Understanding the Impact of a Bitcoin Decline on Altcoins

The cryptocurrency market has long been dominated by Bitcoin, but what happens if its price plummets or its dominance wanes? In such a scenario, the fate of other major coins like Ether (ETH) and XRP becomes a critical concern. This article delves into the relationship between Bitcoin and altcoins, exploring how a sharp decline in Bitcoin could trigger systemic contagion and affect the entire crypto market.

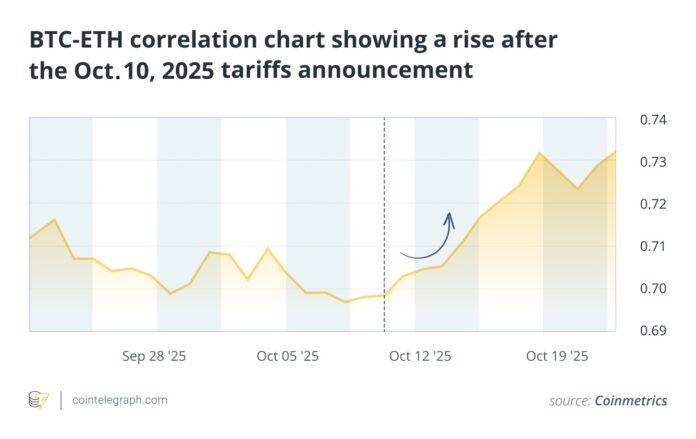

A decline in Bitcoin often leads to a decline in altcoins through both liquidity and trust channels. During times of crisis, the market tends to view cryptocurrencies as a single risk asset rather than evaluating individual utility, as evidenced by the high correlations between BTC-ETH and BTC-XRP. Correlation and beta analysis is essential to quantify how much Ether and XRP depend on Bitcoin’s performance.

Why Bitcoin Dominance Matters

Bitcoin serves as an “anchor asset” in the crypto market, and its dominance has a significant impact on other coins. When Bitcoin weakens, the entire market loses its sense of stability and direction. Historically, Bitcoin has had a large share of the crypto market capitalization, and most altcoins have a strong correlation with Bitcoin price movements.

For example, after a significant market event, the crypto market experienced a large-scale liquidation, with Bitcoin plummeting. According to CoinMetrics, the BTC-ETH correlation increased from 0.69 to 0.73, while the BTC-XRP correlation increased from 0.75 to 0.77. This strong convergence confirms that altcoins are not decoupling based on their individual utility during a liquidity crisis triggered by macroeconomic fears.

Liquidity and Mood Channels

A major Bitcoin crash could trigger large-scale liquidations driven by margin calls and cascading sell-offs, resulting in massive capital outflows that hit all crypto assets. Additionally, a collapse of the original decentralized asset undermines the core thesis of the entire crypto industry, leading to a loss of investor confidence and a prolonged bear market.

Measuring Bitcoin Dependence and Risk

Step 1: Define the Shock Scenario

The analysis begins with selecting a plausible high-impact Bitcoin event, such as a 50% drop in BTC in 30 days, or a structural change, such as a drop in Bitcoin dominance from 60% to 40%.

Step 2: Quantify Dependency

The next step is to calculate the current Pearson correlation coefficient between ETH, XRP, and BTC. This statistical measure captures the linear relationship between the daily returns of assets and provides a basis for dependence.

Step 3: Estimate the Immediate Price Reaction

Using correlation data, apply regression analysis to calculate the beta (β) of each altcoin relative to BTC. The beta coefficient estimates the expected price movement of the altcoin for every one unit change in Bitcoin.

What Happens to Ether and XRP in a Bitcoin Shock Scenario?

In a Bitcoin-centric shock scenario, liquidity often flows into stablecoins or exits the market entirely in search of protection from volatile assets. Although Ether benefits from a robust Layer 1 utility, it is not immune to the effects of a Bitcoin decline. During market stress, the correlation with Bitcoin often increases as institutional capital treats both as risk assets.

However, assets like XRP, which face higher regulatory and structural risks and lack Ether’s extensive, organic on-chain revenue mechanisms, could be disproportionately affected. Such shocks often trigger a vicious cycle in which the collective loss of confidence outweighs the fundamental token utility, triggering an associated market-wide decline.

Hedging Your Strategy if BTC Loses its Dominance or Price Falls

Hedging a crypto portfolio against a sharp Bitcoin decline requires more than basic diversification. Systemic shocks have shown that extreme correlations often negate the benefits of risk diversification.

Discover Derivatives

During times of extreme panic, the futures market can trade at a steep discount to the spot price, opening up opportunities for experienced traders to engage in relatively low-risk, non-directional arbitrage.

Diversify Your Portfolio with Risk Buffers

Hold positions in tokenized gold, real-world assets (RWAs), or fiat-backed stablecoins to preserve portfolio value. These assets serve as liquidity reserves when crypto markets enter a downward spiral.

Monitor Dominance and Correlation Relationships

Tracking the rolling short-term correlation of ETH and XRP to BTC can serve as a real-time warning signal that diversification benefits are disappearing, confirming when immediate hedging measures may be required.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision.

Read the original article at https://cointelegraph.com/news/without-bitcoin-what-happens-to-ether-and-xrp?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound