XRP ETFs Experience First Outflow Day Amid Crypto ETF Selloff

According to SoSoValue data, XRP (XRP) ETFs have experienced their first daily reversal, marking a significant shift in investor sentiment. This reversal comes after a steady accumulation of assets since mid-November 2025. The outflow day also follows a strong start to the year, with funds recording consecutive inflow days, bringing their cumulative net inflows to $1.2 billion.

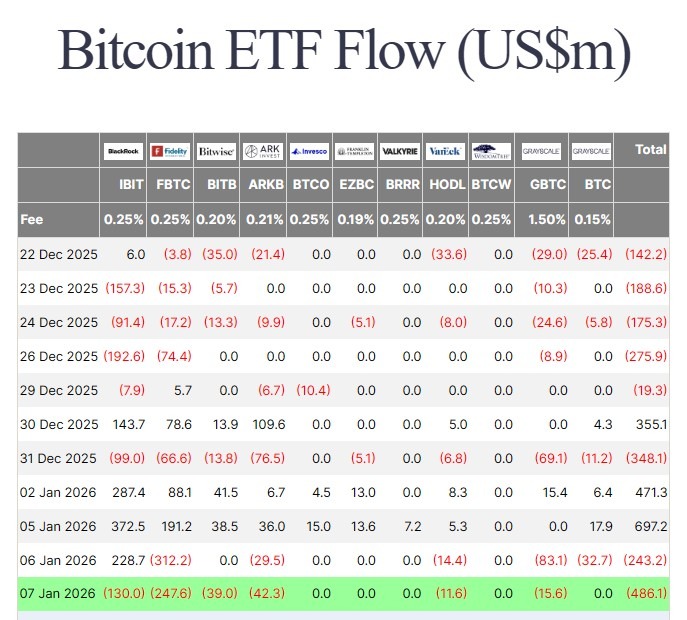

The red day coincided with strong selling pressure in major crypto-related ETFs. Data from Farside Investors shows that spot Bitcoin (BTC) ETFs recorded $486 million in outflows on Wednesday, the largest day of net outflows since November. Spot Ether (ETH) ETFs also turned negative on Wednesday, recording $98 million in net outflows. Despite this, XRP ETFs remain among the strongest performing cryptocurrency exchange-traded products (ETPs), with total net assets still exceeding $1.5 billion.

Crypto ETF Flows Become Patchy in 2026

On the first trading days of the year, ETF flows varied greatly by asset class. Spot BTC ETFs began January with significant inflows of $471 million on Friday and $697 million on Monday, before outflows of $243 million on Tuesday reversed and a sharper decline of $486 million occurred on Wednesday. ETH spot ETFs recorded a similar pattern, with inflows of $174 million on Friday, $168 million on Monday, and $114 million on Tuesday, before outflows of $98 million on Wednesday.

Smaller crypto ETFs have performed better, with spot Solana (SOL) ETFs continuing to attract capital and recording modest but consistent inflows in the first few trading days of January. Chainlink (LINK) ETFs switched to flat inflows on Wednesday after several days of modest inflows between $822,000 and $2.2 million. Meanwhile, Dogecoin (DOGE) ETFs saw no net moves on Tuesday and Wednesday after starting the year strong with inflows of $2.3 million and $1.6 million on Friday and Monday.

Related: XRP Falls Below $2 Despite $1 Billion ETF Inflows: How Low Can the Price Fall?

From One-Sided Inflows to Normalization

Wednesday’s outflow follows weeks of strong demand for XRP-linked ETF products, which managed to accumulate over $1 billion in assets driven by investors’ familiarity with the token and its performance. According to Sui Chung, CEO of CF Benchmarks, XRP’s long track record makes it easier to attract traditional investors. The XRP ETF’s momentum continued through December, with a 29-day uninterrupted inflow streak, while other crypto ETF products saw heavy monthly outflows as traders repositioned towards year-end.

XRP started 2026 as one of the top-performing major currencies, supported by its ETF inflows, bullish sentiment, and falling forex balances. However, analysts warned that ETF inflows and sentiment are no guarantee of sustained price increases. The first day of outflows could be a reflection of this transition. At the time of writing, XRP is trading at $2.12, down 7% in the last 24 hours.

Magazine: Big Questions: Would Bitcoin Survive a 10-Year Blackout?

For more information, visit https://cointelegraph.com/news/xrp-etfs-first-outflow-day-crypto-etf-selloff?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound