deepen as September begins. The forthcoming month has historically been a challenging period for the cryptocurrency, with a well-established tendency to slide. Since 2013, Bitcoin has closed in the red for eight of the past twelve months, with average returns slipping about −3.80%.

Understanding the “September Effect”

The “September Effect” is a phenomenon where traders tend to lock in profits after summer rallies or reposition portfolios ahead of Q4. This trend is not unique to Bitcoin, as the S&P 500 index has also experienced average returns of around -1.20% in September since 1928. As Bitcoin often trades in sync with broader risk assets, it can become a victim of this seasonal drag. However, it’s essential to note that every green September for Bitcoin has come only after a bruising August, hinting at sellers front-running.

BTC/USD monthly price chart. Source: TradingView

Contrarian Views and Technical Analysis

Analyst Rekt Fencer suggests that a “September dump is not coming” this year, citing Bitcoin’s performance in 2017. A chart overlay of 2017 and 2025 reveals a near-mirror image, with Bitcoin slipping sharply in late August, finding footing at a key support zone, and then reversing higher. This pattern could indicate that the cryptocurrency is poised for a parabolic leg upward. The $105,000–$110,000 zone, which acted as resistance earlier in the year, has now flipped into support, forming a classic bullish structure in technical analysis.

BTC/USD daily price trend comparison in 2017 vs. 2015. Source: TradingView

Hidden Bullish Divergence and Potential Rally

A “hidden bullish divergence” is evident in Bitcoin’s relative strength index (RSI), which hasn’t fallen as much as the price. This usually means the market is not as weak as the price chart suggests, hinting that buyers are quietly stepping back in. Analyst ZYN suggests that Bitcoin could be on track for a fresh all-time high above $124,500 within the next 4–6 weeks, owing to these technical patterns that justify a potential rally in September.

BTC/USD weekly price chart. Source: TradingView/ZYN

Weaker Dollar and Its Impact on Bitcoin

Currency traders are turning bearish on the dollar as a slowing US economy and expected Fed rate cuts weigh on sentiment. The 52-week correlation between Bitcoin and the US Dollar Index (DXY) has slipped to −0.25, its weakest level in two years. This shift improves Bitcoin’s odds of climbing in September if the dollar’s slump continues. Analyst Ash Crypto predicts that the Fed will start the money printers in Q4, leading to trillions flowing into the crypto market and a potential parabolic phase where altcoins could explode 10x-50x.

BTC/USD vs. DXY 52-week correlation coefficient. Source: TradingView

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. For more information, visit the original source: https://cointelegraph.com/news/will-bitcoin-price-drop-in-september