Introduction to the World Liberty Financial Token (WLFI) and its Potential Impact on the Crypto Market

A recent study by Amberdata, a data provider, has shed light on the potential relationship between the World Liberty Financial Token (WLFI), a DeFi governance token linked to the Trump family, and the crypto market. According to the analysis, WLFI may have signaled a major market collapse just hours before the Bitcoin move. This article aims to delve into the details of the study and explore the possible implications of the findings.

WLFI’s Anomalies Before the Sell-Off

On October 10, 2025, approximately $6.93 billion in leveraged crypto positions were liquidated in less than an hour, resulting in a 15% decline in Bitcoin (BTC) and a 20% decline in Ether (ETH). Notably, smaller tokens lost up to 70% of their value. The Amberdata report highlights that WLFI began a sharp decline more than five hours before the general market downturn, while Bitcoin was still trading near $121,000 with little immediate stress. Mike Marshall, the author of the report, notes that “a five-hour lead time is hard to dismiss as a coincidence,” suggesting that this duration is what separates a truly actionable alert from a statistical artifact.

Unusual Patterns in WLFI Trading Activity

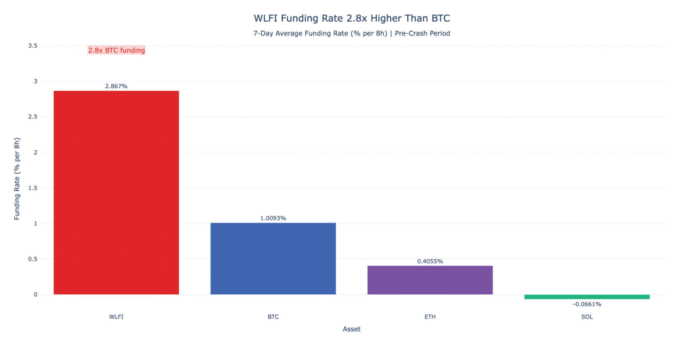

Researchers analyzed three unusual patterns in WLFI trading activity, including a spike in trading activity, a sharp divergence from Bitcoin, and extreme leverage. The study reveals that WLFI’s hourly volume rose to around $474 million within minutes of the political news related to the tariffs, about 21.7 times its normal level. Meanwhile, WLFI perpetual futures funding rates reached about 2.87% every eight hours, translating to an annual borrowing cost of nearly 131%. WLFI financing rating. Source: Amberdata

WLFI’s Holder Base and Trading Patterns

The study does not allege that insider trading occurred but argues that the way crypto markets are structured can result in certain assets having greater importance than their size suggests. WLFI’s holder base is concentrated among politically connected participants, in contrast to Bitcoin’s widespread ownership. Marshall notes that the trading pattern appeared to be “instrument specific,” meaning activity was focused on WLFI rather than the broader crypto complex. The timing of the trading activity is also remarkable, with volume accelerating about three minutes after the public tariff news, suggesting prepared execution rather than retailers interpreting headlines in real-time.

Connection Between WLFI and the General Market Decline

The connection between WLFI and the general market decline is based on leverage. Many crypto trading platforms allow traders to use multiple assets as collateral for borrowed positions. When WLFI fell sharply, the value of this collateral plummeted, forcing traders to sell liquid assets like Bitcoin and Ether to cover their positions. These sales caused prices to fall and led to further liquidations across the market. WLFI crashed before Bitcoin. Source: Amberdata

WLFI Responded to Stress Faster than Bitcoin

Amberdata data shows that WLFI’s realized volatility reached nearly eight times that of Bitcoin during the episode, making the company particularly vulnerable to stress. Researchers argue that structurally fragile, highly leveraged assets may move first during market shocks. Marshall notes that the results should not be interpreted as evidence that WLFI can reliably predict downturns, but the behavior is significant, and the useful life of this signal is limited.

For more information on this topic, please visit the original article at https://cointelegraph.com/news/wlfi-early-warning-signal-crypto-amberdata-study?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound